BlackRock Competitors: Analyzing the Key Players in the Investment Landscape

In the dynamic world of financial services, BlackRock emerges as a titan, commanding a significant presence in the investment management sector. As a leading asset manager, BlackRock has carved a niche that not only influences markets but also shapes investment strategies globally. This article delves into BlackRock's market position, offering insights into BlackRock competitors, similar companies, and alternatives within the intricate landscape of asset management.

Overview of BlackRock and Its Market Position

Introduction to BlackRock’s Business Model

BlackRock’s business model centers around offering a comprehensive range of investment products and solutions tailored for both institutional investors and retail clients. By integrating ETFs, mutual funds, and advanced portfolio management, BlackRock has become a benchmark in global finance. With over $10 trillion in assets under management (AUM) as of 2024, it remains one of the most influential firms in the sector.

“BlackRock’s success is rooted in its scalability, operational efficiency, and its data-centric approach to portfolio management,” notes Laurence D. Fink, Chairman and CEO of BlackRock.

BlackRock’s Role in Asset Management

In the sphere of asset management, BlackRock sets the standard. It provides tools such as Aladdin, its risk management platform, and operates the iShares ETF lineup. These innovations have redefined how investors interact with markets. However, several BlackRock competitors and companies similar to BlackRock have gained momentum.

According to a 2024 report by PwC, “Investor expectations are shifting towards firms that combine robust data analytics with ESG-driven performance. BlackRock and its rivals are racing to deliver on both fronts.”

Top BlackRock Competitors

Below is a comparative table of major BlackRock competitors highlighting key metrics:

| Company | Assets Under Management (2024) | Key Offerings | Client Focus |

|---|---|---|---|

| Vanguard Group | $8.6 trillion | ETFs, Mutual Funds | Retail & Institutional |

| State Street Global | $4.1 trillion | ETFs, Index Funds | Institutional |

| Fidelity Investments | $4.9 trillion | Mutual Funds, Advisory | Retail & Institutional |

| Morgan Stanley | $1.5 trillion (Wealth division) | Investment Banking, Advisory | High-Net-Worth |

| Charles Schwab | $8.1 trillion (incl. TD Ameritrade) | ETFs, Robo-Advisors | Retail |

| Invesco | $1.6 trillion | Active/Passive Funds | Institutional |

Expert Insight: Morningstar’s latest ranking places Vanguard and Fidelity at the top of investor trust index scores, largely due to their consistent performance and fee transparency.

Vanguard Group: Low-Cost Innovation

Vanguard is among the most formidable BlackRock competitors, largely due to its low-fee ETF and mutual fund offerings. Known for its unique client-owned structure, it pioneered passive investing and remains a go-to for cost-conscious investors.

“The ETF war has become a fee war. Vanguard has set the tone, forcing others to follow or risk irrelevance,” says ETF.com analyst Dave Nadig.

State Street Global Advisors: Institutional Giant

State Street, known for managing the SPDR ETFs, holds a commanding position in institutional asset management. Like BlackRock, it offers robust index investing products and serves governments, endowments, and pension funds worldwide.

Fidelity Investments: Tech Meets Advisory

Fidelity stands out with its innovation in financial technology and personalized advisory services. It blends traditional mutual funds with cutting-edge robo-advisory platforms, appealing to both novice and seasoned investors.

Morgan Stanley: The Power of Integration

After acquiring E*TRADE and Eaton Vance, Morgan Stanley has expanded into investment management and wealth services. Its global reach and tailored high-net-worth strategies position it as a major BlackRock alternative.

Charles Schwab: Accessibility and Tech

Schwab leverages its tech-first platform and low-cost trading options to attract retail investors. With TD Ameritrade under its umbrella, Schwab has significantly grown its assets under management and now competes directly with companies like BlackRock.

Invesco: Alternative Assets Focus

Invesco offers a diversified portfolio with a strong emphasis on real assets, ESG, and alternative investments. This niche positioning provides clients with non-correlated opportunities that differ from traditional ETF strategies.

Expert View: “Invesco’s alternative strategy gives them access to a less crowded alpha space–something that large index players often overlook,” states Karen Dolan, Senior Investment Strategist at JP Morgan.

Comparative Investment Strategies

| Firm | Investment Approach | Tech Integration | ESG Focus |

|---|---|---|---|

| BlackRock | Diversified, Global | Aladdin AI Platform | Strong |

| Vanguard | Index-Based, Low-Cost | Basic Tools | Moderate |

| State Street | Institutional, Passive | Quantitative Analytics | Moderate |

| Fidelity | Active & Tech-Enhanced | Personalized Robo-Advisors | Growing |

| Schwab | Retail-Oriented, Automated | Schwab Intelligent Portfolios | Limited |

| Invesco | Specialty & Alternatives | Focused Platforms | Strong |

Trends Reshaping the Competition

Tech Disruption in Asset Management 🤖

From robo-advisors to AI-powered forecasting, technology is redefining how BlackRock competitors design and offer financial products. Firms investing in platforms like BlackRock’s Aladdin gain a significant edge.

Stat: Deloitte reports that 68% of asset managers are increasing their budget allocation toward machine learning and predictive analytics in 2025.

