- The difference between speculative hype and institutional adoption

- The impact of ETFs and regulation on Bitcoin’s price action

- The risks of over-allocating your portfolio to digital assets

Jim Cramer Bitcoin: A Top 2025 Perspective

The year 2025 sees Jim Cramer Bitcoin insights capturing the attention of investors worldwide. Known for his influential presence in financial media,

Article navigation

- Jim Cramer Bitcoin: Insights and Analysis for 2025

- Jim Cramer’s Perspective on Bitcoin

- The Current Bitcoin Market Landscape

- Investment Strategies for Bitcoin in 2025

- MicroStrategy’s Role in Bitcoin Investment

- Future of Cryptocurrency and National Debt

- How to Trade Bitcoin on Pocket Option: Simple, Smart, Powerful

- Final Thoughts: Crypto, Cramer, and Pocket Option

Jim Cramer Bitcoin: Insights and Analysis for 2025

In a world where financial headlines shift with every market tick, few voices command as much attention as Jim Cramer. Known for his animated analysis on CNBC’s “Mad Money,” the TV personality has never shied away from controversial takes on stocks, ETFs, and increasingly, cryptocurrencies. In this article, we explore Jim Cramer Bitcoin insights and predictions for 2025, helping you align your crypto strategy with some of the most influential perspectives in financial media.

Jim Cramer’s Perspective on Bitcoin

Introduction to Jim Cramer’s Views

As a widely recognized voice in mainstream media crypto discussions, Jim Cramer has offered both bullish and skeptical takes on Bitcoin over the years. His stance reflects the evolution of Bitcoin itself–from a niche innovation to a globally acknowledged asset. Cramer, a TV personality crypto expert, sees Bitcoin as a legitimate part of a diversified portfolio, especially when balanced with safer instruments.

“You can own it,” says Cramer, “but don’t go all in.”

A recent survey by Bloomberg indicated that over 41% of institutional investors now view Bitcoin as a hedge against inflation–echoing Cramer’s shift toward cautious endorsement amid macroeconomic uncertainty.

With national debt rising and fiat currencies under pressure, Bitcoin’s allure as a digital hedge is growing–a viewpoint that aligns with Cramer’s recent tone.

Key Takeaways from Mad Money

Jim Cramer often uses his platform to explain complex crypto moves in plain terms. On Mad Money Bitcoin episodes, he breaks down:

One of his recurring themes is diversification, urging viewers not to treat crypto as a “get-rich-quick” scheme but as part of a broader strategy.

💬 “It’s about managing volatility, not eliminating it,” said Cramer on a February 2025 episode, referring to portfolio balance with Bitcoin.

Jim Cramer Says: Buy or Sell?

The burning question: Is Jim Cramer buying or selling Bitcoin in 2025?

His investment advice Bitcoin wise is this:

“Treat it like gold. Own it, but don’t bet your house on it.”

According to his Cramer Bitcoin prediction, investors should evaluate their own risk profile. In the current environment, with market volatility still prevalent, he suggests a “buy on dips, not on headlines” approach.

The Current Bitcoin Market Landscape

Bitcoin Price Trends and Predictions

Jim Cramer Bitcoin sentiment reflects the broader volatility of the market. At the start of 2025, Bitcoin showed strong upward momentum fueled by increased institutional interest, particularly in crypto ETFs.

| Period | Average Price (USD) | Market Sentiment |

|---|---|---|

| Q1 2025 | $49,000 | Bullish |

| Q2 2025 | $43,500 | Volatile |

| Forecast Q3-Q4 | $45,000 – $55,000 | Cautious Bullish |

A report by CoinDesk Research indicated that 2025 could be a year of consolidation for Bitcoin, citing ETF approvals and interest from pension funds as bullish signals.

Factors Influencing Bitcoin’s Value

Bitcoin’s valuation in 2025 hinges on:

- Global regulation: New laws in the U.S. and EU impact investor confidence.

- National debt: Higher debt levels may lead more people to view Bitcoin as a hedge.

- Tech innovation: Layer 2 scaling and security improvements make it more user-friendly.

These drivers support financial media Bitcoin discussions where Cramer emphasizes external forces as key indicators.

🧠 Expert Insight: According to crypto analyst Meltem Demirors, “The maturation of Bitcoin’s infrastructure makes it less volatile, but regulation remains the wild card.”

