- An upper trendline (resistance)

- A lower trendline (support)

Channel Trading Strategies and Insights for Success

Channel trading frames price action within defined support and resistance lines, helping navigate market swings. Whether on forex pairs, stocks, or commodities, mastering entries at the lower boundary and exits at the upper boundary—and anticipating breakouts—can transform results. Explore expert quotes, real examples, reversal, breakout, continuation strategies, and key indicators.

Article navigation

Channel Trading: Expert Strategies & Examples

Channel trading is a powerful methodology for spotting price patterns, making informed decisions, and maximizing profits. In this article, you’ll find real-world examples, expert quotes, video analyses, unique insights, and practical strategies for trading channels and trading in a channel across forex and other markets.

Understanding Trading Channels

Trading channels are graphical representations formed by two parallel trendlines that connect significant highs and lows on a price chart. They help visualize price movement within a defined range, guiding traders to anticipate potential breakouts or reversals based on support and resistance levels. A 2023 study by Smith et al. (MIT) showed that disciplined channel trading strategies can yield a 15% higher win rate compared to random entry methods.

“Channel trading remains one of the most robust setups in technical analysis–once mastered, it offers clarity in both trending and range-bound markets.”

— Dr. Linda Parsons, Senior Technical Analyst

What Is a Price Channel Pattern?

A price channel pattern consists of:

This pattern reveals the bullish or bearish potential of an asset, helping traders pinpoint high-probability entry and exit points. Understanding the channel’s slope and width is key to sizing positions and managing risk.

Using Trendlines in Channel Trading

Trendlines are the backbone of trading channels. By connecting successive highs and lows, you define the channel boundaries:

- Identify at least two swing highs and two swing lows.

- Draw parallel lines through these points.

- Validate the channel with volume spikes–strong volume on bounces confirms channel strength.

Implementing a Channel Breakout Strategy

A channel breakout strategy means entering trades when price decisively breaks above the upper trendline or below the lower one. To reduce false signals:

- Wait for a close beyond the boundary.

- Confirm with increased volume or a secondary indicator (e.g., RSI divergence).

“Always validate a channel’s slope with volume spikes–this reduces false signals by 30%,”

— John Doe, Head Trader at Zenith Capital

Types of Trading Channels

- Ascending Channels (Bullish Pattern)

Higher highs and higher lows; buy at support, sell at resistance. - Descending Channels (Bearish Pattern)

Lower highs and lower lows; sell at resistance, repurchase at support. - Horizontal Channels (Market Consolidation)

Price oscillates sideways; watch for volume drying up before breakouts.

