- European Central Bank interest rate guidance

- Hungary’s inflation data and MNB reaction

- EU funding and fiscal debates with Hungary

- Capital inflows and regional political risk

EURHUF: Trends, Monetary Debates, and How to Trade the Euro-Forint Pair

The EUR/HUF currency pair represents the Euro versus the Hungarian Forint. It's a regional pair shaped by broader European policy and Hungary's evolving local economy. For those seeking directional setups and monetary divergence, EUR/HUF offers a unique blend of EU influence and Central European volatility. Let's explore HOW TO TRADE EURHUF and where current policy tensions stand.

The EURHUF FOREX landscape is often driven by monetary divergence between the ECB and the Hungarian National Bank (MNB), capital flow dynamics, and EURHUF KEY DEBATES surrounding inflation control and political independence.

What Is EUR/HUF?

EUR/HUF shows how many Hungarian Forints are needed to purchase one Euro. As Hungary is a non-Eurozone EU member, this pair reflects both domestic central bank action and Eurozone-wide developments.

Traders often follow the EURHUF PREDICTION models to anticipate shifts based on inflation outlook, fiscal alignment, and regional confidence levels.

How Currency Quotation Works

If EUR/HUF = 392.50, that means 1 Euro equals 392.50 Hungarian Forints. The Euro is stronger in this setup.

Example: Exchanging €100 would yield 39,250 HUF. Small shifts in this rate can signal larger monetary shifts within the region.

Factors Influencing EUR/HUF Movement

These are at the heart of ongoing EURHUF KEY DEBATES, especially as Hungary balances monetary stability with political autonomy.

How to Interpret EUR/HUF Price Changes

If EUR/HUF rises from 390.00 to 400.00, it suggests Euro strength or weakening confidence in the Hungarian economy.

If it drops to 385.00, the Forint is likely gaining.

Example: A move from 392.10 to 397.80 may be a reaction to Hungary delaying rate hikes while the ECB stays hawkish — shaping the current EURHUF PREDICTION sentiment.

