- Affordability: Low-cost entry allows acquisition of more shares with less capital.

- High Growth Potential: These stocks can provide substantial upside potential if the company’s projects thrive.

- Diversification: Including these stocks in your portfolio can distribute risk across various investment types.

Best Gold Stocks to Buy Under $5 in 2025

Investing in gold has long been a favored tactic for diversifying investment portfolios and safeguarding against inflation. While the appeal of gold stocks is widely recognized, identifying the most promising options priced below $5 presents unique possibilities. This piece delves into choices and methods to maximize your investment potential and ensure well-informed decisions in the gold market.

Article navigation

- Understanding the Gold Market

- The Role of Gold in Diversification

- Why Consider Gold Stocks Under $5?

- Key Factors in Selecting Gold Stocks

- Top Picks: Best Gold Stocks to Buy Under $5

- Navigating the Risks

- Trading Gold Stocks with Pocket Option

- Example of Using Pocket Option

- Tips for Maximizing Returns

- Conclusion

Understanding the Gold Market

Before diving into details, understanding the enduring appeal of gold as an investment is crucial. Gold serves as a defense against inflation and currency instability. Unlike paper money, it holds intrinsic value. Historically, during economic uncertainty, gold prices tend to climb, offering a refuge for investors. For example, during the 2008 financial crisis, gold prices soared as investors sought security in the chaos of the markets. Uncovering the best gold stocks to buy under $5 demands diligence and strategic foresight. Will gold rate decrease in coming days

The Role of Gold in Diversification

Gold’s distinct characteristics make it an excellent diversification tool. Unlike equities and bonds, gold does not directly track market performance. This means that even if stock markets are faltering, gold might retain or gain value, offsetting losses in other portfolio areas. In 2020, as the COVID-19 pandemic triggered global market fluctuations, gold experienced a notable surge, surpassing $2,000 per ounce for the first time.

Why Consider Gold Stocks Under $5?

Imagine having $500 to invest. With gold stocks under $5, you could potentially purchase 100 shares of a company, compared to only a few shares of a pricier stock. This enables greater exposure and potential profits if the stock’s value increases. Nvidia stock forecast 2040

Key Factors in Selecting Gold Stocks

- Company’s Financial Health: Examine balance sheets and income statements to verify financial stability. A company with a solid asset base and manageable debt is generally a safer choice.

- Project Pipeline: Evaluate the company’s current and future mining projects. Companies with a diverse and promising array of projects are more likely to thrive.

- Market Trends: Stay updated on gold price trends and market conditions. Utilize resources like the World Gold Council for information.

- Management Team: A skilled management team can adeptly handle the complexities of mining operations. Seek out teams with a successful track record in project management and strategic growth.

*Conduct asset analysis directly on the platform using 30+ analysis tools. Available after registration.

Top Picks: Best Gold Stocks to Buy Under $5

1. Gold Resource Corporation (GORO)

| Pros | Cons |

|---|---|

| Diverse operations | Volatile market |

| Strong production growth | High operational costs |

Gold Resource Corporation maintains a balanced portfolio of gold and silver projects, demonstrating promising production growth despite market volatility. Their operations in Mexico and Nevada mitigate geographic risk, and recent efforts to streamline operations aim to cut costs and boost margins.

2. McEwen Mining Inc. (MUX)

| Pros | Cons |

|---|---|

| Experienced management | High debt levels |

| Strategic acquisitions | Share dilution concerns |

McEwen Mining boasts a seasoned management team and a strategic approach to acquisitions, though it grapples with challenges related to debt and dilution. The company’s focus on increasing output and reducing costs through technological investments could be advantageous if gold prices rise. Archer aviation stock prediction 2030

3. Golden Star Resources Ltd. (GSS)

| Pros | Cons |

|---|---|

| Strong asset base | Political risk in operating regions |

| Focus on safety and sustainability | Limited geographical diversification |

Golden Star Resources emphasizes sustainability and safety, supported by a robust asset base, though it operates in regions with political risks. Their commitment to ethical mining practices and community engagement distinguishes them in an industry often scrutinized for environmental impact.

