- ECB monetary policy tightening or loosening

- Bank of Japan yield curve control and inflation strategy

- Eurozone inflation, GDP growth, and labor market reports

- Risk sentiment in global equity and bond markets

EURJPY: Rate, Trend, and Macroeconomic Drivers -- Learn How to Trade the Euro/Yen Pair

The EUR/JPY currency pair represents the Euro against the Japanese Yen. It combines the monetary dynamics of the Eurozone and Japan -- two very different economies. EUR/JPY is known for clear trends and high liquidity, making it ideal for traders looking to capture directional moves. Let's explore what drives this pair, how to trade EURJPY, and whether EURJPY is bullish or bearish in 2025.

The pair is particularly sensitive to interest rate differentials and risk sentiment — two key themes in EURJPY MACROECONOMIC FACTORS 2025. It’s a common focus in professional EURJPY STOCK outlooks and short-term traders’ strategies alike.

What Is EUR/JPY?

EUR/JPY measures how many Japanese Yen are needed to buy one Euro. The Euro reflects the economic stability of the European Union, while the Yen is traditionally seen as a low-yield safe-haven currency.

Key EURJPY MACROECONOMIC FACTORS 2025 include monetary policy divergence, inflation expectations, and real interest rate spreads. When the ECB tightens and the BOJ maintains easing, the pair often trends upward.

How Currency Quotation Works

If EUR/JPY = 165.80, that means one Euro equals 165.80 Japanese Yen. The Euro is the base currency.

Example: Exchanging €100 gives you ¥16,580. If the rate rises to 167.20, it shows Euro strength or Yen weakness.

Factors Influencing EUR/JPY Movement

When global investors seek yield, EUR/JPY tends to rise. If risk-off sentiment dominates, the Yen strengthens and the pair falls.

How to Interpret EUR/JPY Price Changes

A rise from 164.00 to 166.50 shows Euro strength or weak demand for the Yen.

A fall from 165.20 to 162.80 signals JPY gains or Euro pullback.

Example: If EUR/JPY spikes after ECB signals more rate hikes, that reflects strong EURJPY SENTIMENT leaning bullish.

Step-by-Step Quick Trading Example on EUR/JPY

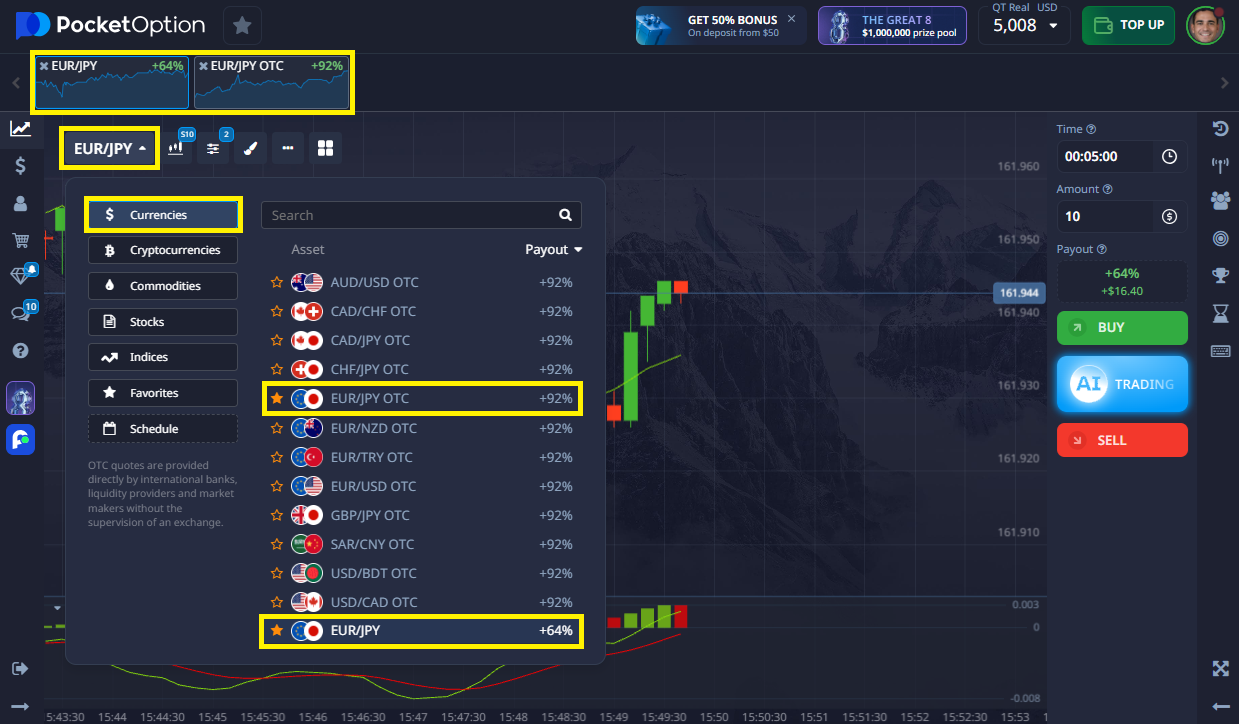

- Log into Pocket Option and locate EUR/JPY or EUR/JPY OTC in the asset list.

- Analyze the chart using trendlines, volume, and the latest EURJPY SIGNAL.

- Choose your trade size starting from $1.

- Select expiration — from 5 seconds and up (for OTC assets).

- Make a forecast:

- Click BUY if you believe EUR/JPY will rise.

- Click SELL if you expect it to fall.

- Potential return appears before execution — up to 92% for a correct forecast.

➡️ Trading starts fast — register in seconds, deposit from $5 (deposit may vary depending on payment methods), or use a free demo to explore the market.

Try Risk-Free — $50,000 Demo Account

Want to learn HOW TO TRADE EURJPY with zero risk? Pocket Option offers a free $50,000 demo account — use it to test your strategy, review live EURJPY RATE charts, and explore EURJPY SENTIMENT without pressure.

You’ll be able to analyze the EURJPY TREND, get familiar with signals, and decide whether IS EURJPY BULLISH OR BEARISH — all before switching to real trading.

When ready, you can deposit from $5 and unlock full access to:

- Copy-trading

- Cashback

- Competitive tournaments

- Advanced tools and analytics

Conclusion

Whether you’re reviewing EURJPY MACROECONOMIC FACTORS 2025 or looking for intraday trades, the Euro/Yen pair offers dynamic movement and structure. Learning HOW TO BUY EURJPY and HOW TO INVEST IN EURJPY starts with mastering the basics — rate structure, sentiment, and trend identification. Pocket Option gives you the tools to begin risk-free, with support for both novice and advanced traders.

FAQ

How to trade EURJPY effectively?

Use technical indicators, review macroeconomic events, and follow live sentiment to time your entries.

How to buy EURJPY on Pocket Option?

Select the pair, review the chart, and open a short-term forecast trade based on your analysis.

How to invest in EURJPY for the long term?

Watch ECB and BOJ policy shifts, and use swing strategies tied to trend confirmations.

What is the current EURJPY rate?

The rate fluctuates daily -- check Pocket Option charts for the most recent live price.

Is EURJPY bullish or bearish right now?

It depends on current market sentiment and economic data -- use signals and analysis tools to decide.