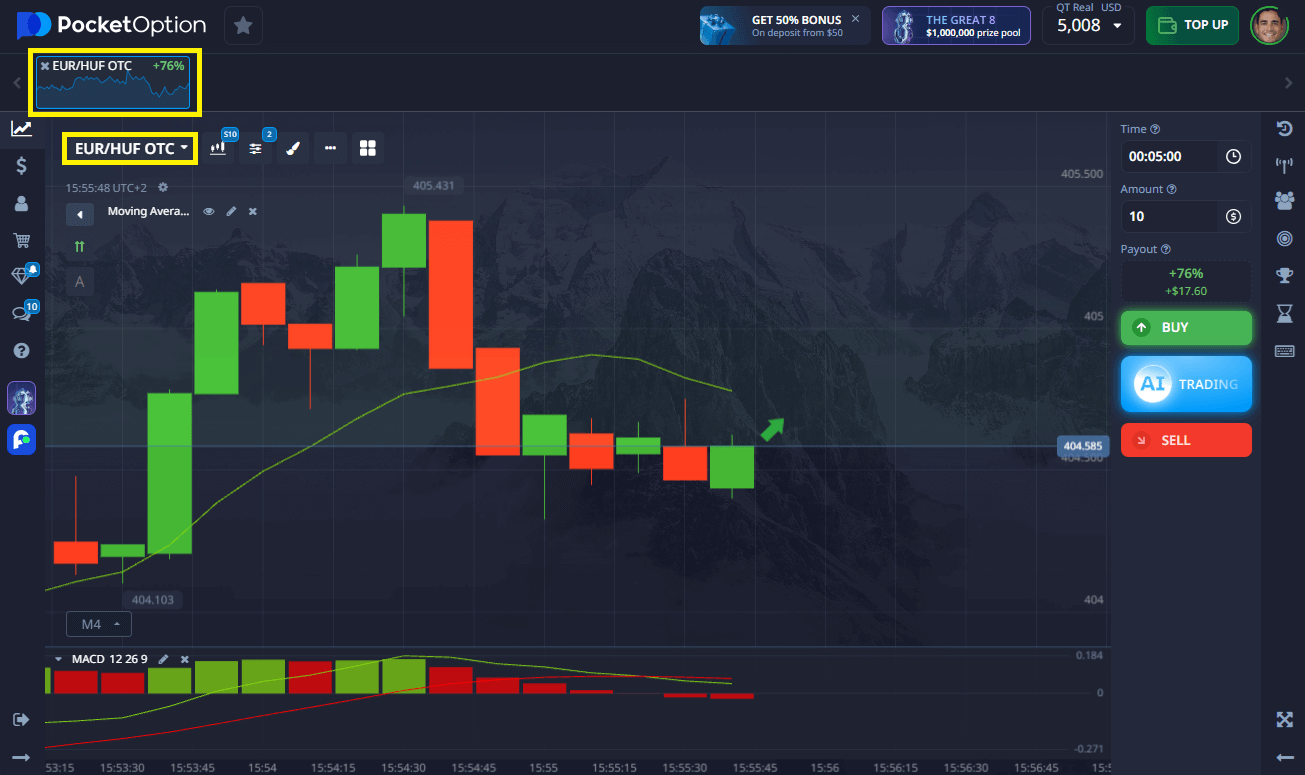

Step-by-Step Quick Trading Example on EUR/HUF

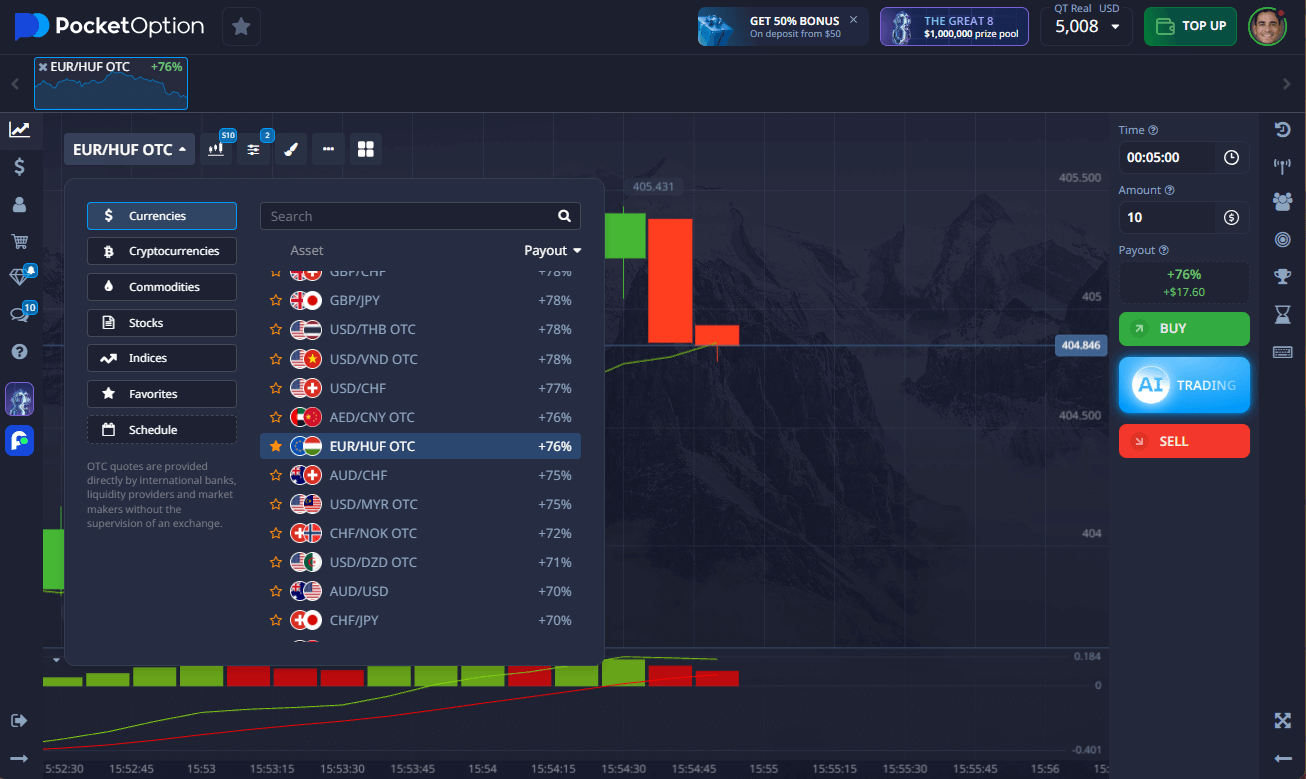

- Open the Pocket Option platform and find EUR/HUF OTC in the asset list.

- Analyze the chart using indicators, levels, and prediction tools.

- Set your trade amount — starting from just $1.

- Choose your trade time — from 5 seconds and up (for OTC assets).

- Forecast the direction:

- Click BUY if you think the price will rise.

- Click SELL if you think it will fall.

- The expected return — up to 92% — is shown before confirmation.

➡️ It takes just seconds to get started. Begin trading with a $5 minimum deposit (deposit may vary depending on payment methods), or explore the EURHUF setup safely with demo mode.

Try Risk-Free — $50,000 Demo Account

Not sure HOW TO TRADE EURHUF yet? Try a $50,000 demo account on Pocket Option to test your predictions, chart reactions, and track key macro moves.

Use the opportunity to experiment with strategies, follow news events, and gain clarity on HOW TO INVEST IN EURHUF before trading real money.

Switch to a live account anytime from $5 and unlock:

- Copy-trading

- Cashback programs

- Strategy tournaments

- Full suite of trading tools

Conclusion

Whether you’re analyzing rate spreads or following EURHUF KEY DEBATES, the Euro–Forint pair is full of short- and medium-term potential. You can start by learning HOW TO BUY EURHUF in demo mode, refining strategy based on your EURHUF PREDICTION logic, and scale gradually with confidence.

FAQ

How to trade EURHUF as a beginner?

Start with demo practice, analyze central bank trends, and trade small amounts while refining your entries.

How to buy EURHUF?

Choose the pair, review market structure, and open a forecast trade based on short-term or macro signals.

How to invest in EURHUF long term?

Follow rate differentials between ECB and MNB, and monitor EU--Hungary relations and funding issues.

What are the current EURHUF key debates?

They involve inflation strategy, EU funding tensions, and the MNB's response to political pressure.

What is the EURHUF prediction for 2025?

Analysts expect continued volatility depending on central bank divergence and Hungary's fiscal independence trajectory.