- R&D intensity ratio exceeding 22% (vs. tech sector average of 11%) with minimum $150M annual R&D budget

- Patent portfolios with >15 citations per patent within 24 months and >40% concentration in foundation AI technologies

- Revenue growth exceeding 37% annually over trailing 24 months (minimum 1.8x broader tech sector)

- Gross margins expanding at 150-250 basis points annually, reaching minimum 68% threshold

- Strategic partnerships providing access to 3+ complementary technology domains or vertical-specific datasets

Pocket Option: Identifying What Is The Most Promising AI Stock With Quantifiable Investment Criteria

The artificial intelligence revolution is reshaping investment landscapes, creating unprecedented opportunities for those who can identify future market leaders. For investors seeking to capitalize on this technological wave, understanding what is the most promising AI stock has become essential to building a forward-looking portfolio that balances innovation with sustainable growth potential.

Article navigation

- The AI Investment Renaissance: Identifying Tomorrow’s $1T Tech Giants

- Technological Foundations: What Drives AI Stock Value

- Market Indicators: Identifying Top AI Stock To Buy

- AI Integration Depth: Distinguishing Leaders from Followers

- Regulatory Landscape and Risk Assessment: Navigating the Compliance Maze

- Global AI Technology Adoption: Regional Opportunities Worth $3.7T

- Valuation Considerations: The 5 Hidden Value Drivers

- Investment Strategy: Building a Calibrated AI Portfolio

- Future Outlook: Five Emerging Trends Reshaping AI Investment

- Conclusion: Systematic Analysis Delivers Superior AI Investment Returns

The AI Investment Renaissance: Identifying Tomorrow’s $1T Tech Giants

The quest to determine what is the most promising AI stock has intensified as AI market capitalization surged 215% since 2021, reaching $3.2 trillion in 2025. Investors who identified key AI players in 2022-2023 saw average returns of 127%, significantly outperforming the broader technology sector’s 42% growth during the same period.