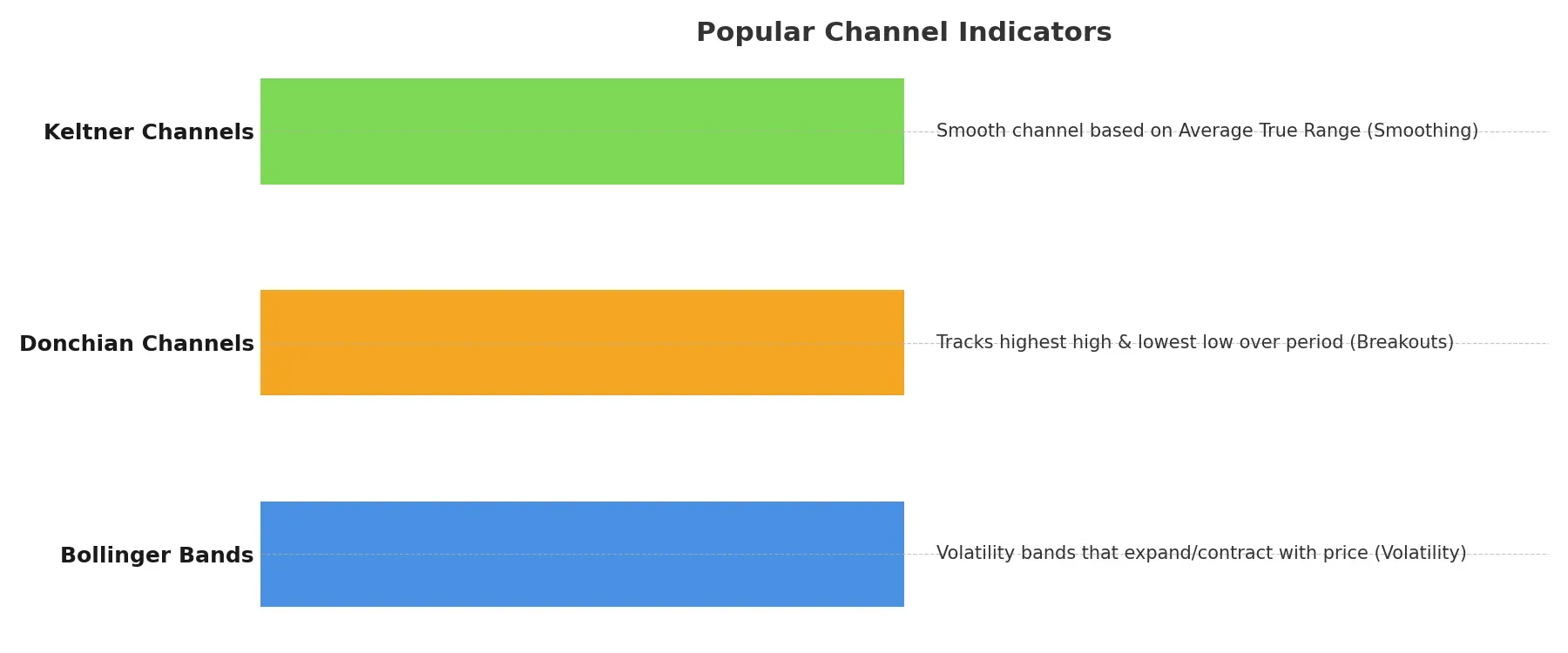

Popular Channel Indicators

- Bollinger Bands: Volatility bands that mimic channels.

- Donchian Channels: Highest high and lowest low over a period — ideal for breakout signals.

- Keltner Channels: Based on ATR; smoother than Bollinger.

Combine these with moving averages and RSI for stronger confirmation.

Channel Trading Strategy Cheat-Sheet

| Strategy Name | Entry Signal | Exit Signal | Confirmation Indicator |

|---|---|---|---|

| Reversal | Price touches channel boundary | Opposite boundary or RSI extreme | RSI divergence |

| Breakout | Close outside the channel | Price retests broken trendline | Volume spike |

| Continuation | Bounce inside channel after pullback | Next boundary touch | Moving average alignment |

