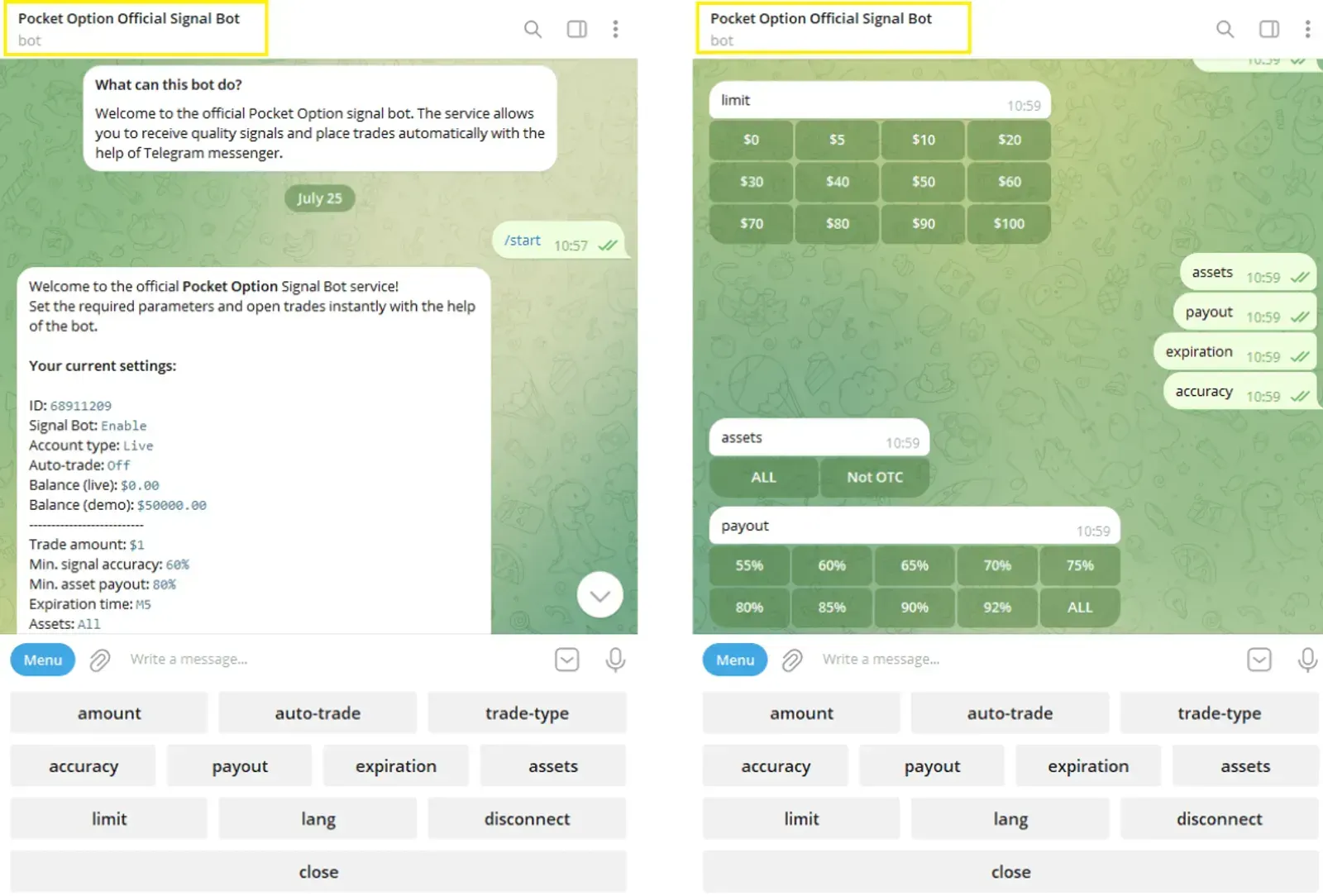

- Switch between demo or live account

- Set trade size, asset filters, minimum profit

- Enable auto mode or manual control

Bot Stock Trading

Bot stocks are increasingly attracting attention from Vietnamese investors, creating both significant opportunities and challenges for investors.

