- Era-specific corporate seals

- Watermarks visible under backlight

- Microprinting (post-1968)

- Unique alphanumeric numbers and CUSIP identifiers (post-1964)

- Authentic signatures of Ford executives

Comprehensive Ford Stock Certificate Analysis

Ford stock certificates embody a unique intersection of American industrial heritage and financial markets. These physical documents represent more than ownership - they're historical artifacts with potentially significant value for both collectors and investors seeking alternative portfolio assets.

Article navigation

- Unlock the Full Potential of Pocket Option Start Trading from Just $5 Start

- The History and Evolution of the Ford Stock Certificate

- Origins: The Birth of Ford and Its First Certificates

- Evolving Designs: From Art Deco to Security Printing

- The Question of Authenticity

- Collectors vs. Investors: Two Ways to Value Ford Certificates

- Where to Buy Ford Stock Certificates

- Digital Transformation: From Paper to Electronic

Unlock the Full Potential of Pocket Option

Start Trading from Just $5

Start

The History and Evolution of the Ford Stock Certificate

A Ford stock certificate is far more than an ownership slip – it is a cultural artifact, a financial record, and a piece of art rolled into one. Across more than a century, these documents have mirrored the rise of the automotive industry, the transformation of Wall Street, and the changing face of industrial design.

For collectors, they belong to the elite category of vintage stock certificates – valued not just for rarity, but for the story they tell about American capitalism. For investors, they represent an unusual but fascinating corner of automotive stock investment, where financial worth meets historical charm.

“Each Ford certificate is a miniature time capsule–combining artistry with economics and giving us a snapshot of how finance looked in a given decade.” – Dr. William Harper, financial historian, American Institute of Economic Studies

Today, while shares are registered electronically, platforms like Pocket Option allow you to experience Ford in a modern way: trade ford motor company stock alongside 100+ global assets, starting with just $5 (the amount may vary depending on the geo and payment method), or practice strategies risk-free with an unlimited demo account.

Origins: The Birth of Ford and Its First Certificates

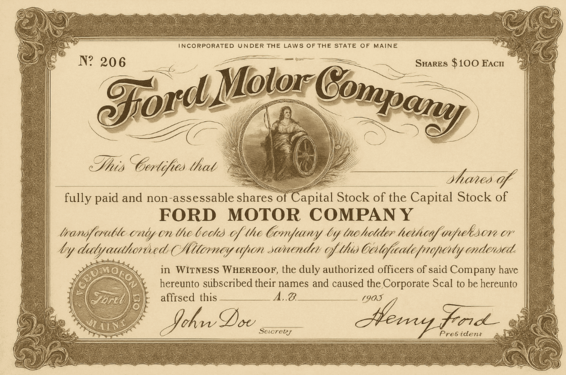

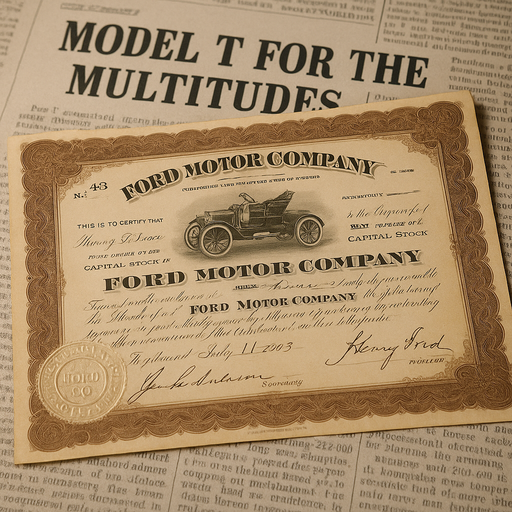

When Henry Ford and 11 investors founded Ford Motor Company on June 16, 1903, they raised $28,000. Each contribution was recorded with a paper stock certificate, bearing intricate Victorian engravings and Ford’s own signature.

These documents are now among the most desirable collectible stock certificates in existence. Auction records show that early issues–especially those signed by Ford himself – can sell for $30,000 – $97,500. Even cancelled versions (marked as redeemed or voided) routinely attract bids of $15,000 – $25,000, purely for their historical significance.

A 1903 certificate is not merely a piece of paper. It represents the gamble of investors who believed in the idea of the Model T – an automobile “for the great multitude.” Owning one today means holding a tangible fragment of American industrial ambition.

Evolving Designs: From Art Deco to Security Printing

As Ford grew, so did its certificates.