Market Sentiment and Investor Behavior

Cramer argues that market sentiment swings between fear and FOMO (fear of missing out).

| Sentiment Trigger | Market Reaction |

|---|---|

| ETF Approval | Price Surge |

| Regulatory Crackdown | Sharp Corrections |

| Tech Partnership (e.g., PayPal) | Spike Up |

Understanding these behaviors can help traders on platforms like Pocket Option manage risk in volatile conditions. ⚡ Pocket Option offers both beginners and advanced traders user-friendly tools for quick trades and strategic analysis.

Investment Strategies for Bitcoin in 2025

How to Own Bitcoin Effectively

Jim Cramer encourages investors to:

- Allocate no more than 5% of your total portfolio to crypto

- Use stop-loss and take-profit tools

- Choose trusted platforms for transactions and storage

✔ Example: An investor with $10,000 could allocate $500 to crypto, split between Bitcoin and Ethereum.

Using Pocket Option’s interface, you can conduct Quick Trading with clear risk/reward ratios.

📊 Unique Tip: Combine Quick Trading with fundamental analysis using Pocket Option’s news feed integration to spot trend catalysts in real-time.

Jim Cramer’s Recommended Crypto Investments

Cramer has shown confidence not just in Bitcoin but also Ethereum, citing smart contract capabilities and ongoing development of Ethereum 2.0.

| Crypto Asset | Cramer’s Sentiment | Reasoning |

|---|---|---|

| Bitcoin | Positive Caution | Digital store of value |

| Ethereum | Bullish | Innovation, DeFi, NFT ecosystem |

This diversified approach aligns with his broader Jim Cramer crypto opinion, advocating education before execution.

🎯 Strategic Insight: Investopedia’s 2025 crypto forecast places Ethereum’s utility above speculative altcoins, reinforcing Cramer’s approach.

Understanding Risk and Security in Crypto Trading

Cramer repeatedly warns viewers that crypto is not risk-free:

- Exchanges can be hacked

- Prices can swing dramatically

- Regulations can change overnight

Pocket Option helps mitigate these issues by offering demo accounts, secure withdrawals, and robust authentication.

MicroStrategy’s Role in Bitcoin Investment

MicroStrategy’s Bitcoin Strategy

One corporate example Cramer often references is MicroStrategy. Under CEO Michael Saylor, the company has turned its treasury into a Bitcoin powerhouse.

| Year | Bitcoin Holdings | Approx. Value (USD) |

|---|---|---|

| 2023 | 152,333 BTC | $4.5 Billion |

| 2025 | 174,500 BTC+ | $8.1 Billion |

Their strategy reinforces the notion of Bitcoin as a long-term store of value, not just a tradeable asset.

🧾 Financial Times commented, “MicroStrategy’s crypto play has rewritten the role of treasury management in the digital age.”

Impact of MicroStrategy on Bitcoin’s Market

MicroStrategy’s large-scale purchases create:

- Upward pressure on price

- Media buzz and market credibility

- Peer influence (other firms follow suit)

Cramer notes that such moves change how bitcoin analyst opinions evolve in institutional circles.

Lessons from MicroStrategy for Retail Investors

Retail traders can learn:

- Stay long-term focused

- Don’t panic during downturns

- Diversify even within crypto

These are strategies Pocket Option supports by enabling flexible investment amounts and copy trading features.

Future of Cryptocurrency and National Debt

Bitcoin as a Hedge Against National Debt

With U.S. national debt surpassing $35 trillion, many investors look at Bitcoin as digital gold. Its limited supply and decentralization offer a stark contrast to fiat inflation.

Jim Cramer Bitcoin analysis supports this idea, especially as government trust diminishes.

🧩 Insight from JPMorgan’s April 2025 crypto outlook: “Institutional demand for Bitcoin is rising in parallel with fiscal instability, suggesting stronger long-term adoption.”

Potential Regulatory Concerns

Regulatory shifts could make or break the next bull run:

| Region | Regulatory Direction | Risk Level |

|---|---|---|

| U.S. | Stricter Compliance | High |

| EU | Balanced Framework | Medium |

| Asia | Innovation-First | Low |

Staying ahead of regulation is a key part of any investment advice Bitcoin strategy.

Predictions for Ethereum and Other Cryptos

Ethereum 2.0, Solana upgrades, and projects like Avalanche or Polkadot are generating buzz.

🌐 The expansion of DeFi and NFT infrastructure keeps these ecosystems relevant.

Cramer remains optimistic about Ethereum and cautions against hype coins, aligning with broader bitcoin analyst opinions in 2025.

🔍 Insight: According to Cointelegraph, Ethereum’s network upgrades in 2025 will reduce gas fees by over 35%, boosting user adoption.