Navigating the Risks

- Market Volatility: Prices can fluctuate significantly, influenced by geopolitical events and economic indicators. For instance, tensions in key gold-producing nations can cause sudden price spikes.

- Operational Risks: Mining endeavors might be affected by environmental regulations and unforeseen technical issues. Companies in politically unstable regions face additional challenges.

- Liquidity Risks: Low-priced stocks may have reduced trading volumes, complicating the buying or selling of large quantities without impacting the price. This can lead to greater price swings and increased risk.

Trading Gold Stocks with Pocket Option

- User-Friendly Interface: Perfect for both newcomers and seasoned traders. The intuitive design ensures easy navigation and trade execution.

- Quick Trading: Enables rapid trade execution, capitalizing on market shifts. This feature is crucial in the volatile gold market, where prices can change swiftly.

- Analytical Tools: Supplies a variety of tools to help analyze market trends and make informed decisions. From technical indicators to market news, these resources can enhance your trading approach.

Main Pocket Option feature: You don’t need to buy or sell physical assets — simply forecast whether the price will rise or fall. If your forecast is accurate, you can earn up to 92% profit. No download is required; the platform is fully browser-based.

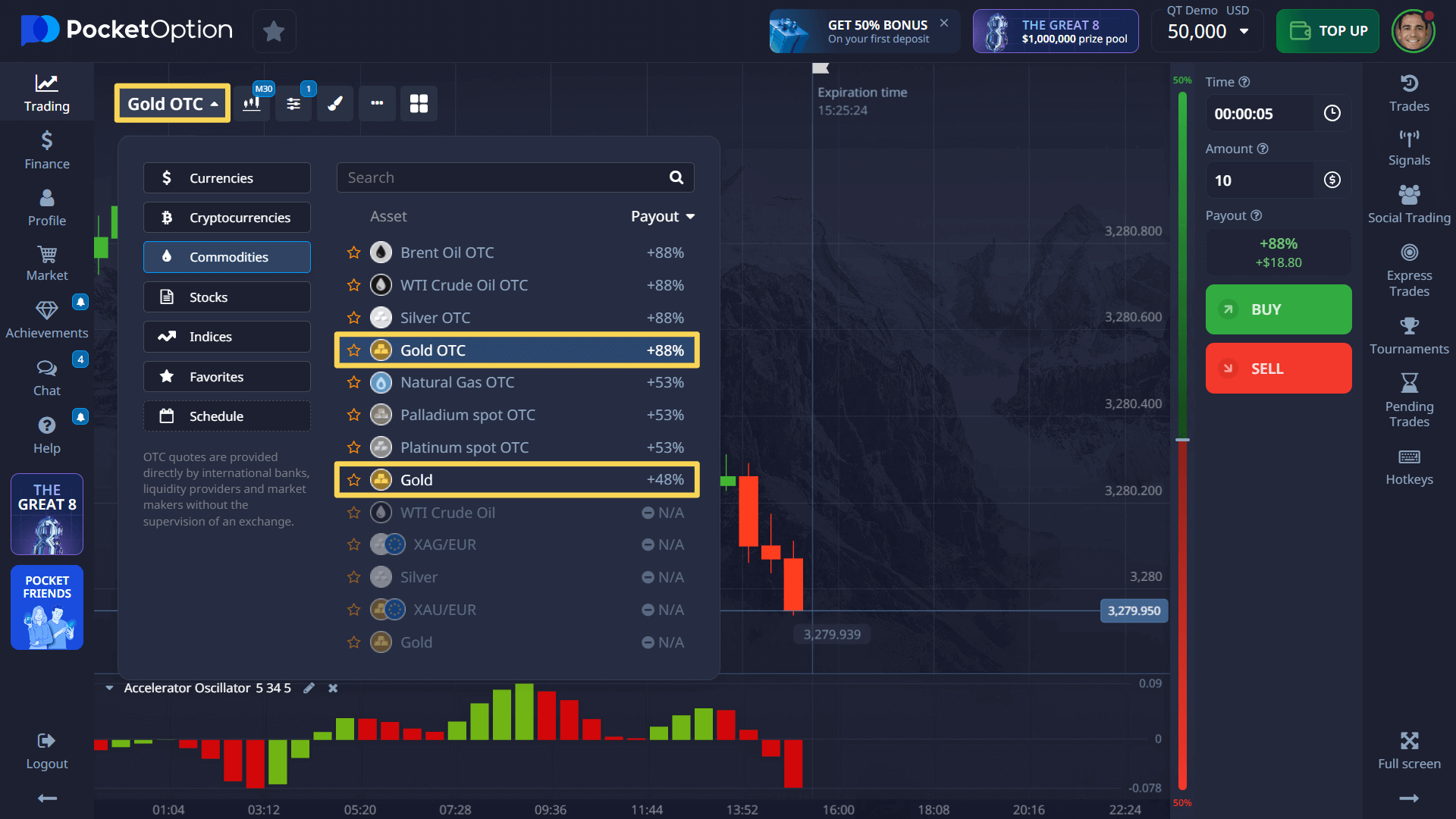

⚡Gold OTC are available 24/7 on the platform, allowing for flexible and continuous trading opportunities — even on weekends.