Article navigation

- Bot Stock Trading: Guide and Analysis with Trading Bots

- Understanding Trading Bots

- Real-World Examples of Bots and How They Work

- Why Use AI Bots for Stock Trading?

- Types of Bots in Stock Trading

- Choosing the Best AI Trading Software

- Strategy Automation: Pocket Option in Action

- Future Trends in AI Stock Trading

Bot Stock Trading: Guide and Analysis with Trading Bots

Welcome to the future of trading — where smart algorithms and artificial intelligence do the heavy lifting. Whether you’re a beginner or a seasoned trader, integrating a bot stock trading solution can supercharge your results. And if you’re using Pocket Option, you’re already halfway there. Let’s explore how AI-powered bots are changing the stock market and how you can leverage these tools for smarter, faster, and more effective trades.

Understanding Trading Bots

What is a Trading Bot?

A trading bot is an automated tool powered by a stock market algorithm that executes trades based on predefined strategies. These bots analyze massive datasets, identify patterns, and make trades with minimal human input. Pocket Option offers an official signal bot as well as AI trading.

How Do AI Trading Bots Work?

AI trading bots use machine learning and predictive analytics to adapt to evolving market conditions. These tools continuously scan market data, test strategies, and execute trades automatically.

Main functions of AI bots:

| Feature | Description |

|---|---|

| Market Scanning | Real-time data analysis to identify entry/exit points |

| Strategy Backtesting | Simulate trading strategies using historical data |

| Trade Execution | Executes trades automatically without emotional bias |

| Cross-Asset Flexibility | Works across stocks, ETFs, crypto, and more |

Real-World Examples of Bots and How They Work

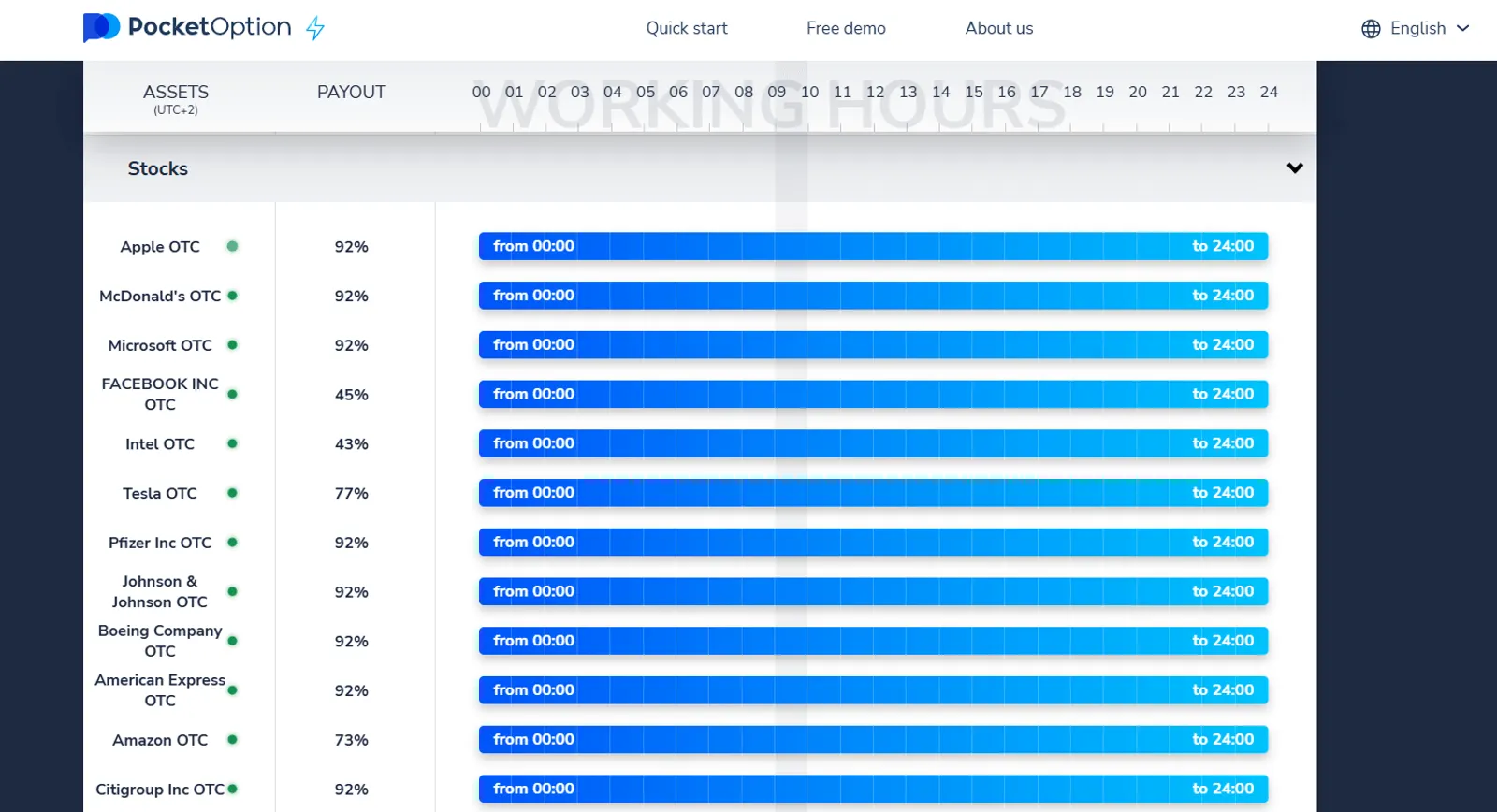

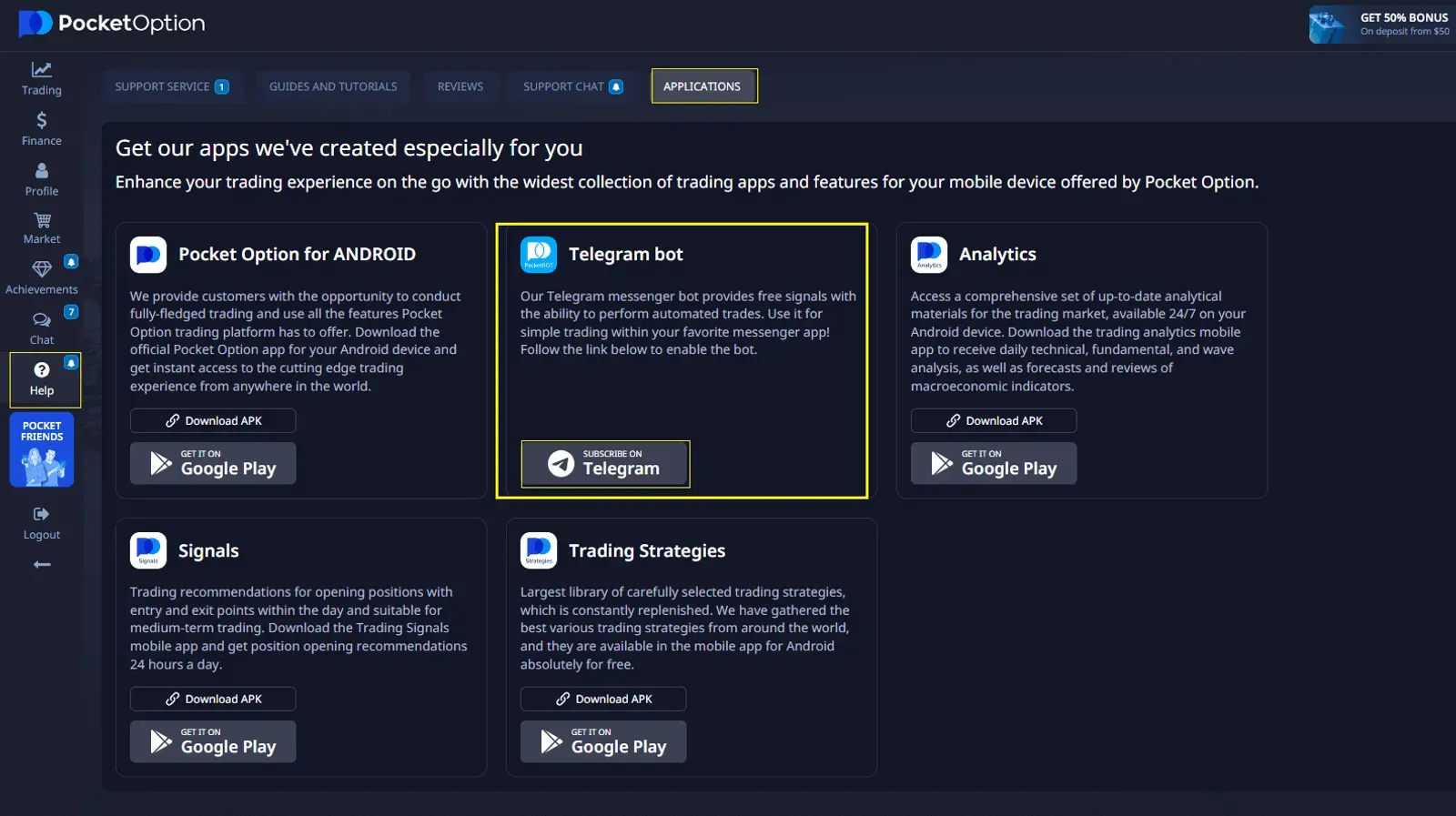

1. Pocket Option Telegram Signal Bot

Where to find: Built-in tool, accessible from Help → Applications or Signals tab inside Pocket Option.

How it works: Once you start the bot in Telegram, it connects to your account and either sends signals or trades automatically based on your settings.

Configuration options:

Expert Quote: “The Pocket Option bot’s simplicity belies its power. With proper setup, it serves as a 24/7 assistant — reacting faster than a human could.” — Maria Lopez, fintech automation expert

2. Built-In AI Trading Bot

Where to find: Activate in account settings (Settings → AI Trading)

Key features:

- Uses RSI, MACD, moving averages

- Makes Buy/Sell decisions and sets expiry times

- Tested on 10,000+ market scenarios with 89% signal accuracy and 68% win rate

Pro Tip: Best for beginners looking to automate entry-level strategies in a controlled way

3. Third‑Party Trading Bots (Outside Pocket Option)