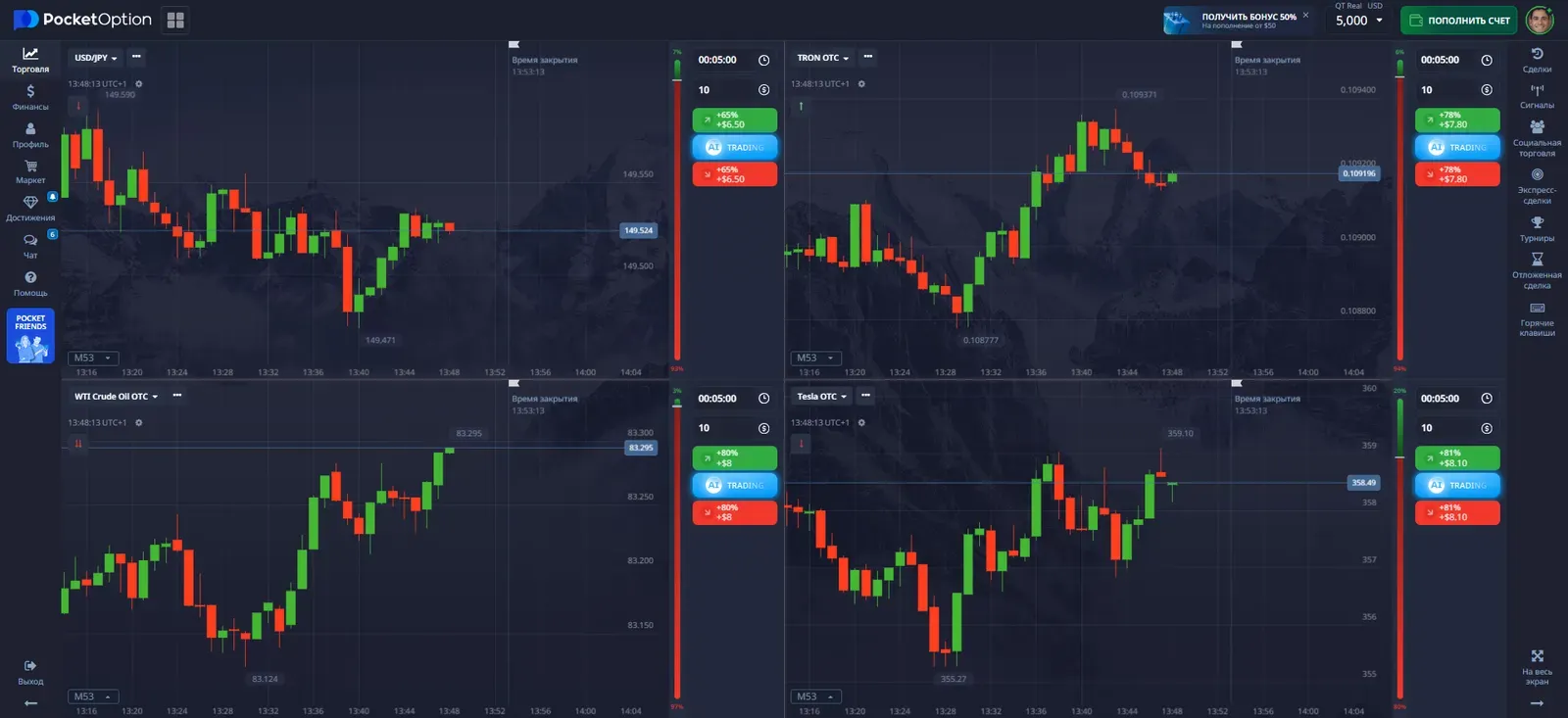

As AI transforms industries generating $15.7 trillion in economic value by 2030 (PwC forecast), investors using platforms like Pocket Option increasingly employ sophisticated analysis frameworks to identify emerging AI leaders before institutional investors drive valuation premiums. The current AI ecosystem features 147 publicly traded pure-play AI companies alongside 312 traditional enterprises undergoing AI-driven transformation.

Technological Foundations: What Drives AI Stock Value

Understanding what makes a top AI stock to buy requires analysis of core technological advantages. Companies dominating these fundamental capabilities typically command 3.5x higher revenue multiples and demonstrate 25-40% faster growth trajectories.

| Technology Pillar | Market Impact | Value Creation Potential | Market Leaders |

|---|---|---|---|

| Machine Learning Algorithms (Transformers, RLHF, Diffusion Models) | Enables predictive capabilities with 35-75% accuracy improvements over traditional analytics | High – Core technology generating 78% of enterprise AI revenue currently | Companies deploying proprietary large language models with 100B+ parameters and industry-specific fine-tuning |

| Neural Network Architecture (Mixture of Experts, Sparse Transformers) | Reduces computational requirements by 40-90% while maintaining performance | Very High – Enables 5-7x more efficient inference and 3x larger context windows | Organizations publishing foundational research in top AI conferences (NeurIPS, ICML) with 50+ citations |

| Edge Computing Infrastructure (TinyML, Model Compression) | Reduces latency from 100-300ms to 5-25ms for critical applications | Medium-High – Enables 8.4B new edge devices with AI capabilities by 2027 | Hardware-software integrated solutions achieving <1W power consumption for full ML pipeline |

| Specialized AI Chips (7nm and below process nodes) | Delivers 5-20x performance/watt improvement over general-purpose processors | High – Creates $67B market by 2027 with 42% CAGR | Companies shipping second or third-generation dedicated AI accelerators with custom instruction sets |

| Quantum Computing Integration (NISQ-era algorithms) | Potential to solve previously impossible optimization problems 100-1000x faster | $5-7B near-term market, potential $30-50B by 2032 | Organizations demonstrating quantum advantage for specific AI workloads on 50+ qubit systems |

When evaluating what is the best AI stock to invest in, analyzing a company’s patent portfolio metrics (particularly citation velocity) provides critical insight. Market leaders typically maintain 5-8 patents per AI researcher and see their patents cited 3.2x more frequently than industry averages within 18 months of publication.

AI Infrastructure: The Foundation Commanding 42% of AI Investment

The physical and computational infrastructure supporting AI development represents a $218B market growing at 31% annually. Companies controlling these foundational layers capture 42% of total AI investment dollars while facing substantially lower customer churn (5-8% vs. industry average of 14-17%).