1920s: The ornate flourishes gave way to cleaner designs, featuring the first standardized Ford logo. Anti-counterfeiting measures such as specialized inks and embedded threads were added.

1930s-1940s: The designs embraced Art Deco influences. In 1936, the famous vignette of the River Rouge plant appeared, symbolizing Ford’s industrial might. These certificates combine elegance with history – typically valued between $800 and $7,500 today.

1950s-1970s: A blue-green palette became the standard, reflecting modernist trends. By 1968, microprinting and watermarks made forgery much harder.

1980s-2000s: Certificates included holograms, UV inks, and computerized numbering systems. Though visually striking, they are less rare, trading between $100 and $500.

Post-2000: Paper issues became rare, available only by special request and additional fees ($50-$250), making them a new kind of scarcity.

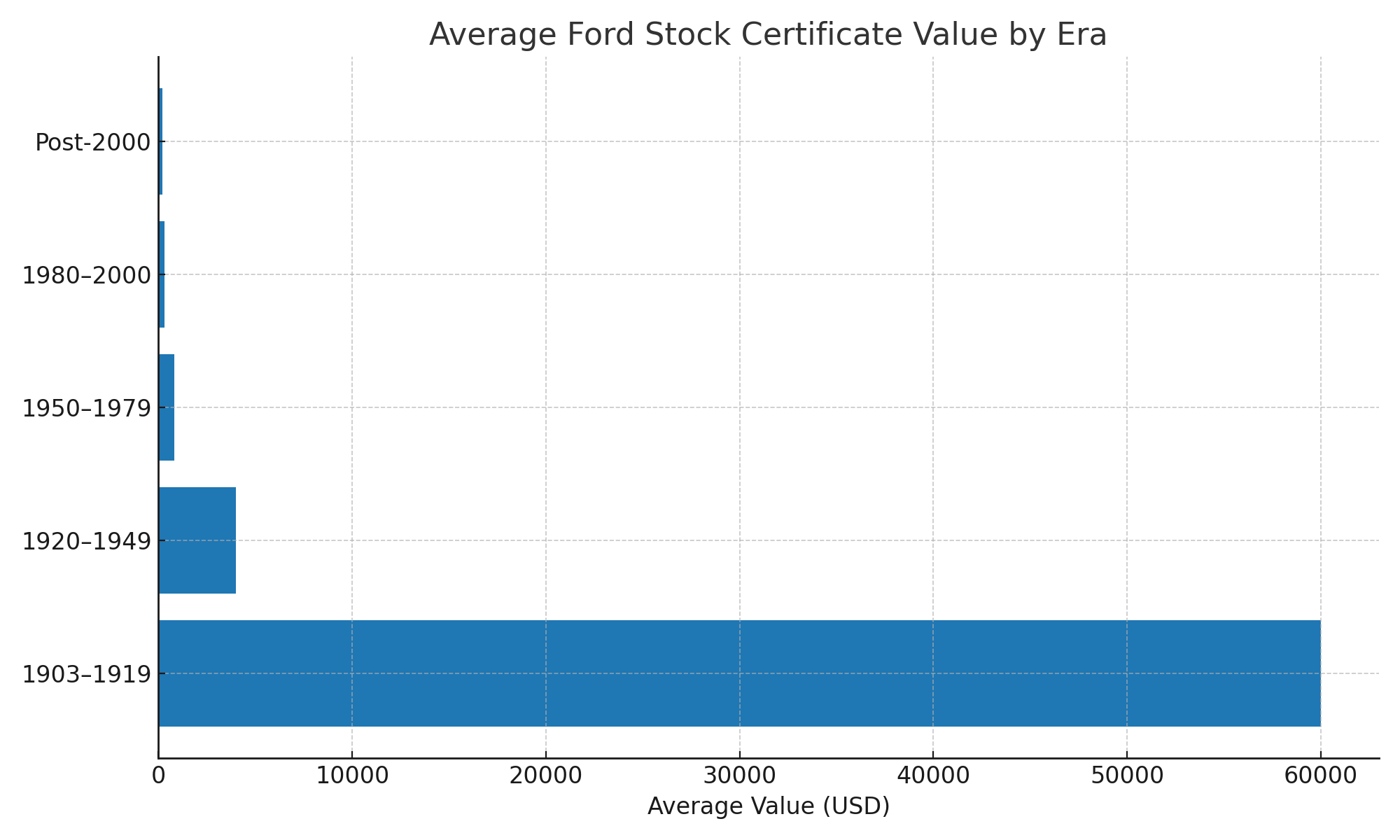

| Era | Features | Collector Value |

|---|---|---|

| 1903-1919 | Henry Ford signature, ornate engravings | $15,000–$97,500 |

| 1920-1949 | Art Deco, River Rouge vignette | $800–$7,500 |

| 1950-1979 | Blue-green modern designs | $200–$1,500 |

| 1980-2000 | Holograms, UV security inks | $100–$500 |

| Post-2000 | Limited issuance, RFID | $75–$300 |

“Certificates from pivotal corporate events – the Dodge Brothers buyout in 1919 or Ford’s 1956 IPO–often fetch 50–70% premiums compared to standard issues of the same era.” – George Remington, editor of Scripophily Journal

