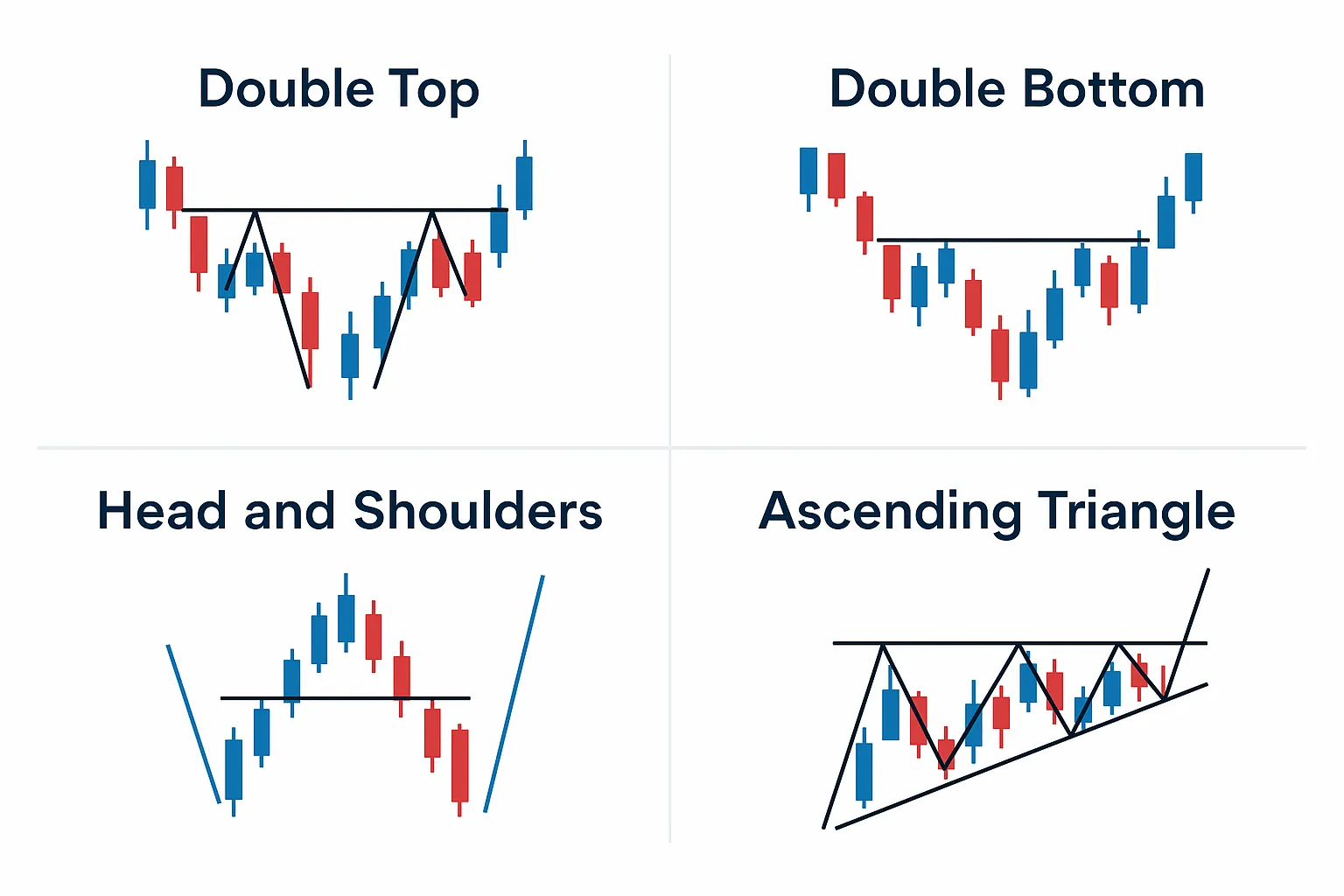

- A triangle? Traders are waiting.

- A breakout? Momentum just won the battle.

- A double top? Buyers are exhausted.

Chart Pattern Recognition: AI-Powered Technical Analysis Tools

Chart patterns have been a part of technical analysis for decades. From triangles and flags to head-and-shoulders, they’ve helped traders interpret market psychology and anticipate moves.