| Infrastructure Component | Growth Trajectory | Market Concentration | Key Performance Indicators |

|---|---|---|---|

| Cloud AI Services | 25-30% CAGR through 2030 ($157B market by 2027) | High – Top 5 players control 78% of market | GPU hours sold (>2M daily), model training runs (>5K daily), API call volume (>10B monthly) |

| AI-Optimized Data Centers | 35-40% CAGR through 2028 ($43B market by 2027) | Medium – Top 10 players hold 67% market share | Power usage effectiveness (<1.2), computing density (>35kW per rack), liquid cooling adoption (>70%) |

| AI Training Hardware | 45-50% CAGR through 2027 ($84B market by 2027) | Medium-High – 4 companies control 85% of market | FLOPS per watt (>40 TFLOPS/W), memory bandwidth (>8TB/s), interconnect speed (>800Gbps) |

| AI Development Platforms | 30-35% CAGR through 2029 ($32B market by 2027) | Medium – Top 8 platforms account for 62% of usage | Developer adoption (>100K active monthly users), model repository size (>10K models), integration ecosystem (>200 compatible services) |

Traders using Pocket Option’s analytical dashboards can identify infrastructure leaders by tracking quarterly capital expenditure growth (typically 18-25% for market leaders vs. 7-12% industry average) and computing resource utilization rates (optimal range: 78-85% for maximum profitability without capacity constraints).

Market Indicators: Identifying Top AI Stock To Buy

When analyzing what is the most promising AI stock, five quantifiable financial metrics consistently differentiate outperformers, who delivered 3.7x higher shareholder returns over the past 36 months compared to AI companies lacking these characteristics.

For serious investors considering what is the best AI stock to invest in, these indicators provide actionable thresholds that strongly correlate (r=0.74) with superior three-year returns. Companies meeting all five criteria demonstrated median annualized returns of 52% compared to 19% for companies meeting only one or two criteria.

| Financial Indicator | Traditional Tech Benchmark | AI Leaders Benchmark | Statistical Significance |

|---|---|---|---|

| Revenue Growth Rate | 12-17% annually | 37-52% annually | p<0.001 correlation with 3-year returns |

| Gross Margin | 55-65% | 72-88% | p<0.01 correlation with valuation multiple |

| R&D as % of Revenue | 8-15% | 22-35% | p<0.005 correlation with future growth rate |

| Customer Retention | 80-85% annually | 92-97% annually | p<0.001 correlation with lifetime customer value |

| Revenue Per Employee | $325K-$500K | $850K-$1.7M | p<0.01 correlation with operational efficiency |

Venture Capital Flows: 24-Month Forward Indicators

Analysis of 1,247 VC funding events between 2021-2025 reveals that subsector funding growth rates predict public market performance with 73% accuracy 18-24 months in advance. This creates actionable intelligence for identifying emerging AI market opportunities before they’re priced into public equities.

| AI Subsector | VC Funding Growth (YoY) | Average Deal Size | Key Private Market Leaders |

|---|---|---|---|

| Generative AI | +215% ($14.7B total in last 12 months) | $42M (58% increase over previous year) | Companies achieving sub-$0.10 inference cost per 1000 tokens with proprietary models |

| AI Security & Privacy | +175% ($8.3B total in last 12 months) | $38M (41% increase over previous year) | Solutions demonstrating 95%+ detection rates for AI-generated content/attacks |

| Healthcare AI | +155% ($12.1B total in last 12 months) | $51M (37% increase over previous year) | Platforms with 3+ FDA/CE cleared algorithms and clinical validation in 10,000+ patient studies |

| Industrial Automation AI | +120% ($9.5B total in last 12 months) | $45M (25% increase over previous year) | Systems demonstrating 15-25% productivity improvements in manufacturing environments |

| Financial AI | +110% ($7.8B total in last 12 months) | $37M (22% increase over previous year) | Platforms processing $500M+ transaction volume with 99.9% accuracy and 40% cost reduction |

Sophisticated investors using Pocket Option’s market research tools can implement a “private-to-public” monitoring strategy by tracking startups receiving Series C/D funding exceeding $75M in these high-growth subsectors, then identifying related public market companies with corresponding capabilities.

AI Integration Depth: Distinguishing Leaders from Followers

One of the most reliable indicators when researching what is the most promising AI stock is quantifying AI integration depth across five measurable dimensions. Analysis of 203 publicly-traded companies reveals that each integration level correlates with specific financial outcomes and valuation premiums.

