- Regulated exposure to BTC without holding crypto directly

- Fits into traditional brokerage bitcoin funds

- Simpler tax handling vs holding BTC yourself

- Ideal for bitcoin portfolio diversification

Merrill Lynch Bitcoin ETF – Investment Guide

Looking to gain secure exposure to Bitcoin through a trusted financial institution? The Merrill Lynch Bitcoin ETF offers investors a gateway into cryptocurrency markets without direct ownership of digital assets. ✅ This makes it a complementary choice for those exploring both long-term bitcoin ETF investment and short-term market plays.

What Are Bitcoin ETFs?

Bitcoin ETFs (Exchange-Traded Funds) are cryptocurrency investment vehicles that allow investors to track Bitcoin’s market price through regulated platforms. These ETFs eliminate the need to manage private keys or wallets while offering bitcoin exposure under the umbrella of SEC regulated Bitcoin ETF structures.

Institutions like Merrill Lynch, part of Bank of America, are positioning themselves in this space to offer clients a safe, regulated entry point into crypto investing, fitting seamlessly into traditional brokerage bitcoin funds.

Types of Bitcoin ETFs

| Type | Description |

|---|---|

| Spot Bitcoin ETF | Tracks the actual market price of Bitcoin in real time. |

| Futures Bitcoin ETF | Tracks futures contracts; influenced by market speculation and time decay. |

Financial giants like Merrill Lynch, Wells Fargo, and others are leaning toward spot Bitcoin ETF offerings due to their simplicity and transparency, which also helps maintain ETF liquidity in the market.

Why Consider Bitcoin ETFs?

Bitcoin ETF Benefits

With support from firms like Merrill Lynch and UBS, clients can integrate ETFs into broader digital asset management strategies backed by expert advisory.

Merrill Lynch Bitcoin ETF Strategy

Institutional Crypto Investment Focus

Merrill Lynch stands out in the institutional adoption of Bitcoin ETFs by specifically targeting wealth management clients who demand both performance and security. Their strategy is built around combining deep financial expertise with the infrastructure of Bank of America, ensuring that clients have access to top-tier research, custody, and execution.

Their approach includes:

- Offering SEC regulated Bitcoin ETF products with transparent structures and competitive fees

- Providing expert research and crypto newsletters that include market outlooks, regulatory updates, and trading opportunities

- Ensuring secure crypto custody solutions through Bank of America’s institutional-grade systems, minimizing counterparty and operational risks

- Maintaining high ETF liquidity to facilitate large transactions with minimal price impact

This strategy positions Merrill Lynch as a trusted partner for investors looking to integrate bitcoin ETF investment into broader digital asset management plans.

ETF Fee Structure Comparison

| Provider | Type | Estimated Fee | Regulator | Custody Partner |

|---|---|---|---|---|

| Merrill Lynch | Spot Bitcoin ETF | ~0.25% | SEC | Bank of America Custody |

| Vanguard | Crypto Fund | ~0.30% | SEC | Third-party custodians |

| BlackRock | Spot Bitcoin ETF | ~0.20% | SEC | Coinbase Custody |

Compared to Vanguard and BlackRock, Merrill Lynch offers a competitive fee structure while leveraging the in-house capabilities of Bank of America for custody. This integration allows faster transaction settlement, enhanced compliance oversight, and reduced reliance on external custodians — a significant advantage in managing regulated cryptocurrency funds.

Furthermore, Merrill’s active engagement with institutional clients means they continuously refine their offerings, adding features such as advanced order types, portfolio analytics tools, and direct advisor access for clients seeking more personalized strategies.

How to Buy Bitcoin ETFs with Merrill Lynch

Buying a Bitcoin ETF through Merrill Lynch is a straightforward process, but understanding each step can help you make better investment decisions and avoid common pitfalls.

Steps to Invest

- Open or log into your Merrill Edge or Merrill Lynch brokerage account. If you’re not yet a client, you’ll need to complete the account opening process, which includes providing personal details, verifying your identity, and funding your account.

- Search for available bitcoin ETF investment products. Use the platform’s search bar or ETF screener to locate offerings such as spot Bitcoin ETFs or other cryptocurrency-linked funds. Look for products labeled as SEC regulated Bitcoin ETF for maximum investor protection.

- Review fund structure, fees, and holdings. Before purchasing, check the ETF’s prospectus for its management fee, underlying assets, and ETF liquidity metrics. High liquidity typically means tighter spreads and more efficient order execution.

- Place your order like any stock or ETF trade. Enter the ticker symbol, specify the number of shares, and choose your order type (market or limit). Confirm the trade and monitor its execution.