Article navigation

- 🧠 Why Chart Patterns Still Matter in 2025

- ⚙️ In the AI Era, Patterns Gain New Power

- 🤖 How AI Recognizes Patterns Differently from Humans

- Start trading

- 🛠 Overview of Top AI-Powered Pattern Recognition Tools

- 📉 Real-World Use Cases: Entry, Exit s Alerts

- 🧪 Testing Pattern Accuracy: AI vs Human Traders

- Start trading

- 🧠 Key Takeaway

- 📲 Where You Can Use AI Tools

- 📚 Sources s References

But manually spotting patterns takes time, experience, and a good deal of guesswork. And let’s face it — even the sharpest eyes miss setups or misread formations.

That’s where AI-powered pattern recognition tools come in. These technologies can scan dozens of charts in seconds, flag precise formations, and even rank their reliability— with no fatigue, no emotion, and no bias.

In this article, we’ll explore how AI is revolutionizing chart pattern analysis, which tools lead the market, how accurate they are compared to humans, and how you can integrate them into platforms like Pocket Option or TradingView for smarter, faster decisions. Whether you’re a beginner looking for confidence or an advanced trader optimizing forspeed — AI-driven pattern tools are no longer a luxury. They’re a serious edge.

🧠 Why Chart Patterns Still Matter in 2025

With so many indicators, algorithms, and data streams out there, it’s easy to think chart patterns are outdated. But in reality, they’ve never been more relevant.

Why? Because chart patterns are a visual reflection of collective trader behavior — supply, demand, fear, greed, and everything in between. And no matter how fast the market evolves, human behavior remains surprisingly consistent.

🔍 Patterns Show Market Psychology

These patterns don’t predict the future. They frame the context — giving you structure for risk and timing.

⚙️ In the AI Era, Patterns Gain New Power

When chart patterns are combined with automation and AI:

- They become faster to find

- Easier to filter for quality

- Possible to backtest at scale

Instead of scrolling through 10 charts to find a setup, AI can scan hundreds in seconds — and bring the best to your screen.

Chart patterns haven’t become less effective — they’ve just become more accessible and actionable with the right tech. Many of today’s most efficient trades begin with AI trading tools that help reduce analysis time and increase accuracy across multiple charts.

🤖 How AI Recognizes Patterns Differently from Humans

Human traders use intuition, experience, and memory to recognize chart patterns — but they’re also prone to bias, inconsistency, and fatigue. AI doesn’t have those limitations.

Here’s how machine learning changes the game:

🧠 Pattern Recognition with Algorithms

AI tools are trained on thousands of historical chart formations. They learn the “shape” of patterns — not just by name, but by structure:

- Symmetry

- Volume behavior

- Breakout direction

- Confirmation strength

Once trained, these systems can scan price action in real time and flag patterns the moment they form — without delay or second-guessing.

⚙️ What AI Can Spot Instantly

- Head and Shoulders (and inverse)

- Double tops/bottoms

- Flags, Pennants, Triangles

- Wedges, Channels

- Harmonics (like Gartley or Butterfly)

AI doesn’t look at charts the way you do — it processes data as geometry and sequence. That means:

- No “wishful” pattern fitting

- No missed micro-setups

- No over-analysis

💡 Bonus: No Sleep, No Ego

AI tools don’t need breaks. They don’t get overconfident. They don’t force patterns where none exist. For traders using platforms like Pocket Option or TradingView, this means more clarity with less screen time.

🛠 Overview of Top AI-Powered Pattern Recognition Tools

AI-driven charting tools have evolved fast. What used to be the domain of institutional traders is now available to anyone — even from a smartphone. These features are now standard in the best technical analysis software used by retail and professional traders alike.

Below is a quick comparison of some of the leading platforms offering automated pattern recognition in 2025.

📊 Comparison Table: AI Chart Pattern Tools

| Tool Name | Strengths | Platform Integration | Accuracy Level |

| TradingView | Real-time scanner, scripting (Pine) | Browser-based, broker sync | Medium–High |

| TrendSpider | Auto-trendlines, multi-timeframe logic | Web + mobile, auto alerts | Very High |

| MetaTrader Plugin AI | Classic pattern auto-detection | MT4/MT5 desktop | High |

| ChartStar AI | Deep learning for exotic formations | Web-based, niche tool | Medium |

| Pocket Option Tools | Embedded auto-alerts for setups | Built into trading terminal | Medium–High |

🔎 What Makes a Tool Stand Out?

- Speed — Can it detect patterns instantly?

- Context — Does it consider volume, trend, or false breakouts?