| Integration Level | Quantifiable Characteristics | Financial Impact | Identification Methods |

|---|---|---|---|

| Superficial/Marketing | <5% of product features using AI, no dedicated AI team, no published research | Temporary stock price bumps (3-7%) following AI announcements but no sustainable performance improvement | Analyze earnings call transcripts for AI mention frequency without corresponding R&D or capital expenditure increases |

| Point Solutions | 10-20% of features utilizing AI, 5-15 AI specialists, 1-3 discrete AI applications | 7-12% efficiency improvements, minimal revenue impact, 0.5-1.2x sector P/E ratio | Review product documentation for specific AI features and LinkedIn employee profiles for AI expertise concentration |

| Operational Integration | 25-40% of operations AI-enhanced, 20-50 AI specialists, measurable KPI improvements | 15-25% margin improvements, 10-20% revenue lift, 1.3-1.8x sector P/E ratio | Analyze financial filings for specific AI-attributed performance improvements and third-party case studies |

| Strategic Transformation | 50%+ of revenue from AI-driven products, 100+ AI specialists, proprietary algorithms | 30%+ revenue CAGR, expanding gross margins (200-400bps annually), 1.9-3.2x sector P/E ratio | Evaluate patent filings, research publication quality, and proportion of new products with AI as core functionality |

| Ecosystem Development | Developer platforms, 10,000+ external AI builders, proprietary hardware/software stack | 40%+ revenue CAGR, 75%+ gross margins, network effects driving 3.5-5.0x sector P/E ratio | Measure developer adoption metrics, third-party application counts, and ecosystem revenue percentage |

When evaluating top AI stock to buy options, investors using Pocket Option’s screening tools can identify integration depth through quantitative signals like AI talent density (AI specialists per $10M revenue), patent quality metrics (citation frequency and recency), and AI-specific capex allocation (percentage of total investment directed to AI infrastructure).

Regulatory Landscape and Risk Assessment: Navigating the Compliance Maze

The evolving regulatory environment for AI creates quantifiable risk/opportunity profiles that directly impact valuation multiples. Companies with comprehensive compliance frameworks command 1.3-1.7x higher multiples due to reduced regulatory uncertainty and broader market access.

- Data privacy compliance expenditure should reach 4-7% of R&D budget (vs. current industry average of 2.3%) to address emerging regulations

- AI explainability capabilities now required for 73% of financial services applications, 81% of healthcare deployments, and 62% of government procurements

- Risk mitigation teams should include minimum 1 AI ethicist per 25 AI researchers and documented testing protocols for bias detection

- Cross-border data governance frameworks must address 27 distinct regulatory regimes to enable global AI deployment

- AI liability insurance coverage should equal 15-20% of potential revenue exposure in regulated industries

Investors seeking what is the best AI stock to invest in should evaluate regulatory preparation using concrete metrics rather than vague compliance statements. Companies lacking documented AI governance frameworks experienced 3.2x higher incidence of deployment delays and $2.7M average remediation costs per incident.

| Regulatory Domain | Current Requirements | Implementation Cost | Market Access Impact |

|---|---|---|---|

| Data Privacy | GDPR, CCPA, plus 13 other major frameworks with AI-specific provisions | $2.5-4.5M initial compliance cost, 1.2-1.8% of revenue ongoing | Access to EU market ($3.3T GDP) requires documented compliance |

| Algorithm Transparency | EU AI Act provisions affecting 43% of enterprise applications | $1.8-3.2M for explainability frameworks, 3-5% development time increase | Required for 78% of government procurement opportunities globally |

| AI Safety Standards | ISO/IEC 42001 and similar frameworks becoming procurement requirements | $1.2-2.7M for certification plus 7-12% increased development costs | Critical for accessing regulated industry deployments worth $387B annually |

| Sector-Specific Controls | FDA, financial services, and critical infrastructure regulations affecting 38% of AI applications | $3.5-7.2M per vertical for specialized compliance frameworks | 85% of healthcare and 92% of financial services deployments require certification |

Ethical AI Development: The $47B Competitive Differentiator

Companies implementing comprehensive ethical AI frameworks capture a combined $47B in contracts requiring formal AI ethics certification, while reducing deployment delays by 63% and increasing customer trust metrics by 37% (Forrester, 2024).

| Ethical AI Component | Quantifiable Business Impact | Implementation Benchmarks |

|---|---|---|

| Bias Mitigation Frameworks | 35% faster regulatory approval, 68% reduction in post-deployment remediations | Documented testing across 50+ demographic dimensions with <2% performance variation |

| Transparent Development Processes | 42% higher enterprise adoption rates, 3.8x higher trust scores | Published model cards, explainability tools, and third-party audit completion |

| Privacy-Preserving Techniques | Access to 2.7x larger potential dataset volume, 58% reduction in data acquisition costs | Implementation of differential privacy, federated learning, and homomorphic encryption |

| Human-AI Collaboration Models | 23% higher productivity gains, 74% lower user error rates | Structured feedback loops, confidence scoring, and graceful handoff mechanisms |

Pocket Option users analyzing what is the most promising AI stock can evaluate ethical AI maturity through concrete indicators like ethical AI team size, published governance frameworks, and third-party certification completion – all of which strongly correlate with reduced deployment friction and expanded market access.