- (Optional) Speak to a Merrill advisor. Consult a professional to integrate bitcoin exposure into your portfolio. Advisors can help you balance long-term growth goals with risk management, and even combine ETF holdings with other asset classes for better diversification.

- Monitor and adjust as needed. Keep an eye on market conditions, regulatory updates, and ETF performance. Adjust your holdings periodically to maintain your desired asset allocation.

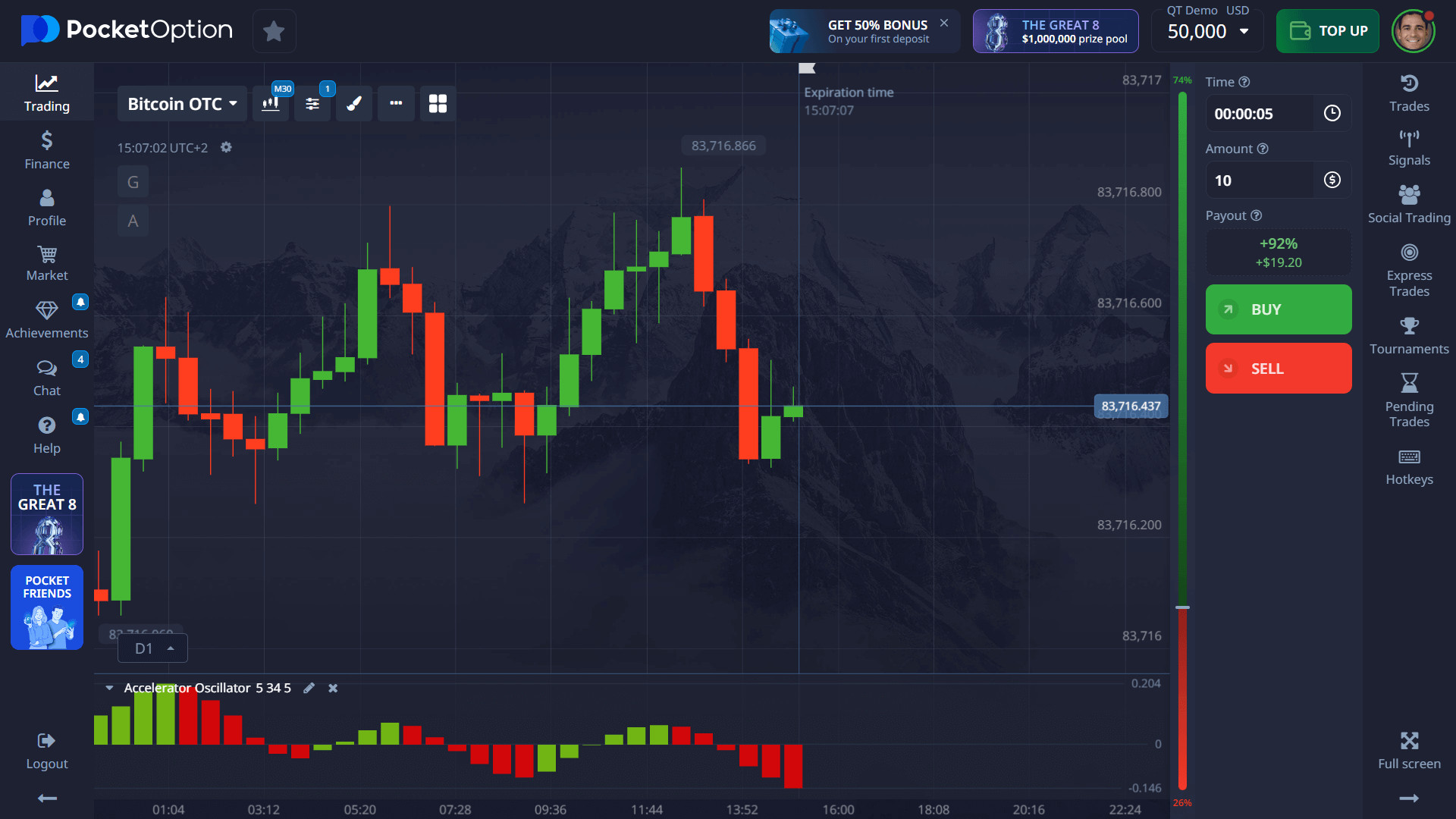

Comparing Bitcoin ETFs vs Quick Trading on Pocket Option ⚡

While ETFs are great for long-term investment, offering regulated bitcoin exposure and integration into retirement accounts or diversified portfolios, they typically involve slower capital appreciation, management fees, and reliance on broader market cycles. Spot Bitcoin ETFs–like those from Merrill Lynch–are designed for investors who prefer a “buy and hold” strategy, benefiting from potential long-term appreciation and portfolio stability. They provide transparency, institutional custody, and ETF liquidity that enables large trades without significantly impacting price.