Explore reliable tools that offer automation for trading:

1. 2Bot (2bot.top) – Chrome Extension

Features:

- Free browser extension tailored to automate trading on Pocket Option.

- Offers two modes:

- Signal Mode: Enters trades when Pocket Option platform signals match your criteria.

- Indicator Mode: Utilizes indicators like CCI‑20 across all active trading pairs—automatically executes trades when criteria are met.

- Risk control tools include settings for minimum profitability thresholds, maximum concurrent trades, take-profit levels, and trade delays to protect your deposit.

- Trial safe: Supports both demo and live accounts.

- Designed with a user-friendly interface for easy setup—even for beginners.

- Available in multiple languages: English, French, Spanish, German, and more

2. MT2Trading Robot – MT4/MT5 Add‑on

Features & Strengths:

- Seamlessly integrates with MetaTrader 4 & 5, enabling advanced automation across compatible brokers (e.g., Pocket Option, AvaTrade, IC Markets).

- Supports copy trading, risk management, economic news filtering, and custom strategy setup.

- Offers both demo and live trading modes.

User Sentiment & Ratings:

- TrustPilot verifies an overall rating of 4.3/5, praising its profit potential, time-saving convenience, and reliable automation.

- DayTrading.com flags occasional issues like unreliable customer support and emphasizes no guaranteed returns.