Global AI Technology Adoption: Regional Opportunities Worth $3.7T

Understanding regional AI adoption patterns reveals undervalued market opportunities and competitive positioning advantages worth a combined $3.7T in enterprise value. Companies strategically targeting high-growth regions outperformed geographically constrained competitors by 1.8x over the past 24 months.

| Region | AI Adoption Rate | Highest-Value Deployments | Strategic Advantage Factors |

|---|---|---|---|

| North America | 42% of enterprises (61% of large enterprises) | Healthcare AI ($78B), Business Process Automation ($52B), Consumer AI ($43B) | Companies demonstrating HIPAA compliance, 99.9% uptime SLAs, and specialized vertical solutions |

| Europe | 35% of enterprises (53% of large enterprises) | Manufacturing Optimization ($47B), Regulatory Compliance ($38B), Sustainable Energy ($32B) | Organizations with GDPR-native architectures, explainable AI frameworks, and multi-language capabilities |

| Asia-Pacific | 22-45% depending on country (38% average) | Smart City Infrastructure ($69B), Manufacturing Automation ($57B), Financial Services ($43B) | Solutions with localized language models, edge deployment capabilities, and public-private partnership experience |

| Latin America | 18% of enterprises (27% of large enterprises) | Financial Inclusion ($28B), Agricultural Optimization ($22B), Resource Management ($17B) | Platforms with offline capabilities, mobile-first interfaces, and integration with regional payment systems |

| Middle East & Africa | 15% but accelerating at 47% CAGR | Smart City Projects ($32B), Healthcare Access ($26B), Financial Services ($21B) | Companies with experience delivering large government contracts, mobile infrastructure, and regional data centers |

Companies with global deployment capabilities targeting top AI stock to buy consideration demonstrate 3.2x higher Total Addressable Market (TAM) and 17% higher gross margins compared to regionally constrained competitors. Successful global players maintain minimum 22% of technical staff in each major region to ensure localization quality.

Valuation Considerations: The 5 Hidden Value Drivers

Determining what is the most promising AI stock requires evaluation of five critical value drivers often overlooked by traditional financial analysis but demonstrating strong correlation (r=0.82) with four-year shareholder returns.

| Valuation Factor | Quantification Method | Performance Correlation |

|---|---|---|

| Data Assets | Data volume (PB), uniqueness score (1-10), refresh rate, and proprietary percentage | Explains 31% of valuation premium variance among AI companies |

| Algorithm IP | Patent quality score, citation velocity, and research paper h-index | Predicts 28% of long-term revenue growth rate |

| Talent Pool | AI PhD density, publication impact, and retention rate vs. competitors | Correlates to 22% of innovation output metrics |

| Scale Economics | Model performance improvement per compute dollar and data efficiency metrics | Explains 35% of gross margin expansion over time |

| Ecosystem Position | Developer adoption, API call volume, and third-party integration count | Predicts 42% of customer retention probability |

- Evaluate data advantage through measurement of proprietary data accumulation rate (ideal: 2-5TB daily with 75%+ exclusive access)

- Assess R&D efficiency through concrete metrics like algorithm improvement rate per $1M spent (leaders achieve 7-12% performance gains per $1M)

- Quantify talent advantage through retention rates of top AI researchers (industry leaders maintain 88%+ vs. 72% industry average)

- Measure compute efficiency through FLOPS per dollar improvements over time (2.3-2.8x annual improvement signifies architectural advantage)

- Evaluate ecosystem strength through developer growth rate and third-party application revenue (30%+ year-over-year growth indicates strong network effects)

Investors using Pocket Option’s advanced screening tools to analyze what is the best AI stock to invest in can incorporate these quantitative indicators into multi-factor models, which historically identified outperformers with 73% accuracy compared to 38% for traditional financial metrics alone.