For investors today, history echoes in a different way. Instead of waiting weeks to process a certificate, traders on Pocket Option buy and sell Ford stock instantly, automate trades with AI 🤖, or even join tournaments 🏆 to compete and learn.

The Question of Authenticity

Because stock certificate value can be immense, fakes exist. Authentication is crucial. Genuine Ford certificates include:

Collectors often rely on magnifiers to check microprinting or use UV lights to confirm hidden features. High-value pieces are usually submitted to professional grading services such as PCGS or R.M. Smythe.

“Think of authentication as insurance. Without provenance or grading, you might be holding a $50 souvenir instead of a $5,000 artifact.” – Sarah Dunham, portfolio strategist, MarketWatch

Collectors vs. Investors: Two Ways to Value Ford Certificates

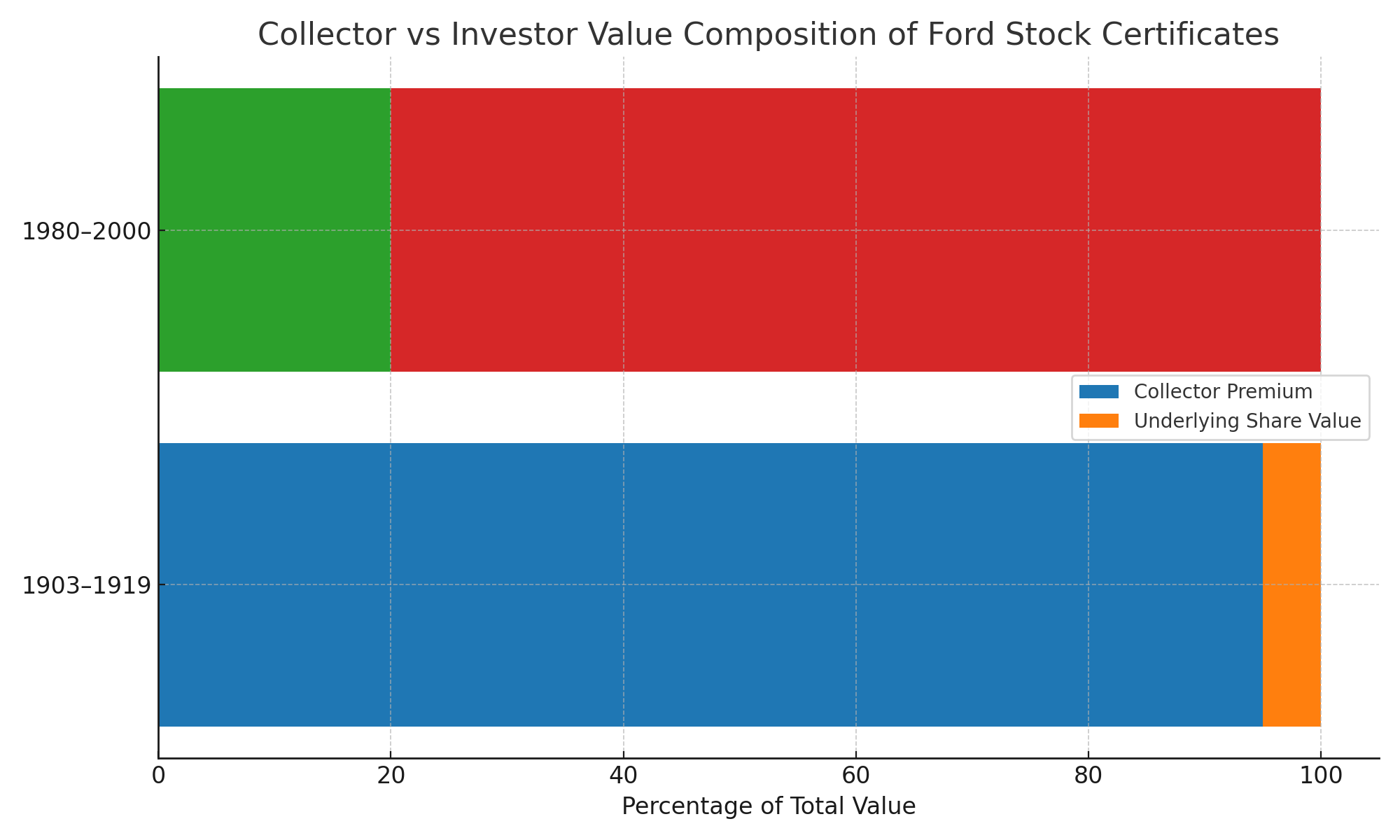

The debate over whether a Ford stock certificate is a collectible or an investment often comes down to perspective.

Collectors care about:

- Rarity and survival rate

- Condition grading (1-10 scale)

- Historical connection (milestones like IPOs or restructurings)

- Signatures (Henry Ford = 500% premium, Edsel Ford = 200%)

Investors care about:

- Ford’s current NYSE performance (ticker: F)

- Dividend yield (currently 4%+)

- Industry factors like EV transition

- Liquidity of electronic vs. paper holdings

Some pursue a hybrid strategy. During market downturns, when Ford shares may decline, the collectible premium often remains stable – or even rises. This makes Ford certificates a hedge-like diversification tool within an automotive stock investment portfolio.

Pocket Option embodies the investor’s side of this spectrum. Traders highlight its social trading tools – “I learned faster by copying top strategies,” says user Michael R. – and the convenience of its mobile app 📱, making Ford shares tradable in minutes rather than weeks.

Where to Buy Ford Stock Certificates

If you want to own a Ford certificate, you have several options:

- Specialized auctions: Heritage, Christie’s, and other auction houses often feature Ford certificates, especially during memorabilia sales.

- Online marketplaces: Sites like eBay or Scripophily.net list both cancelled and active certificates, though caution is needed regarding authenticity.

- Brokers: For post-2000 certificates, you can request one through your broker for a fee, though the process is slow and requires paperwork.

Collectors recommend asking for provenance whenever possible. Certificates with auction pedigrees command 15–30% more because they carry authentication certainty.