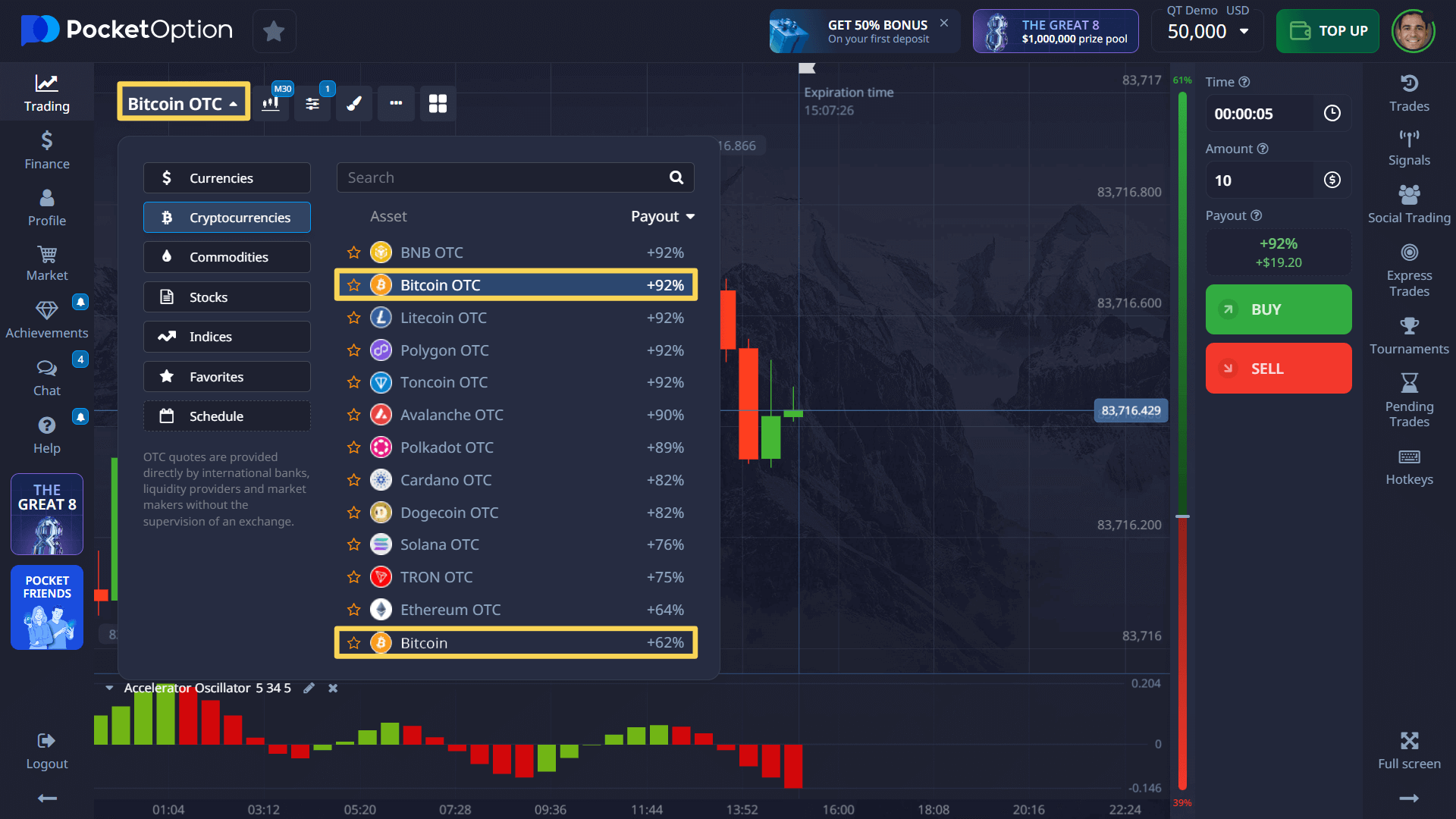

Pocket Option’s Quick Trading, by contrast, caters to those seeking to capitalize on crypto market volatility strategies in real time. Instead of waiting months or years for returns, traders can enter and exit positions within seconds to minutes. This approach offers:

- High flexibility: Trade 100+ assets 24/7, including BTC, AAPL, and TSLA, with expiry times from 5 seconds.

- Low entry barrier: Start with as little as $1 per trade.

- Advanced tools: Use charting, Trader Sentiment, and AI signals to refine entries.