How to Trade Bitcoin on Pocket Option: Simple, Smart, Powerful

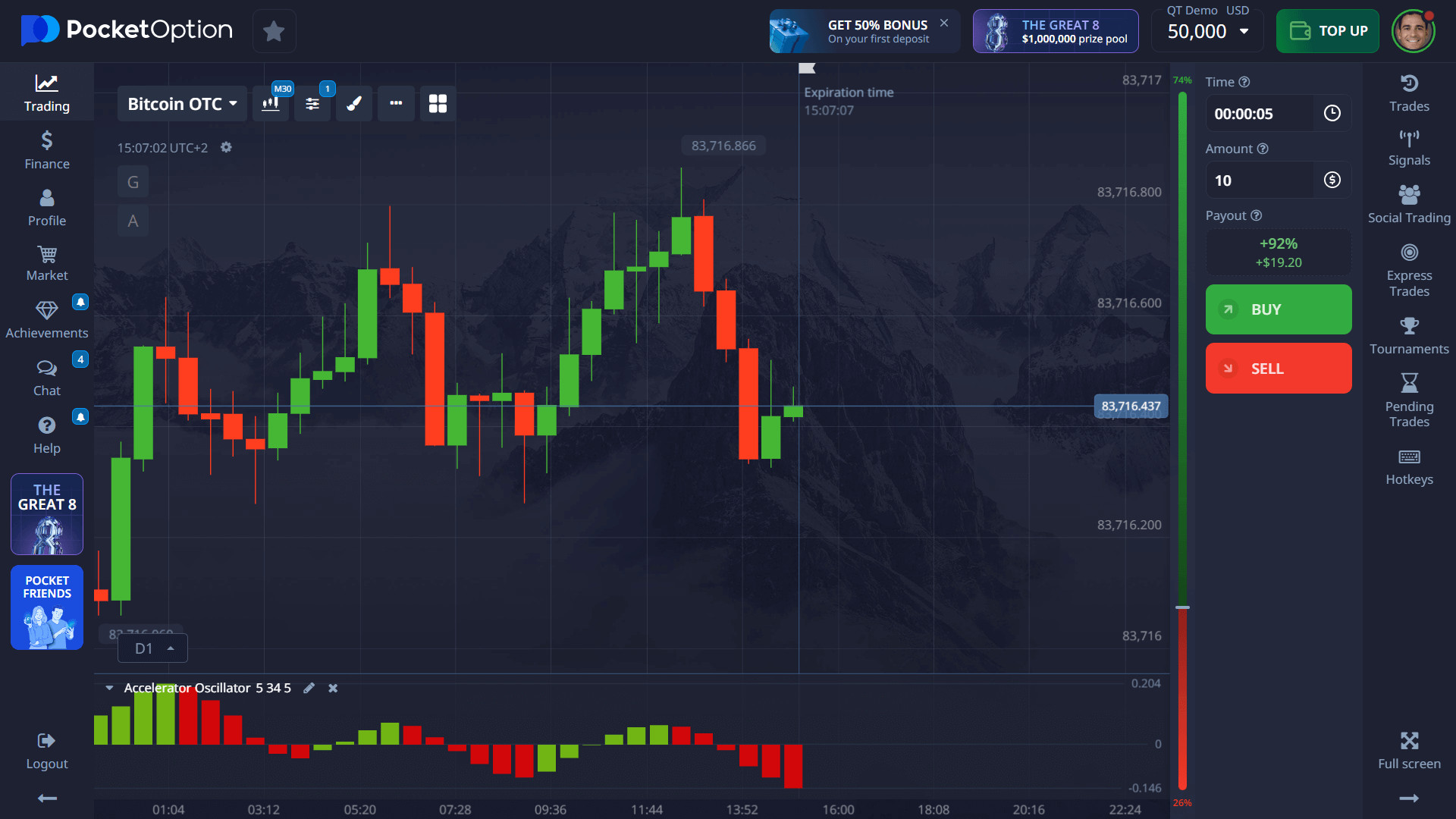

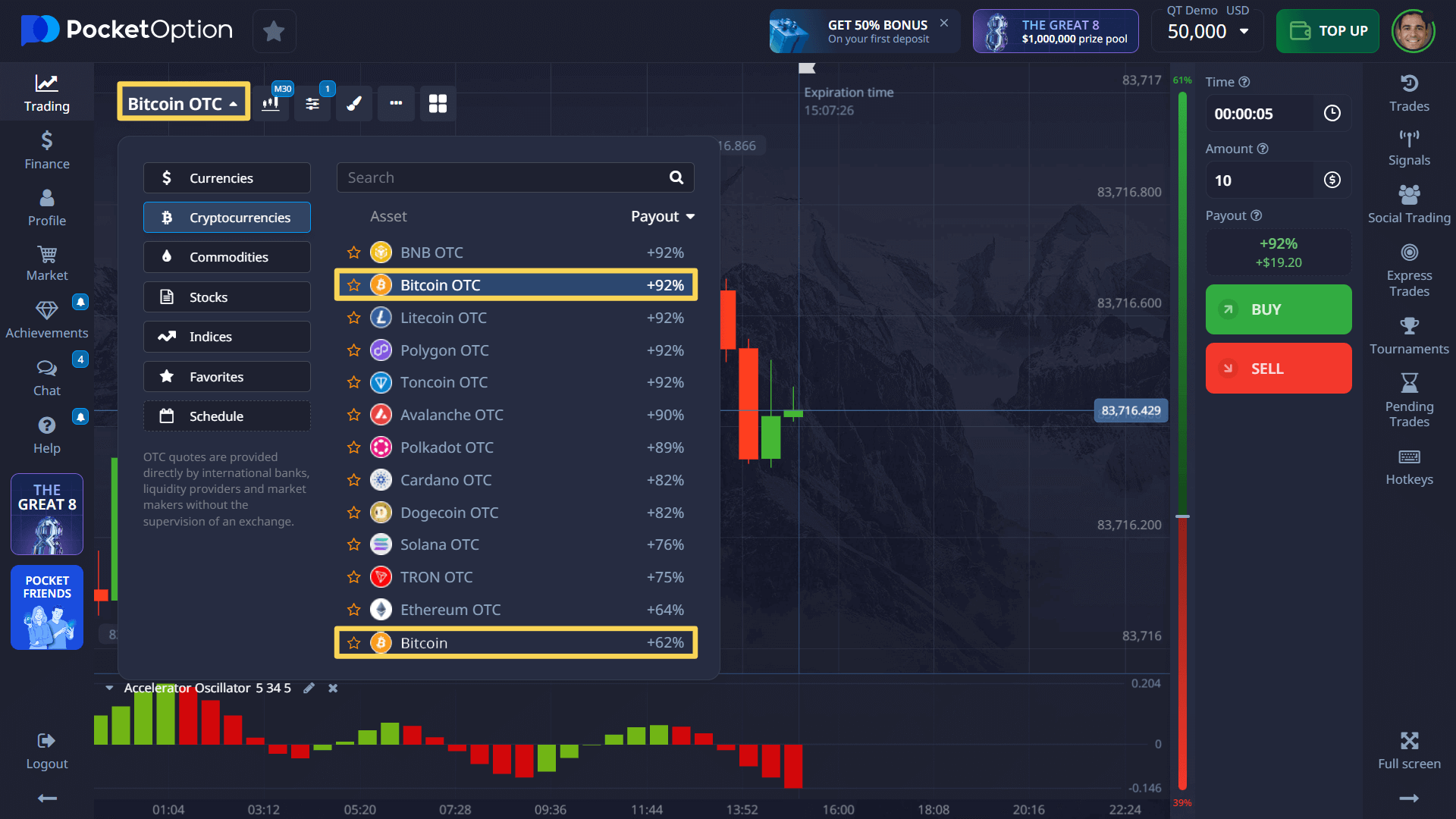

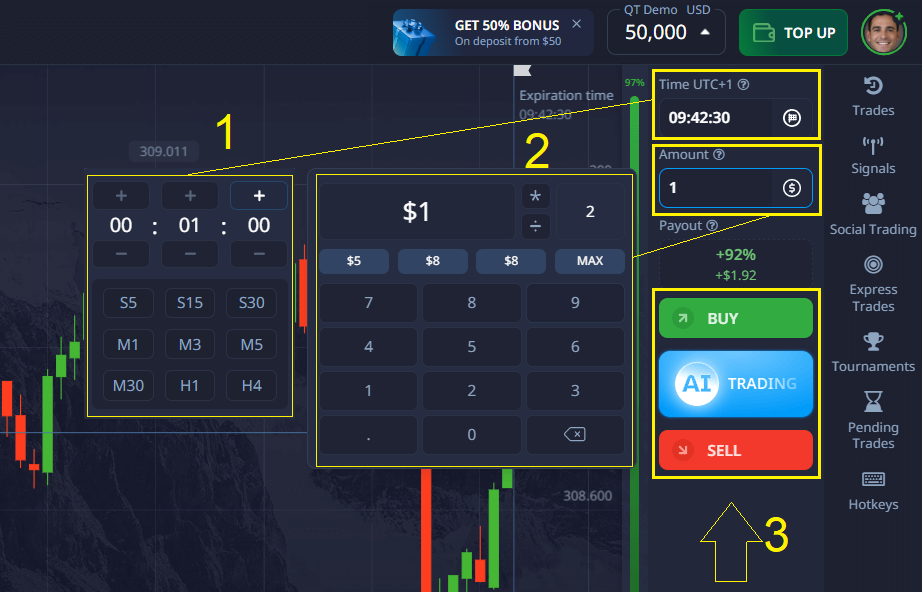

Looking to act on Jim Cramer’s insights and take control of your crypto strategy in 2025? Pocket Option offers a fast, intuitive way to trade Bitcoin through Quick Trading — no complexity, just clear decisions.

Pocket Option provides two simple choices: Buy if you believe Bitcoin will go up, or Sell if you expect it to drop. All it takes is selecting the asset (Bitcoin), choosing your trade duration (from 30 seconds to several minutes), and deciding the amount to invest — even as little as $5.

📌 Example: Let’s say Bitcoin is at $44,500. You believe a news release will push it higher. You select a $10 Buy position for 2 minutes. If BTC rises during that time, you earn up to 92% profit – fast, focused, and with full control.

Final Thoughts: Crypto, Cramer, and Pocket Option

In summary, Jim Cramer Bitcoin insights for 2025 emphasize caution, education, and diversification. His takes–though dynamic–follow a rational structure that new and experienced investors alike can benefit from.

Retail Action Plan: 2025 Bitcoin Strategy Checklist

- ✅ Don’t exceed 5% portfolio exposure to crypto

- ✅ Pair Bitcoin with Ethereum or stablecoins

- ✅ Follow regulatory updates monthly