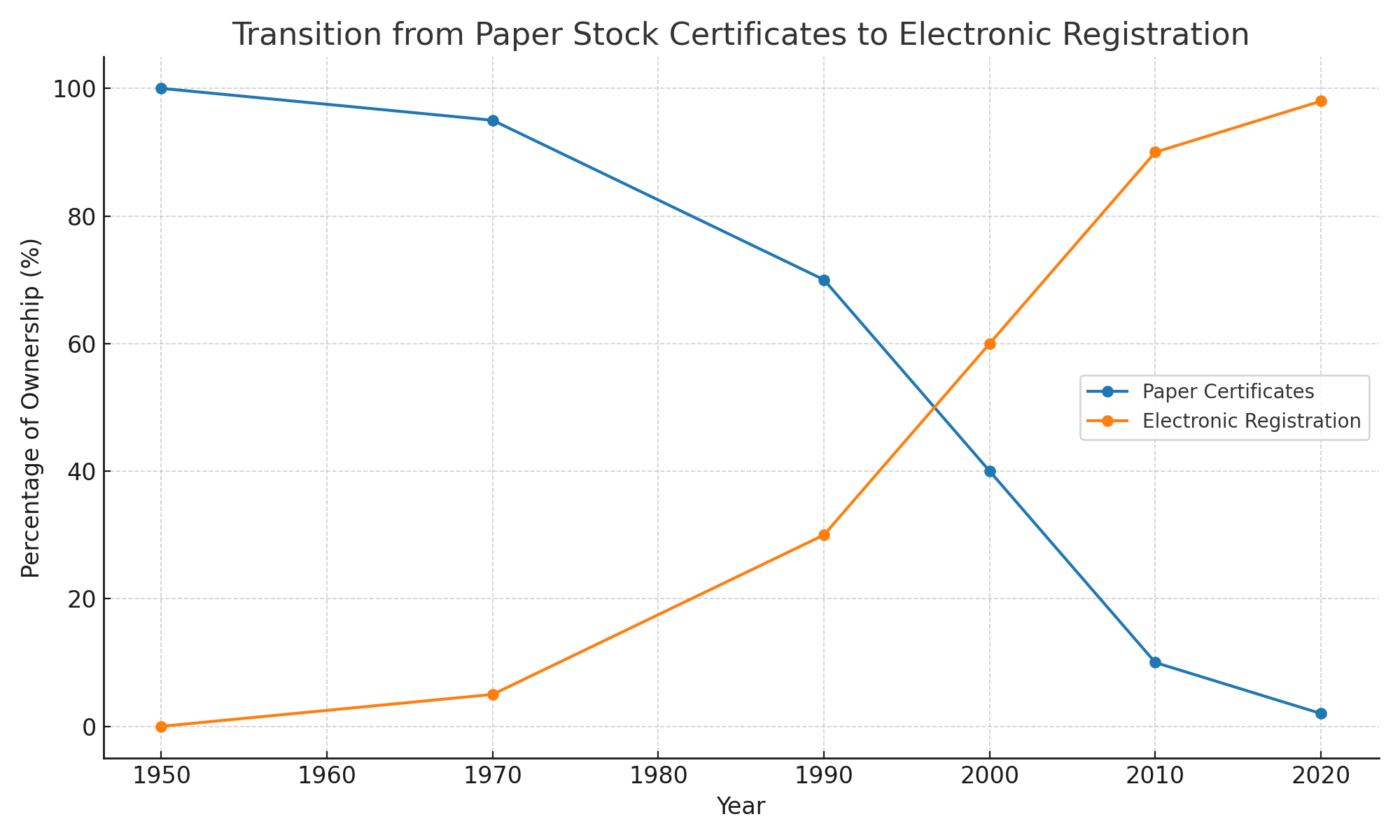

Digital Transformation: From Paper to Electronic

The disappearance of paper certificates reflects a global market shift. Electronic registration offers speed, security, and efficiency: instant transfers, automatic dividend payments, and no risk of physical loss.

Yet paradoxically, this shift increased the collectible appeal of the remaining paper issues. What was once ordinary proof of ownership is now rare memorabilia.

“Scarcity is a powerful driver. As electronic trading dominates, the few paper certificates that remain become even more desirable.” – Financial Times commentary, 2022

Platforms like Pocket Option bring this transformation full circle. You no longer need to wait weeks for a transfer – you can buy, sell, or even automate your Ford trades instantly. Bonuses, flexible payment methods, and educational materials make the process accessible for both beginners and professionals.

FAQ

What is a Ford stock certificate worth?

The value of a Ford stock certificate depends on its age, rarity, and condition. Early certificates from 1903–1919, some of which carry Henry Ford’s own signature, can sell for $30,000–$90,000 or more, while mid-century examples often range from a few hundred to several thousand dollars. More recent issues, especially post-2000 certificates, are generally worth $75–$300, unless tied to a special event or ownership history.

How to get a Ford stock certificate?

Today, most Ford shares exist electronically, but it is still possible to request a paper stock certificate through a broker for an additional fee, usually between $50 and $250. This process can take several weeks and requires specific forms, which is why collectors often prefer to purchase certificates already in circulation through auctions or online marketplaces.

Are Ford stock certificates valuable?