- Potentially higher short-term returns: Up to 92% profit on a correct forecast, with instant settlement.

However, Quick Trading requires active management, discipline, and risk control, as outcomes depend on short-term price movements rather than long-term asset growth.

🔁 Example Trade on Pocket Option (BTC/USD)

- Select asset: BTC/USD

- Analyze using chart tools or Trader Sentiment

- Set amount: from $1

- Select time: from 5 seconds on OTC

- Predict direction and click Buy or Sell

🎯 If your forecast is correct, you can earn up to 92% profit. Profit percentage is shown when selecting the asset.

Current Market Trends and Bitcoin ETF Inflows 📈

- Over $12 billion in global spot ETF inflows in 2025 (Bloomberg data), reflecting a 35% increase compared to 2024

- Institutional investors driving demand via Merrill Lynch Bitcoin ETF, Fidelity, and Grayscale, with Merrill capturing a growing share of new inflows

- Increasing regulatory clarity from the SEC boosting investor confidence, including recent guidelines on ETF custody and reporting standards

- Growing ETF liquidity enabling smoother large-scale transactions for institutions, with average daily trading volumes for leading Bitcoin ETFs now exceeding $18 billion

- Surge in cross-border interest, as European and Asian markets explore spot Bitcoin ETF approvals, potentially expanding the investor base globally

These trends support the growing legitimacy of cryptocurrency investment vehicles and suggest ongoing growth. Analysts project that by the end of 2025, total assets under management (AUM) in U.S.-listed spot Bitcoin ETFs could surpass $50 billion, further cementing their role in institutional portfolios.

Expert Insights 🔍

“The demand for spot ETFs signals a maturing market ready for mainstream investors.”— Bloomberg Intelligence

“Combining crypto exposure with professional advisory, as Merrill does, marks a pivotal shift in digital asset integration.”— CryptoSlate

Adding to this, Bloomberg’s July 2025 report noted that U.S.-listed spot Bitcoin ETFs reached a record $18 billion in daily trading volume following renewed institutional interest, with Merrill Lynch products capturing a notable share. The SEC’s recent approval of additional custodians is expected to enhance security and market participation.

Merrill’s analysts also highlight the importance of tracking ETF liquidity, noting that higher liquidity levels have historically reduced trading spreads by up to 15%. They continue publishing regular market updates on bitcoin ETF benefits, potential regulatory shifts, and forecasts for digital assets within diversified portfolios.

Key Risks and Strategic Considerations

| Risk Factor | Description |

|---|---|

| Regulatory shifts | Delays or denials of ETF approval can impact prices |

| Crypto market volatility | Bitcoin remains highly volatile; consider risk tolerance |

| ETF management structure | Look into how the ETF manages tracking, custody, and slippage |

Mitigate risk with diversification, regular portfolio reviews, and advisory services.

FAQ

What is a Merrill Lynch Bitcoin ETF?

It’s a SEC-regulated fund offered through Merrill Lynch that lets investors gain bitcoin exposure without buying it directly. It’s a convenient way to access crypto markets through a traditional brokerage.

How do Bitcoin ETFs differ from direct Bitcoin?

Bitcoin ETFs are traded like stocks and managed by financial institutions, while direct Bitcoin requires personal custody in a crypto wallet. ETFs are simpler, safer, and easier for regulated portfolio inclusion.

What are Bitcoin ETF risks?

Main risks include price volatility, regulatory uncertainty, and tracking discrepancies. Always assess your risk tolerance before investing.

Are Bitcoin ETFs suitable for retirement accounts?

Yes, they can be included in IRAs or 401(k)s, offering crypto exposure in a regulated form. Consult your advisor to ensure alignment with your goals.

How to buy Bitcoin ETF shares?

Log in to your Merrill Lynch account, search for the ETF, review its details, and place an order—just like buying any stock.

Are Bitcoin ETFs suitable for retirement accounts?

Bitcoin ETFs can be included in certain retirement accounts, offering tax-advantaged cryptocurrency exposure. However, their volatility makes them best suited as a small allocation within a diversified retirement portfolio based on your risk tolerance.

How can I purchase shares of a Bitcoin ETF?

You can purchase Bitcoin ETF shares through most brokerage platforms that offer access to the exchanges where they're listed. Pocket Option and traditional financial services providers offer various ways to access these investment vehicles.

Conclusion: Positioning for the Future of Crypto

Whether you prefer institutional crypto investment through a Merrill Lynch Bitcoin ETF or fast-paced Quick Trading via Pocket Option, the world of digital assets has never been more accessible. Smart investors combine long-term strategies like ETFs with agile platforms like Pocket Option to maximize opportunity.

Start trading