- “XRP season has started… on a clear path to hitting $4.35 by the end of July 2025.”- Alex Cobb (TheCryptoBasic)

- XForceGlobal (Elliott Wave analyst) sees momentum towards $20–30 in early 2026: “The altcoin is on the cusp of a Wave 3 breakout.”

- Crypto Beast states: “XRP holders are about to ‘print’ … with a minimum breakout target of $8.”

- Bitget Analyst (EconomicTimes) expects institutional flows to push XRP to $5 by end‑2025

- Barron’s (Dec 2024) reporting: “Arthur Azizov… anticipates a range of $5 to $7 in the first half of 2025.”

Simpsons XRP Prediction: Will XRP Hit $589? What Do Experts Say?

Speculation surrounding xrp simpsons—the viral meme claiming The Simpsons predicted XRP reaching $589—has sparked heated debate. But reality-checks confirm it’s a myth. In contrast, reputable analysts and market experts offer grounded predictions and insights for XRP through 2025. This article goes in-depth into those forecasts, expert commentary, and actionable recommendations for traders—especially Quick Traders on Pocket Option.

🧠 “Simpsons XRP”: Debunking the $589 Meme

No genuine episode ever featured Bart’s chalkboard writing “XRP to hit $589+ by EOY.” This fabricated screenshot has been fact-checked and dismissed by outlets like Investing.com and MarketWatch. Still, it circulated widely–another reminder: verify before you trade.

Current XRP Landscape & 2025 Outlook

XRP remains a key player among cryptocurrencies–valued for fast, low-cost international remittances. As of July 2025, it’s trading near $2.70–2.80, driven by renewed institutional interest and regulatory momentum.