- Customizability — Can you set rules for which patterns to trade?

- Platform integration — Does it plug into your broker (like Pocket Option)?

The best tools don’t just recognize shapes — they help turn signals into structured trades.

📉 Real-World Use Cases: Entry, Exit s Alerts

Pattern recognition only becomes valuable when it translates into trade decisions. Whether you trade binaries, forex, or stocks — the real power of AI pattern tools lies in how you act on their signals.

🔽 Entry Example: Triangle Breakout

- Detected pattern: Symmetrical triangle on EUR/USD, 15m chart

- AI signal: Breakout alert with volume confirmation

- Action: Enter a 1-minute “Call” as price breaks resistance

- Why it works: The pattern shows compression; breakout is directional with momentum

🔼 Exit/Target Example: Flag Continuation

- Detected pattern: Bullish flag during uptrend

- AI signal: Re-entry alert after consolidation

- Action: Enter “Call” with expiration matching flag projection time (1–5m)

- Exit: Let expiration close the trade, no manual action needed

🔔 Alert Use Case: Head s Shoulders Top

- Pattern: Classic HCS forming on BTC/USD

- Platform: AI scanner triggers early warning

- Action: Avoid long trades, set up short entry or “Put” during right shoulder break

AI tools reduce reaction time and help remove hesitation. With tight expirations like on Pocket Option, that extra second of early detection can mean everything.

🧪 Testing Pattern Accuracy: AI vs Human Traders

Can AI actually recognize chart patterns better than experienced traders? In many cases — yes. But it depends on context, complexity, and how the tools are used.

Here’s how they compare by key criteria:

📊 AI vs Human Pattern Detection — Comparison Table

| Metric | AI Pattern Tools | Human Traders |

| Speed | Milliseconds (real-time scanning) | Minutes (manual chart review) |

| Consistency | 100% rule-based, emotion-free | Varies by mood, fatigue, bias |

| Pattern Diversity | Dozens recognized automatically | Limited to personal experience |

| Volume s trend filters | Integrated in some tools (TrendSpider) | Requires separate manual analysis |

| False positive handling | Improving with ML, not perfect | Often filtered by intuition |

| Context awareness | Developing with time (AI learning) | Strong in experienced traders |

🧠 Key Takeaway

AI wins in speed, scale, and objectivity.

Human traders still excel in contextual judgment — especially in messy markets.

💡 Best results often come from using AI to detect — and human logic to validate.

📲 Where You Can Use AI Tools

AI pattern tools are only useful if they fit into your trading workflow. Fortunately, many of them now plug directly into major platforms.

🔌 Where You Can Use AI Pattern Recognition:

- Pocket Option: Built-in AI trading function

- TradingView: Community scripts + integrated AI tools with alerts

- MetaTrader 4/5: Plugin-based recognition systems for classic technical patterns

- TrendSpider: Full automation with smart drawing + backtesting

Most platforms allow real-time alerts, mobile push notifications, and sometimes auto- trading integrations via API.

💡 Choose a tool that works where you trade — not one that requires switching platforms.

📚 Sources s References

1. TrendSpider Blog – Automated Chart Pattern Detection

2. TradingView – AI s Scripted Pattern Tools

3. Pocket Option – Built-In Technical Tools s Alerts

4. Investopedia – Technical Patterns s AI Analysis

FAQ

Can AI tools detect patterns better than I can?

In most cases — yes. They scan faster, don’t miss shapes, and aren’t influenced by emotions or bias. But combining AI with your own analysis is often best.

Are AI-detected patterns always reliable?

No pattern is 100% reliable. AI improves consistency and speed — but market context still matters. Use AI as a filter, not a guarantee.

Can I use these tools with binary options?

Absolutely, and not just with binary options. Platforms like Pocket Option support Quick Trading — fast expiry trades that work well with breakout or momentum patterns detected by AI.

Do I need to pay for these tools?

Some are free (like TradingView scripts), others are paid (TrendSpider, premium MT5 plugins). Start with free tools, then upgrade as needed.

CONCLUSION

AI-powered chart pattern recognition is no longer just for hedge funds — it’s a practical, scalable tool available to everyday traders. Whether you’re scanning for triangle breakouts or catching a reversal before it forms, AI tools save time, remove bias, and unlock setups across markets and timeframes. When combined with platforms like Pocket Option, they become a powerful edge — helping you trade smarter, not just faster.

Start trading