Expert Observation:

Tobias Robinson (CEO of DayTrading.com, trader with 25+ years of experience) notes:

“MT2Trading provides intuitive automation through MT4/MT5 add-ons, bridging algorithmic strategies with binary and forex markets.”

3. GitHub‑Hosted Open‑Source Bots (e.g., po_bot_ml)

Overview:

These bots empower technically inclined traders to develop, backtest, and deploy custom trading strategies using code.

Available Tools – from a GitHub repository:

- po_bot_indicators.py: Trades based on indicator combinations (e.g., PSAR).

- po_bot_ml.py: Uses Random Forest ML algorithm with features like MACD, CCI, PSAR, Awesome Oscillator. Executes trades when prediction confidence exceeds a threshold (e.g., >0.60).

- po_bot.py: Implements a Martingale strategy—progressing trade amounts after losses.

- test_on_historical_data.py: Enables strategy backtesting on historical data.

Important Notes:

- Requires setup on Mac or Linux, and .NET 6.0 or newer.

- Version 1 (free) is fully usable; Version 2 is paid but offers 10 free trades daily as trial.

- The repository itself notes that ‘profitability is not guaranteed’—these are experimental tools.

Summary Table

| Bot / Platform | Key Features | Best Suited For |

|---|---|---|

| 2Bot (Chrome) | Free, CCI‑based strategies, demo/live modes, risk controls | Beginners, quick setup, demo experimentation |

| MT2Trading Robot | MT4/MT5 integration, copy trading, risk tools, multi-broker support | Retail traders using MetaTrader ecosystems |

| GitHub Bots | Full-code access, ML strategies, indicator-based, backtesting | Developers, quant traders, experimental testing |

Final Insights

- 2Bot is excellent for speedy trials and quick automation with safety controls—ideal for anyone starting out or testing strategies.

- MT2Trading gives flexibility and advanced setup, especially for traders using MetaTrader—though expect a monthly fee and mixed support reviews.

- Open-Source Bots offer the deepest customization for technically minded users—but come with no guarantees and require a good grip on coding and risk management.

Why Use AI Bots for Stock Trading?

Key Advantages

- ⏱ Speed: Bots react instantly to market changes.

- 🧠 Logic-Based Decisions: No emotional trades.

- 📈 Scalability: Run multiple strategies 24/7.

- 📊 Performance Monitoring: Track and optimize results over time.

Real-Life Use Case

Let’s say you’re tracking Apple stock. A bot can be set up to:

- Monitor Apple news & price movements

- Automatically buy when the RSI falls below 30

- Sell when profit exceeds 3%

This setup runs 24/7, adjusting without your manual input.

Types of Bots in Stock Trading

Automated vs. Manual Trading

| Criteria | Automated Stock Bot | Manual Trading |

|---|---|---|

| Speed | Instant execution | Subject to human delay |

| Accuracy | Algorithm-based decisions | Influenced by emotion |

| Monitoring | 24/7 market scanning | Limited by human availability |

| Strategy Testing | Advanced backtesting capabilities | Manual guesswork |

AI-Powered Bots

These are not your average bots. An AI trading bot can learn from past trades, adapt its strategy, and optimize trade timing.

Best Free AI Bots for Beginners

Many platforms, including Pocket Option, offer free bot-like functionalities. These are perfect for beginners to test strategies without risking real capital.

Popular beginner features:

- Demo account with $50,000 virtual funds

- Built-in trading signals from algorithmic systems

- One-click trade execution

Choosing the Best AI Trading Software

What to Look For

- User-Friendly Interface

- Real-Time Market Analysis

- Custom Strategy Design

- Broker Compatibility

- Multilingual Support (e.g., algoritmos bursátiles)

Comparison Table

| Feature | Pocket Option Bot | StockHero | 3rd-Party Robo-Trading Tools |

|---|---|---|---|

| Platform Integration | ✅ Built-in | ❌ External | ❌ External |

| Demo Account | ✅ Yes | ✅ Yes | ❌ No |

| Free to Use | ✅ Yes | ✅ Limited | ❌ Rare |

| Language Support | ✅ Multilingual | ✅ English | ❌ Limited |

Working with Brokers

For a bot to operate, it needs to connect to a brokerage. Pocket Option removes that complexity with built-in automation. This means you don’t need to worry about API keys or 3rd-party logins — simply enable the trading signal bot.