Rise of ESG and Impact Investing

Investor demand for Environmental, Social, and Governance (ESG) products has surged. Firms like Invesco and BlackRock are allocating more resources to sustainable finance, while others like Vanguard and State Street cautiously follow.

“We anticipate ESG will drive at least 30% of net flows by 2026,” according to BlackRock’s 2024 annual report.

Regulatory Landscape

New financial regulations are affecting transparency, data handling, and investor protection. Global BlackRock competition must constantly adapt to stay compliant while remaining profitable.

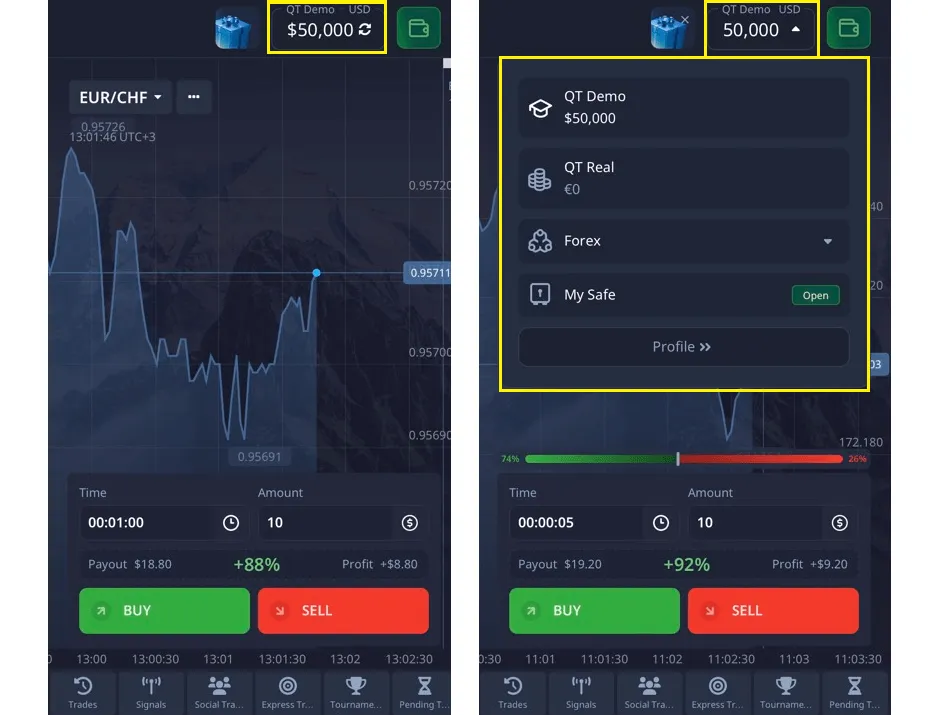

Pocket Option: Trade Global Companies 24/7 🌎

While institutional platforms like BlackRock cater to large-scale investors, retail traders can access markets with innovative platforms such as Pocket Option. The platform enables users to trade over 100 global assets, including company stocks, 24/7, with intuitive Buy/Sell functionality. Whether you’re inspired by companies like BlackRock or just exploring investment opportunities, Pocket Option offers fast, accessible tools to get started.

Conclusion: Who Competes with BlackRock and Why It Matters

The financial services landscape continues to evolve, and BlackRock competitors are actively innovating to challenge the leader. From companies similar to BlackRock like Vanguard and State Street to emerging players focused on alternative investments, the competition drives better products, pricing, and transparency for investors.

Expert Conclusion: “The asset management industry will become increasingly polarized–those who embrace technology and ESG will dominate, while traditional laggards may fade,” predicts Michelle Seitz, former CEO of Russell Investments.

At the same time, platforms like Pocket Option make investing accessible to everyone, allowing users to engage with global markets in real time. As technology, regulation, and investor preferences shift, understanding these dynamics becomes crucial for anyone navigating the modern financial ecosystem.

FAQ

What companies are considered the biggest BlackRock competitors?

The top competitors of BlackRock include Vanguard, State Street Global Advisors, Fidelity Investments, Charles Schwab, Morgan Stanley, and Invesco. These companies offer similar investment services such as ETFs, mutual funds, and institutional portfolio management.

What are some companies similar to BlackRock in terms of services?

Companies similar to BlackRock include Vanguard for passive investing, State Street for institutional solutions, and Fidelity for active management combined with tech-driven advisory. Each provides robust asset management platforms tailored to different types of investors.

Is there a difference between BlackRock and Vanguard?

Yes. While both are leading asset managers, Vanguard is structured as a client-owned firm and is widely known for its low-cost ETFs and mutual funds. BlackRock, on the other hand, is publicly traded and operates Aladdin, a powerful AI-driven risk analytics platform.

Why do investors look for alternatives to BlackRock?

Investors may seek alternatives due to cost sensitivity, a preference for different investment strategies (e.g., ESG-focused or actively managed funds), or platform usability. Firms like Invesco and Schwab appeal to niche or tech-savvy investor bases.

Can I trade stocks of BlackRock competitors on Pocket Option?

Yes, Pocket Option allows retail traders to trade 100+ global assets, including shares of popular companies like those competing with BlackRock, 24/7 using simplified trading tools.