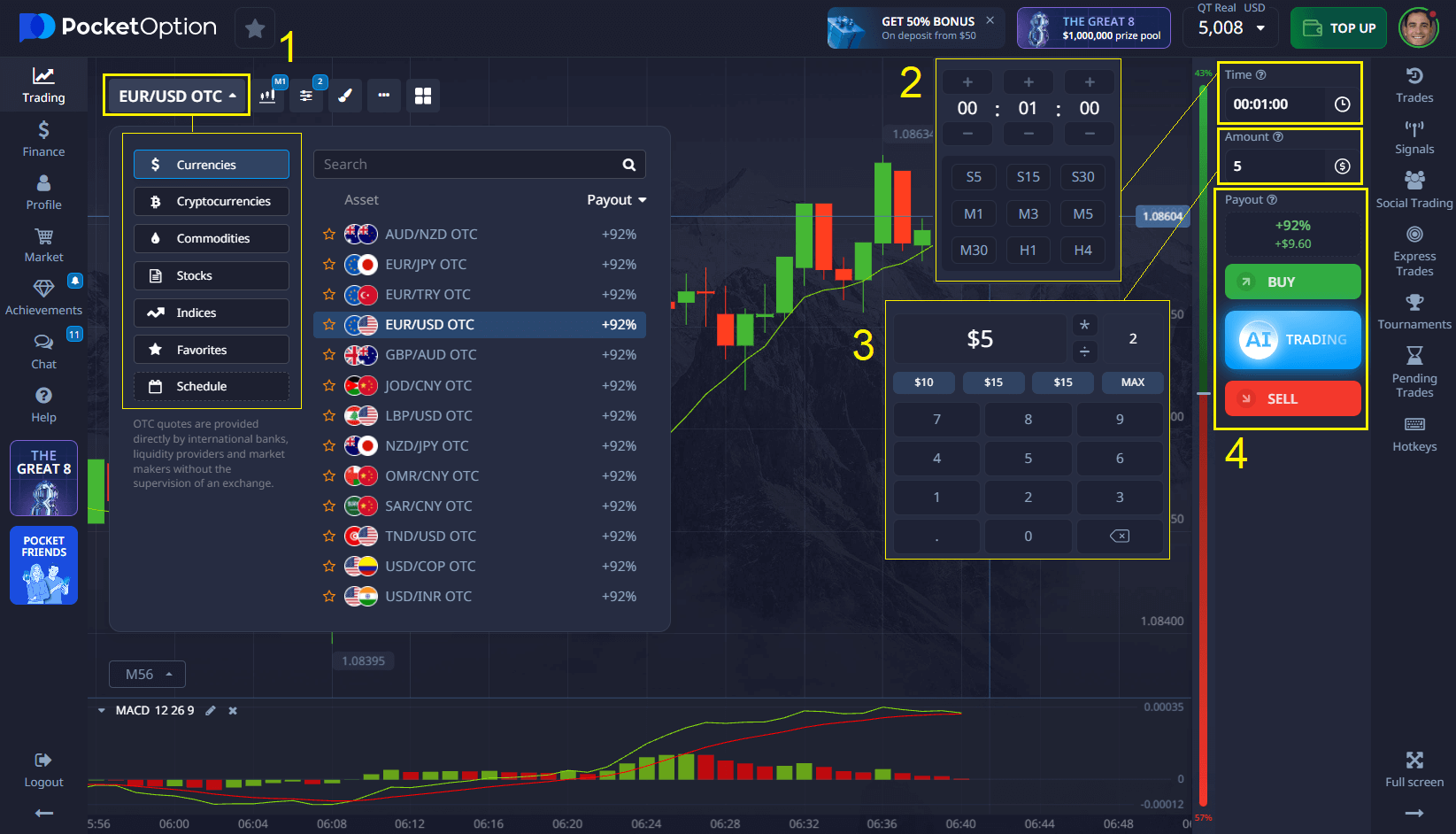

Example of Using Pocket Option

- Choose an asset (in the example it is eur/usd)

- Analyze the chart using trader sentiment or technical tools

- Select the trade amount (from $1)

- Set the trade duration (from 5 seconds for OTC assets)

- Make a forecast:

- If you think the price will go up, click BUY

- If you think the price will go down, click SELL

- If your prediction is correct, you can earn up to 92% profit. The percentage is shown when selecting the asset.

- On a live account (from $5), you can also use features like Copy Trading, Cashback, and other benefits.

Tips for Maximizing Returns

- Stay Informed: Regularly consume market reports and news updates. Websites like Kitco and GoldSeek offer daily insights and analyses.

- Set Clear Goals: Define your investment timeframe and risk tolerance. Are you aiming for short-term gains or long-term stability?

- Diversify Your Portfolio: Avoid concentrating all investments in one area; consider other commodities alongside gold, such as silver and platinum, to spread risk.

Conclusion

Uncovering the best gold stocks to buy under $5 demands diligence and strategic foresight. While these stocks promise high returns, they also entail risks that require careful consideration. By leveraging platforms like Pocket Option, you can enhance your trading experience and potentially increase returns. In practice, staying informed and diversifying investments are keys to mastering the complexities of the gold market.

FAQ

What are the advantages of investing in gold stocks under $5?**

Investing in gold stocks under $5 provides affordability, enabling the purchase of more shares with less capital. It offers high growth potential, as these stocks can significantly appreciate if the company’s projects succeed. Furthermore, they add diversification to your portfolio, distributing risk across various investments.

How can I evaluate the financial health of a gold mining company?**

To evaluate the financial health of a gold mining company, examine its balance sheets and income statements. Look for a strong asset base, manageable debt levels, and positive cash flow. Companies with low debt and high liquidity are generally better positioned to withstand market fluctuations.

What risks are involved in trading gold stocks on platforms like Pocket Option?**

Trading gold stocks on platforms like Pocket Option involves market volatility, where prices can change rapidly due to economic or political events. Additionally, liquidity risks may occur, as low-priced stocks often have lower trading volumes, potentially leading to price swings. It's essential to use analytical tools and set stop-loss orders to manage these risks.

How can Pocket Option enhance my gold trading strategy?**

Pocket Option can enhance your gold trading strategy with its intuitive interface, quick trading capabilities, and comprehensive analytical tools. You can set alerts for price changes to facilitate timely trades, use technical indicators for market analysis, and execute trades rapidly to capitalize on market movements.

Why is diversification essential in a gold investment strategy?**

Diversification is vital as it spreads risk across various assets, reducing the impact of a downturn in any single investment. In a gold investment strategy, diversification can be achieved by adding other commodities, like silver or platinum, and different asset classes, such as stocks and bonds, to balance potential losses with gains.