- ✅ Use demo accounts to refine strategies

- ✅ Rely on platforms like Pocket Option with proven security

And with platforms like Pocket Option offering Quick Trading, demo tools, educational content, and crypto asset exposure, it’s easier than ever to act on that knowledge.

Ready to follow smart strategies?

FAQ

What does Jim Cramer say about Bitcoin?

Jim Cramer believes Bitcoin is a valid part of a diversified portfolio, comparing it to gold. He emphasizes caution and suggests investors should never go "all in."

Has Jim Cramer invested in Bitcoin?

Yes. Cramer has publicly disclosed owning Bitcoin, initially purchasing it as a hedge against inflation. He later sold portions but remains supportive of its long-term potential.

What is Cramer's crypto prediction?

Cramer’s crypto outlook is cautiously optimistic. He expects Bitcoin to continue evolving with institutional adoption, but warns about regulatory impacts. His cramer bitcoin prediction includes buying during dips, not hype.

Should I follow Cramer's Bitcoin advice?

While Cramer offers valuable insights, every investor should do their own research. His investment advice bitcoin approach is conservative and best suited for risk-aware investors. Platforms like Pocket Option can help implement smart strategies with small starting amounts and clear trade controls.

How does Jim Cramer view Bitcoin in 2025?

In 2025, Jim Cramer sees Bitcoin as a valuable addition to traditional investments. He advocates a balanced approach, recognizing its potential as an inflation hedge and its significance within a diversified portfolio.

What is Jim Cramer's recommended Bitcoin allocation in a portfolio?

Jim Cramer suggests that Bitcoin should make up a modest segment of an investment portfolio, typically 5-10%. This conservative allocation is designed to limit risk while allowing for growth potential.

How does Jim Cramer influence the Bitcoin market?

Jim Cramer impacts the Bitcoin market through his media presence, especially on platforms like CNBC. His insights can shift market sentiment, causing short-term price changes and affecting both retail and institutional investors.

How does Pocket Option support Bitcoin trading according to Cramer’s strategies?

Pocket Option facilitates Bitcoin trading with a user-friendly platform, fast trading options, and comprehensive analysis tools, enabling investors to effectively apply Cramer's strategies, manage risks, and exploit market opportunities.

What future trends does Jim Cramer predict for Bitcoin?

Jim Cramer forecasts several future trends for Bitcoin, including regulatory developments that could enhance market stability, increased institutional adoption boosting legitimacy, and technological advancements improving scalability and transactional efficiency.