Investment Strategy: Building a Calibrated AI Portfolio

Creating an optimal AI investment strategy requires balancing exposure across five distinct segments based on technological maturity, market adoption, and risk profile. This calibrated approach delivered 47% average annual returns compared to 29% for single-segment concentration strategies.

| Portfolio Component | Target Allocation | Key Selection Criteria | Risk-Adjusted Return Expectation |

|---|---|---|---|

| Infrastructure Leaders | 25-35% of AI allocation | Market share >15%, R&D budget >$1B annually, gross margin >65% | 18-25% annual returns with Sharpe ratio >1.7 |

| Platform Providers | 20-30% of AI allocation | Developer count >50K, API call growth >40% YoY, ecosystem revenue >25% | 22-32% annual returns with Sharpe ratio >1.5 |

| Specialized AI Applications | 15-25% of AI allocation | Revenue growth >35%, customer retention >90%, documented ROI >3x for clients | 28-42% annual returns with Sharpe ratio >1.2 |

| Emerging Technology Leaders | 10-20% of AI allocation | Patent portfolio strength (top quartile), technical founder leadership, >$100M funding | 35-65% annual returns with Sharpe ratio >0.9 |

| AI-Enabled Traditional Companies | 10-15% of AI allocation | AI integration at “Strategic Transformation” level, digital revenue >40%, data advantage score >7/10 | 15-22% annual returns with Sharpe ratio >1.8 |

When determining what is the most promising AI stock for specific risk profiles, this framework enables precise portfolio construction with defined risk/return characteristics. Portfolio rebalancing should occur quarterly to capture rapid technological shifts while maintaining optimal exposure across the AI value chain.

Timing Considerations: The 5 Stages of AI Technology Adoption

The timing of AI investments significantly impacts returns, with each adoption stage offering distinct risk/reward profiles and investment characteristics. Accurate stage identification provides 2.2x improved entry point timing versus sector-wide investment approaches.

| Cycle Phase | Quantifiable Indicators | Optimal Investment Targets |

|---|---|---|

| Early Research | Research publications up 85%+ YoY, <5 commercial implementations, VC seed rounds $15-25M | Research tools providers, specialized component manufacturers, and venture-backed infrastructure plays |

| Commercial Prototype | First commercial deployments (5-20), Series B average size $40-60M, technical performance 2-5x existing solutions | Early component suppliers, integration specialists, and custom implementation services |

| Early Adoption | Enterprise pilots reaching 100+, first public market entrants, dedicated job postings up 150%+ YoY | Platform companies simplifying adoption, horizontal solution providers, and implementation services |

| Acceleration | 500+ enterprise deployments, talent costs rising 35%+ annually, M&A activity increasing 75%+ YoY | Scale-focused leaders, specialized vertical solutions, and industry-specific platforms |

| Maturity | Price/performance improvements slowing to <20% annually, industry standards emerging, talent costs stabilizing | Cost leaders, managed service providers, and consolidation platforms |

Sophisticated investors on Pocket Option platform implement “adoption wave” strategies by maintaining separate portfolios for technologies at different maturity stages. Currently, foundation models and generative AI occupy early adoption phase, quantum machine learning remains in research phase, while computer vision has entered maturity in many applications.

Future Outlook: Five Emerging Trends Reshaping AI Investment

As investors evaluate what is the most promising AI stock for long-term appreciation, five emerging technological movements will likely create the next generation of market leaders and redefine competitive advantages in the AI landscape.

- Multimodal AI systems demonstrating 4.3x broader application range and $157B market opportunity by 2028

- Neuromorphic computing architectures reducing energy consumption by 98% while enabling new application classes

- Edge AI deployment accelerating at 87% CAGR with 18.7B devices expected by 2028, creating $213B market

- AI-human augmentation tools increasing knowledge worker productivity by 28-47% across creative and analytical domains

- Domain-specific AI chips proliferating with 167 new architectures in development, targeting 7-15x efficiency improvements

| Emerging Trend | Development Timeline | Market Potential by 2030 | Current Investment Opportunities |

|---|---|---|---|

| Autonomous AI Agents | 2025: Early commercial deployments 2027: Enterprise adoption 2028: Consumer applications |

$245B market with 42% CAGR through 2035 | Companies developing agent orchestration platforms, safety frameworks, and interoperability standards |

| AI-Native Applications | 2024: First generation products 2025: Enterprise adoption begins 2026: Legacy software displacement |

$387B market replacing 37% of current enterprise software | Early category leaders showing 150%+ revenue growth and <12-month customer payback periods |

| Quantum-Enhanced AI | 2026: First commercial advantage 2028: Specialized applications 2030: Broader commercial viability |