📊 Market Snapshot

| Factor | Summary |

|---|---|

| Price Range (Jul 2025) | $2.70–$2.80 (Binance technical forecast) |

| Trading Volume | ~$16 B/day (Binance) |

| Technical Setup | Triangle fractal–could break to $3.65 by late Q3 2025 |

| Network Growth | 6.6 M wallet addresses, whale accumulation |

Expert Insights & Quotes

📊 Forecast Summary: Model & Media Consensus

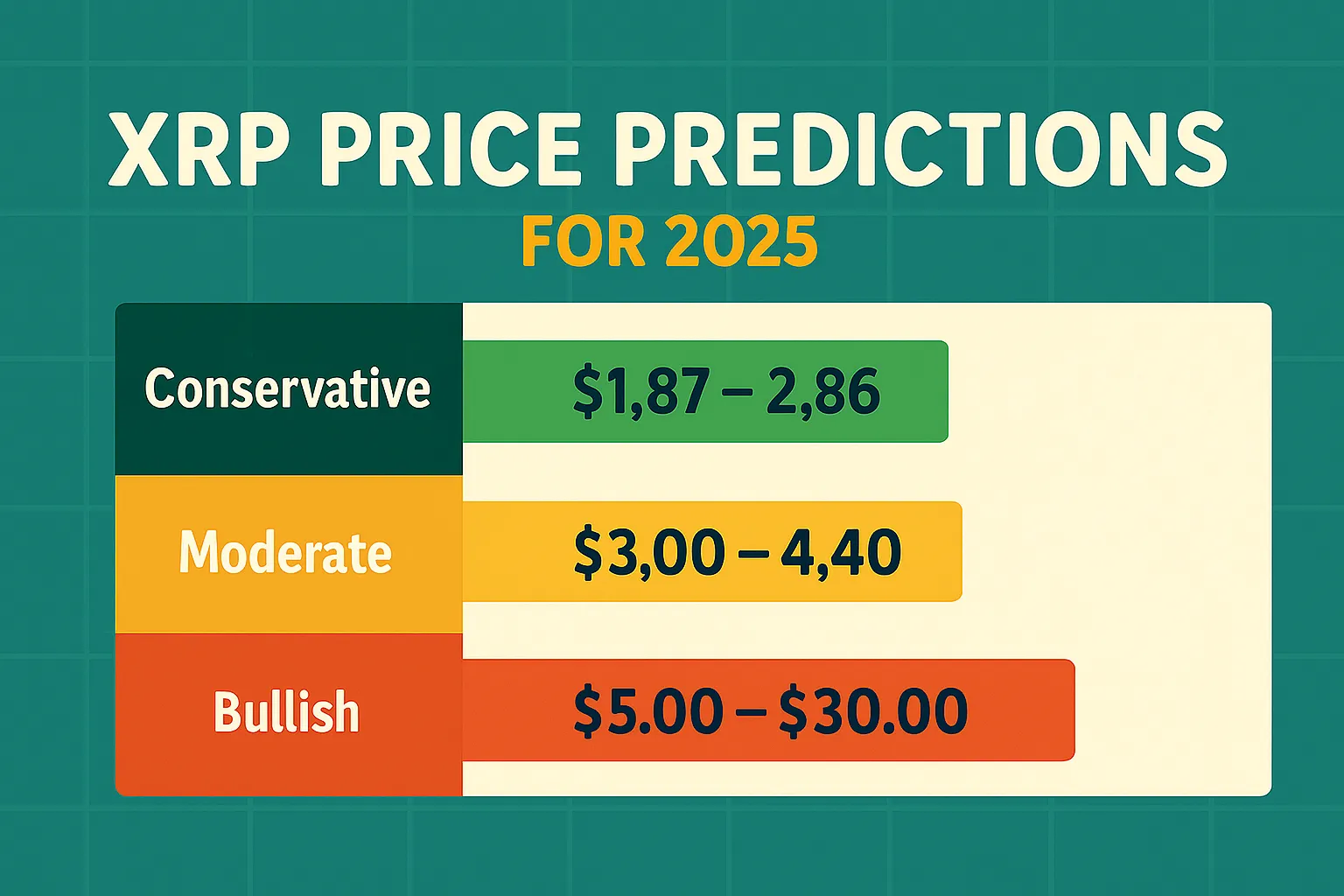

Forecasting XRP’s price in 2025 is a game of probabilities. Below we break down three levels of projections–conservative, moderate, and bullish–based on expert models, media analysis, and on-chain data.

🟢 Conservative Scenario: $1.87–$2.86

Source: Changelly, Finder Panel, Long Forecast

Assumptions:

- XRP continues to grow gradually with no major ETF approval.

- Ongoing legal or regulatory ambiguity suppresses large-scale inflows.

- Bitcoin remains under $90K and altcoin season stalls.

Commentary:

“If institutional adoption plateaus and legal progress is slow, XRP may hover between $2 and $3 for an extended period.”- Changelly Blog, April 2025

Probability Estimate: ~40%

Most likely in a sideways or mildly bullish crypto cycle without explosive catalysts.

🟡 Moderate Scenario: $3.00–$4.40

Source: FXEmpire, MarketWatch, CoinPedia

Assumptions:

- Continued RippleNet growth and ODL usage.

- Legal clarity or partial SEC win.

- Bitcoin > $100K sparks broader altcoin rally.

Expert Insight:

“XRP has historically lagged BTC but catches up aggressively during late-stage bull runs. A price near $4.00 aligns with that structure.”- FXEmpire Analyst

Technical Justification:

- Fractal patterns from 2017 and 2021 suggest breakout potential to $3.65–$4.35 if triangle structure resolves upward.

- RSI/MACD remain bullish with no overbought conditions as of July 2025.

Probability Estimate: ~45%

This is the baseline scenario in most 2025 projections, especially if an ETF or regulatory win materializes.