Yes, many of them are considered highly valuable, particularly as vintage stock certificates. Collectors prize them not just for the underlying shares but for their artistry, rarity, and historical significance. Even cancelled certificates can hold substantial value because they embody key moments of Ford Motor history and often include unique engravings, seals, and signatures.

Where to buy Ford stock certificates?

The most common channels are specialized auctions, such as Heritage or Christie’s, collector platforms like Scripophily.net, or even online marketplaces like eBay. For those seeking newer certificates, brokers remain the only way to obtain freshly issued physical stock certificates, though these are rare and usually carry limited collectible premium.

How do I safely store and preserve my Ford stock certificate?

Store certificates flat (never folded) in acid-free archival sleeves made of mylar or polypropylene. Maintain a stable environment with 60-65°F temperature and 40-50% relative humidity. Avoid all paper clips, staples, adhesives or rubber bands. For certificates valued above $1,000, consider bank vault storage with appropriate insurance coverage specifically listing the certificate with both its investment and collectible values documented.

Legacy Meets the Future

The Ford stock certificate stands at the intersection of history and finance. For collectors, it is a treasure of the past—ornate, rare, and tied to milestones in Ford Motor history. For investors, it is a reminder of how finance has evolved, from slow-moving paper to fast, global, digital markets. Whether valued for its artistry or as part of collectible stock certificates, the certificate’s story continues to resonate. And while paper may fade, the chance to trade Ford’s future remains vibrant—through digital platforms like Pocket Option, which bridges past and present, offering opportunities that Henry Ford’s first shareholders could only dream of.

Start trading