$86B market focusing initially on materials science, drug discovery, and optimization problems | Companies developing quantum neural network architectures and hybrid classical/quantum approaches |

| Neuromorphic Computing | 2025: First commercial chips 2027: Application-specific systems 2029: Mainstream adoption begins |

$127B market disrupting $480B of traditional computing | Organizations with working prototypes demonstrating 20x+ energy efficiency compared to von Neumann architectures |

| AI Regulation Framework | 2024: Initial frameworks adopted 2025: Industry-specific requirements 2026-27: Global harmonization begins |

$78B compliance and cer tification market | Companies building compliance tools, certification standards, and explainability frameworks |

When determining what is the best AI stock to invest in for long-term growth, these emerging trends provide concrete evaluation criteria for assessing a company’s forward-looking strategy rather than current capabilities alone. Leaders demonstrate focused R&D allocation (minimum 15% of budget) to at least two of these emerging domains.

Conclusion: Systematic Analysis Delivers Superior AI Investment Returns

The quest to identify what is the most promising AI stock requires systematic analysis across technological, financial, regulatory, and market dimensions. Investors who apply rigorous quantitative frameworks consistently outperform those relying on narrative-driven approaches or headline technologies.

The most successful AI investors evaluate companies across specific measurable criteria: proprietary technological advantages creating defensible moats, data accumulation mechanisms generating compounding advantages, financial discipline balancing growth with sustainability, regulatory preparedness creating market access advantages, and execution capabilities demonstrated through consistent product delivery.

For investors utilizing Pocket Option’s advanced analytics and structured screening tools, the AI sector offers unparalleled growth opportunities coupled with quantifiable evaluation frameworks. By distinguishing between companies with fundamental AI innovation versus superficial AI marketing, investors can construct portfolios capturing both near-term commercial success and long-term technological leadership.

The most promising AI stocks combine three critical elements: foundational technology innovation creating sustainable competitive advantage, efficient commercial execution demonstrating product-market fit, and strategic positioning aligned with long-term industry evolution. This integrated approach to AI investing provides the highest probability path to identifying tomorrow’s technology leaders today.

FAQ

What factors should I consider when identifying the most promising AI stock?

When identifying the most promising AI stock, evaluate the company's technological moats (proprietary algorithms, data advantages), R&D intensity (percentage of revenue invested in research), talent concentration (AI researcher quality and retention), infrastructure position (cloud capabilities, specialized hardware), and market applications. Also consider financial metrics like revenue growth rates, gross margins, and customer retention alongside regulatory positioning and ethical AI development practices.

How can I differentiate between companies with real AI capabilities versus those just using AI as a marketing term?

Look for concrete evidence of AI integration depth: published research papers in respected AI journals, patents with citations from other researchers, measurable operational improvements attributed to AI implementation, and technical expertise in leadership positions. Companies with substantial AI capabilities typically demonstrate quantifiable metrics like improved prediction accuracy, cost reductions through automation, or new products that couldn't exist without AI technology, rather than simply adding "AI" to marketing materials.

Are pure-play AI companies better investments than traditional companies implementing AI?

Neither is inherently superior. Pure-play AI companies offer focused exposure to AI growth but often carry higher valuation multiples and greater concentration risk. Traditional companies successfully implementing AI might deliver unexpected growth by transforming established business models with new capabilities. The best approach is typically a balanced portfolio with both types: pure-play companies for direct AI exposure and established companies demonstrating successful AI transformation for more defensive positioning.

How important is data ownership for AI companies' long-term success?

Data ownership or privileged access is increasingly critical for sustainable AI advantage. Companies with proprietary datasets, especially those that expand and improve automatically through user interactions, create compounding advantages that competitors struggle to replicate. When evaluating potential investments, assess not just current data assets but data acquisition mechanisms and whether the company's products create "data flywheels" where service improvements lead to more users, generating more data that further improves services.

What timeline should investors expect for returns on AI investments?

AI investment returns follow different timelines depending on development stage. Infrastructure providers (chips, cloud computing) may deliver near-term results as AI adoption accelerates. Platform companies typically show medium-term growth as ecosystems develop. Application-specific AI companies often require longer horizons as market education and adoption cycles complete. Breakthrough technology investments might need 5+ years before commercial viability becomes clear. A staggered approach with positions across these categories can balance near-term results with long-term growth potential.