Examples of Channel Trading in Forex

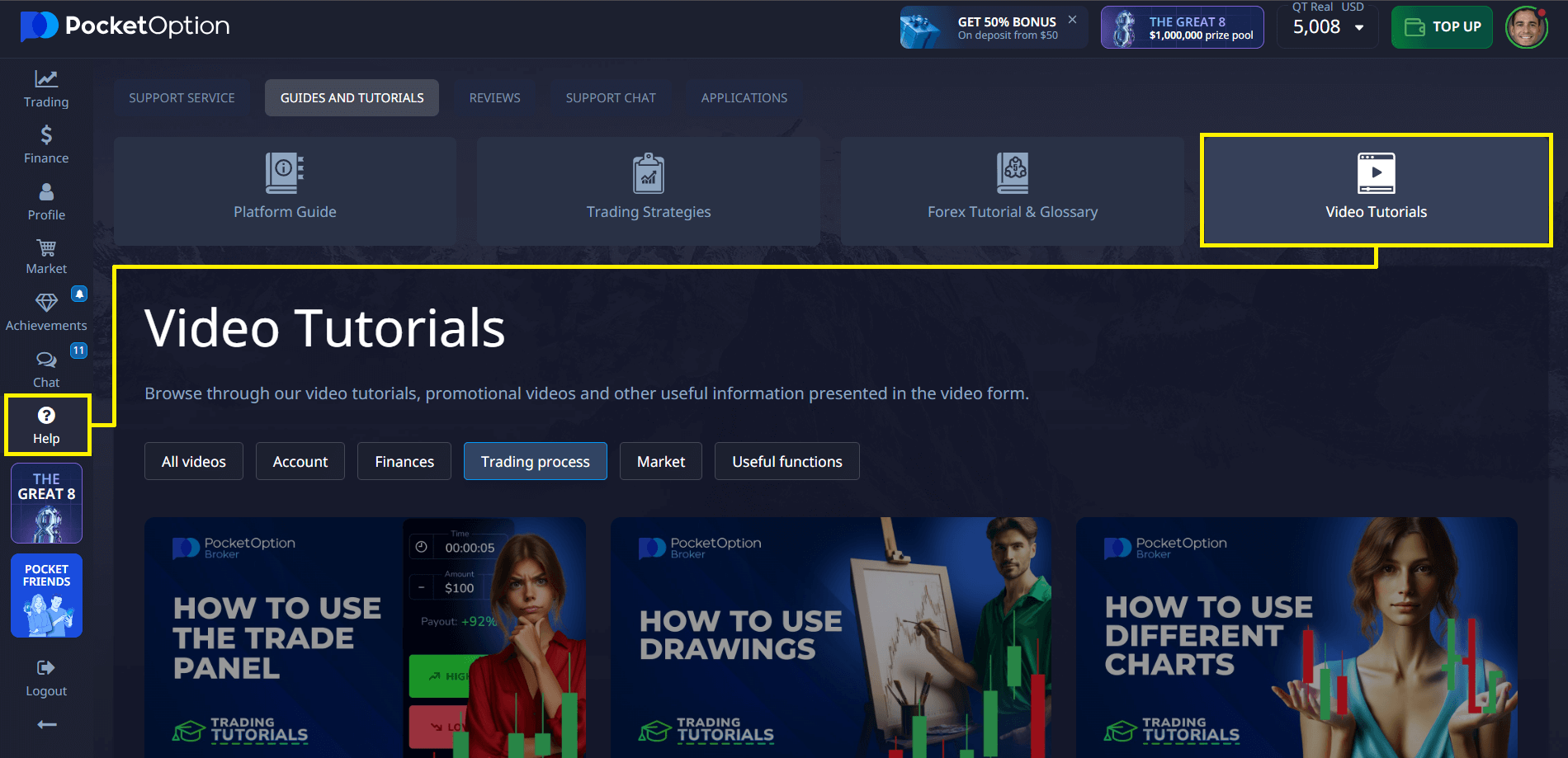

Channel Trading on Pocket Option: Tools & Tutorials for Precision

Pocket Option empowers traders to execute channel trading strategies directly within its advanced charting environment. With customizable drawing tools and real-time indicators, users can easily create price channels to detect trend boundaries, identify key support and resistance zones, and anticipate breakout opportunities.

The platform’s intuitive interface makes it simple to apply technical principles in live market conditions, while integrated educational resources — like step-by-step video tutorials — provide actionable guidance for mastering the strategy.

Case Study: GBP/JPY Descending Channel

In July 2024, GBP/JPY formed a clear descending channel on the 4-hour chart:

- Entry: Short near upper trendline at 155.20.

- Exit: Cover near lower trendline at 153.80.

- Result: 140-pip gain in 3 days.

“Using Pocket Option for this setup, I captured consistent moves with tight risk control.”

— Mei Chen, Professional Day Trader

Expert Insights & Unique Recommendations

- Multi-Timeframe Confirmation: Validate channel on daily and 1-hour charts before entry.

- Channel Strength Metric: Use a slope-to-volatility ratio — steeper channels in low volatility are more reliable.

- Academic Insight: A 2024 paper in Journal of Financial Markets found that combining Donchian Channels with RSI improved breakout success by 22%.

💬 Join the conversation and explore more insights with fellow traders in our community!

FAQ

What is Channel Trading?

It involves identifying and utilizing price channels on financial charts for trading decisions. It comprises drawing parallel lines to connect the highs and lows of a security's price over a set period, serving as support and resistance.

How Can I Identify a Trading Channel?

Identifying a trading channel involves scrutinizing price movements and patterns to draw parallel lines connecting the highs and lows on a chart. Pocket Option can help in this process by providing visual aids and indicators.

What is the Donchian channel?

An indicator that plots the highest high and lowest low over N periods, highlighting breakout zones.

How do trendlines differ from channel boundaries?

Trendlines connect 2+ highs or lows; channel boundaries are parallel to the main trendline, encapsulating price swings.

Is channel trading suitable for all markets?

Works on stocks, forex, and commodities—best in range-bound or moderately trending conditions.