Strategy Automation: Pocket Option in Action

How to Use Automation Effectively

- Choose a trade signal

- Adjust trade size & direction (Buy/Sell)

- Monitor results & optimize

Pocket Option’s AI Signal Bot helps bridge the gap between full automation and trader control.

Maximizing Your Results with AI

Key Tips:

- Use software automático that lets you test before you invest

- Don’t rely on one strategy — rotate based on market condition

- Always track performance using analytics

Expert Recommendations

- For beginners: Start with Pocket Option’s Signal Bot in demo mode.

- For intermediate users: Combine trend-based strategies with automation.

- For advanced traders: Use custom GitHub ML scripts and optimize risk-reward ratios.

Future Trends in AI Stock Trading

| Trend | What It Means for Traders |

|---|---|

| NLP in Trading Bots | Bots understanding financial news & tweets |

| Deep Learning for Prediction | Better market forecasts |

| Multi-Asset AI Engines | Trade crypto, stocks & forex from one interface |

Challenges to Consider

- ❌ Requires strategy understanding

- ❌ Not foolproof — can misread market signals

- ❌ Some platforms lack full transparency

FAQ

What is a stock trading bot?

A stock trading bot is a software tool that uses algorithms or AI to automatically buy and sell stocks based on predefined strategies — no manual input needed.

Are trading bots profitable?

Yes, trading bots can be profitable when configured correctly and paired with solid strategies. However, they still carry risk and require monitoring and optimization

Which is the best AI trading bot?

For ease of use and built-in automation, the Pocket Option AI Signal Bot is one of the top choices. It requires no coding, supports real-time signals, and is free to use on both demo and live accounts.

What are bot stocks and how to identify them?

Bot stocks are stocks primarily traded by automated algorithms or trading robots. You can identify them through signs such as unusual trading volume in short periods, price fluctuations inconsistent with news, repetitive trading patterns, high frequency of small orders with consistent volumes, and immediate reactions to market news.

Should one invest in bot stocks?

Investing in bot stocks can offer profit opportunities but also carries many risks. Investment decisions depend on each investor's knowledge, experience, and risk appetite. If you decide to participate, you need to have a strict risk management strategy, limit the proportion of investment capital, use stop-loss orders, and enhance your knowledge about how trading algorithms work.

What are effective trading strategies with bot stocks?

Some effective strategies include: "Monitor and adapt" - identifying bot operation cycles and adjusting trading timing; using technical analysis adjusted for shorter cycles; analyzing price volatility speed to early identify bot activities; and strict risk management with investment diversification and appropriate stop-loss orders.

How to protect your investment portfolio when bot stocks decline sharply?

When bot stocks decline sharply, you should adhere to your pre-established risk management plan, use stop-loss orders to limit losses, maintain a sufficient cash ratio to take advantage of opportunities during market volatility, avoid using financial leverage, and objectively reassess your analysis before making the next decision.

What will the future of bot stocks in Vietnam be like?

Bot stocks are expected to become increasingly common in Vietnam's stock market. Notable trends include: increasing number and diversification of trading algorithms, greater participation by large financial institutions, stricter legal regulations, increasingly sophisticated analysis and trading tools, and development of "democratized trading bot" platforms allowing individual investors to access automated trading technology.

CONCLUSION

Bot stock trading is revolutionizing the way we approach the markets. Tools like the Pocket Option signal bot offer a seamless way to enter AI-powered trading without needing to code. Whether you're experimenting or scaling up, it's time to embrace the future of intelligent investing. Ready to start? Open a Pocket Option account and try bot-powered tools risk-free!

Start trading