🔴 Bullish & Ultra-Bullish Scenario: $5.00–$30.00+

| Forecast | Source | Comment |

|---|---|---|

| $4.35 | Alex Cobb | “On track to hit by end of July 2025” |

| $8–10 | Crypto Beast | “XRP holders are about to print” |

| $20–30 | XForceGlobal | Elliott Wave analysis supports Wave 3 impulse setup |

| $1,000+ | BarriC | Based on full CBDC adoption and Ripple replacing SWIFT (highly unlikely) |

Reality Check:

“The $1K scenario from BarriC is mathematically improbable in the medium term. It implies a market cap over $100T–more than global equities.”- CoinDesk contributor

While $8–10 is possible under a blow-off top scenario, levels beyond $20 require multi-year adoption and network scale across global central banks and financial institutions.

Probability Estimate:

- $4.35–$8.00: ~10–15%

- $20–30: <3%

- $1,000+: <0.01% (not realistic in current macro structure)

⚠️ Takeaway: Most credible analysts maintain realistic expectations–$3–5 is plausible with supportive catalysts, while extreme projections (# with XRP reaching $50+) are speculative and low-probability in the short-term.

🔍 What Will Move XRP? Key Catalysts for 2025 and Beyond

To understand where XRP is heading, traders must assess four core drivers that shape its price trajectory: regulatory shifts, institutional momentum, technical structures, and macro-market dynamics.

⚖️ 1. SEC & Regulatory Update: Clarity May Trigger a Surge

Since 2020, Ripple Labs’ legal battle with the U.S. SEC has heavily influenced XRP’s price. In 2023, a partial court ruling determined XRP is not a security when sold on public exchanges–a major win for Ripple. However, a final verdict and potential ETF approval remain pending.

Probability: As of Q3 2025, Bloomberg ETF analysts Eric Balchunas and James Seyffart estimate a 98% chance that a spot crypto ETF (including XRP) could be approved before year-end.

Potential Impact: Approval could unlock billions in institutional capital, as ETFs allow traditional investors to gain exposure through regulated vehicles.

“A spot ETF would be the biggest validation XRP has ever received. This is institutional greenlighting.”- James Seyffart, Bloomberg ETF Analyst

🏦 2. Institutional Adoption: ODL & Real-World Use Cases

Ripple’s On-Demand Liquidity (ODL) network is gaining traction among banks and remittance providers. Institutions like Santander, BNY Mellon, SBI Holdings, and Tranglo are either piloting or actively using XRP for cross-border settlements.

Key Metrics:

- Metric: Number of ODL Partners

Value/Status (2025): 50+ across APAC, LATAM, EU - Metric: Volume Growth (YoY)

Value/Status (2025): +178% YoY in RippleNet transactions - Metric: Banks with XRP Integration

Value/Status (2025): BNY Mellon, SBI, PNC, Standard Chartered (pilot)

Ripple also launched its CBDC Platform–leveraging XRP ledger for national currencies like Palau’s digital dollar, creating further institutional relevance.

📈 3. Technical Patterns: Symmetrical Triangle Forming

XRP’s price structure in mid-2025 shows a classic symmetrical triangle pattern, indicating a tightening range and coiling volatility.

Technical Snapshot (as of July 2025):

- Support Level: ~$2.60

- Resistance: ~$2.83–2.90 (near breakout zone)

- Measured Move Target: ~$3.65 if resistance breaks

- Indicators: RSI ~58 (neutral), MACD bullish divergence forming

“We’re in a volatility compression phase. A clean breakout past $2.90 could open a fast move to $3.65 or higher.”- Peter Brandt, veteran chartist

Technical traders on platforms like Pocket Option often leverage this type of breakout with Quick Trading, exploiting fast price actions in seconds or minutes.

🌐 4. Macro Markets: Bitcoin, Inflation & Global Liquidity

XRP’s movements are also tied to broader crypto market sentiment and macroeconomic trends:

- Bitcoin Correlation: XRP historically shows a +0.82 correlation with BTC. When Bitcoin pumps, altcoins follow.

- Liquidity & Rates: With global central banks hinting at rate cuts in late 2025, liquidity may return to risk assets like crypto.

- Geopolitical Tension: Events like sanctions, de-dollarization, or FX instability often push users and institutions toward fast remittance solutions–boosting XRP’s use case.

“We’re entering a reflationary regime. Digital assets like XRP with utility can benefit most when macro winds shift.”- Raoul Pal, CEO RealVision

🧩 Unique Expert Insights & Recommendations

- Agile, data-driven trading beats predictions: The academic study from arXiv shows crypto prices behave like Brownian noise–simpler models outperform complex AI in forecasting

- Focus on network & on-chain KPIs: Santiment highlights wallet growth and relative volume as early breakout indicators

- Risk management is key: Bitcoin cycle, global events, and overhead resistance (~$2.80–3.00) can prompt sudden reversals.

Pocket Option Quick Trading Toolkit

Take your strategy further with Pocket Option:

- AI Trading and Bot: Automate trades based on signals.

- Social Trading & Tournaments: Copy top traders and sharpen skills.

- 24/7 Access to 100+ Assets: XRP, Bitcoin, stocks — trade anytime.

- Bonuses & Payment Flexibility: Over 50 global options to boost your capital.

- Support & Education: Guides, tutorials, and live help.

- Mobile App: Trade in a minute–on the fly.

These advanced tools help apply expert insights in real-time.

Expert Recommendations at a Glance

- Track Key Levels: Buy the breakout above $2.83 or dip toward $2.60 with strict stop-loss.

- Watch Institutional Moves: ETF approval or ODL expansion — prime buy signals.

- Use Technicals Smartly: Target ~$3.65 in breakout scenarios; trail stops below $2.60.

- Don’t Chase Moonshots: Extreme targets ($20+) are long-term or speculative. Keep portfolios balanced.

- Bitget & Barron’s consensus: Prepare for $5–$7 as realistic 2025 mid‑term targets.

Final Thoughts

- The xrp simpsons $589 meme is pure fantasy.

- Credible forecasts range from $3–$5 (most conservative) to $8+ (bullish) in the next 6–12 months.

- Key catalysts: regulation, institutional flows, technical setups, on-chain metrics.

- Use Pocket Option to convert expert insights into quick, tactical trades with risk control and automation.

Armed with these expert insights and trading tools, you’re now prepared to navigate XRP smartly and strategically. Want to dive deeper into on-chain metrics, trading strategies, or crafting content for the Pocket Option blog? I’m ready to help.

FAQ

Did The Simpsons actually predict XRP hitting $589?

No—it's a viral fake. No episode made such a claim. Stick to verified data.

What’s XRP’s realistic price by end‑2025?

Most experts forecast between $3–$5, with moderate upside to ~$7 in strong bullish scenarios.

What key data should I monitor?

Watch for ETF approval, on-chain metrics (wallet growth, volume), Bitcoin correlation, and technical breakouts at $2.83–3.00.

How can Pocket Option tools help?

From automated bot trades to copy trading and 24/7 market access, Pocket Option gives you the edge in volatile movements.

What’s the biggest long-term upside?

Bullish analysts like Crypto Beast and XForceGlobal forecast $8+ potential by mid-2026, with structural breakout patterns possibly leading even higher.

What is "xrp simpsons" and why is it attracting attention?

XRP Simpsons refers to the relationship between the cryptocurrency XRP and the series "The Simpsons," which frequently predicts future trends. This connection has sparked interest for influencing investment behaviors, especially when highlighted in recent episodes.

How do "The Simpsons" affect the financial market?

The Simpsons have a reputation for predicting future events. When they mention cryptocurrencies, such as XRP, it can lead to a temporary increase in transaction volume, demonstrating a direct impact on investor perception.

What are the advantages of using XRP compared to other cryptocurrencies?

XRP offers fast and low-cost transactions, as well as having broad institutional support. However, it faces regulatory challenges and competition from other cryptocurrencies.