- OPEC+ Production Policies: The Organization of Petroleum Exporting Countries and its allies control roughly 40% of global oil production and can significantly impact prices through output decisions.

- Geopolitical Tensions: Conflicts or sanctions affecting major oil-producing regions like the Middle East, Russia, or Venezuela directly impact global supply chains.

- Economic Indicators: Manufacturing data, employment figures, and GDP growth rates signal future energy demand levels.

- USD Strength: Since Brent Oil trades in US dollars, currency fluctuations affect its relative price for international buyers.

- Seasonal Demand Patterns: Energy consumption typically increases during winter in the Northern Hemisphere and summer driving seasons.

How to Trade Brent Oil: Complete Beginner's Strategy

This comprehensive overview explains everything you need to know about how to buy Brent Oil. Whether you're taking your first steps in commodity trading or expanding your portfolio, we'll break down essential concepts and practical strategies to help you understand Brent Oil markets and start trading effectively on Pocket Option.

What is Brent Oil?

Brent Oil, also known as Brent Crude, serves as a primary global benchmark for pricing approximately two-thirds of internationally traded crude oil. Extracted from the North Sea oilfields, it represents a high-quality, light sweet crude with low sulfur content. When you learn how to invest in Brent Oil, you’re essentially speculating on price movements driven by global supply-demand dynamics, geopolitical factors, and economic indicators.

Understanding Brent Oil Price Quotations

Brent Oil price quotations indicate its per-barrel value in US dollars. When quoted at $80, each barrel commands that market price. Price movements directly reflect market conditions: increases typically signal rising demand or supply constraints, while decreases suggest weakening demand or supply expansion. For example, a price jump from $80 to $85 may result from production cuts, geopolitical tensions, or increased industrial consumption. Understanding these price dynamics is fundamental when learning how to trade Brent Oil effectively.

Factors Affecting Brent Oil Movement

Multiple factors influence Brent Oil prices, creating both trading opportunities and risks. Understanding these drivers is essential when learning how to invest in Brent Oil:

How to Read the Brent Oil Exchange Rate

The Brent Oil exchange rate displays the dollar value per barrel. Price movements create trading signals: an upward trend from $80 to $85 indicates strengthening market fundamentals like supply constraints or increased industrial demand. Conversely, a decline from $80 to $75 suggests weakening demand fundamentals or excess production. When learning how to trade Brent Oil, these price movements form the basis for technical analysis patterns that inform trading decisions.

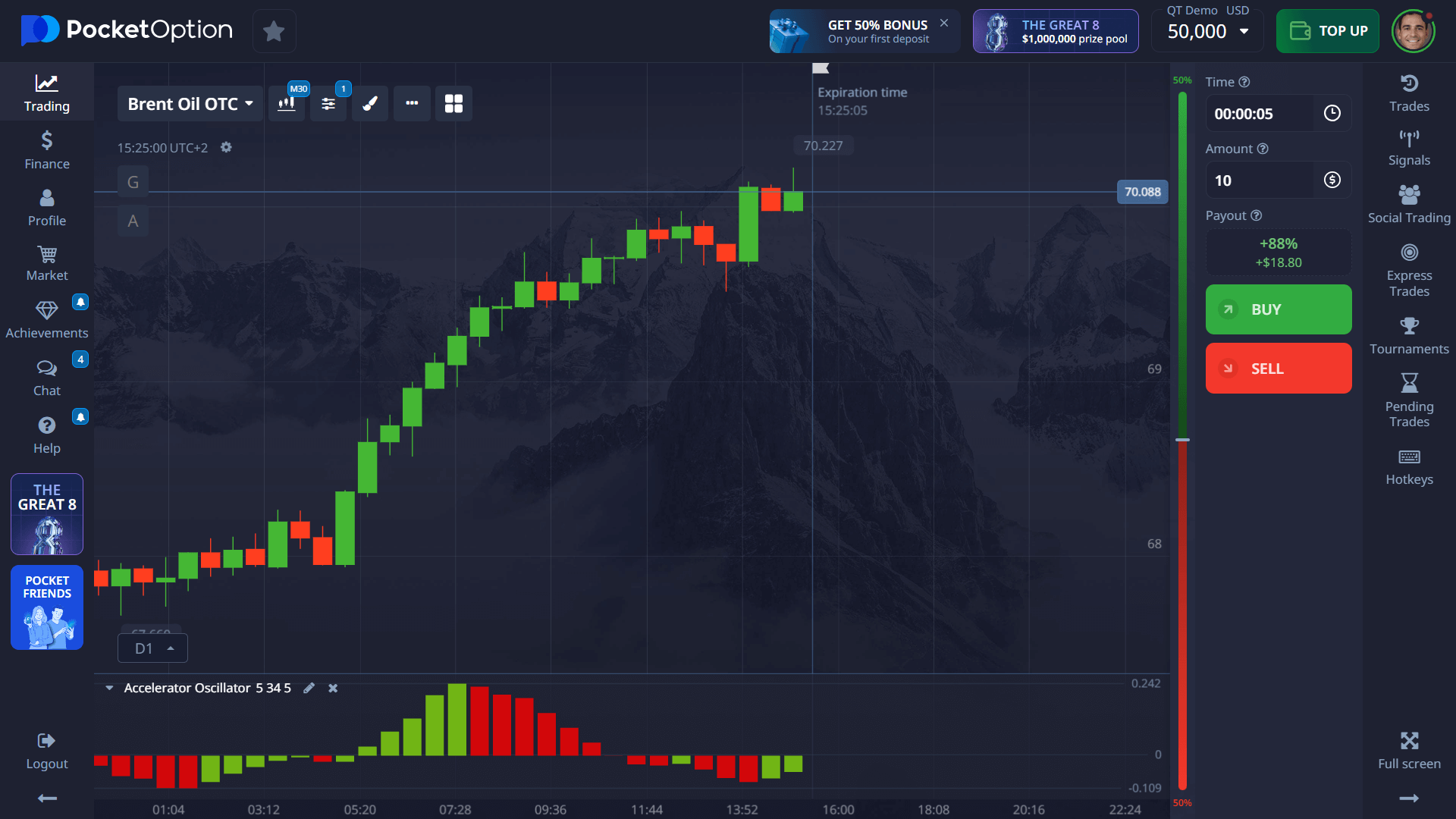

Step-by-Step Tutorial for Quick Trading on Brent Oil

Here’s how to buy Brent Oil on the Pocket Option platform in six straightforward steps:

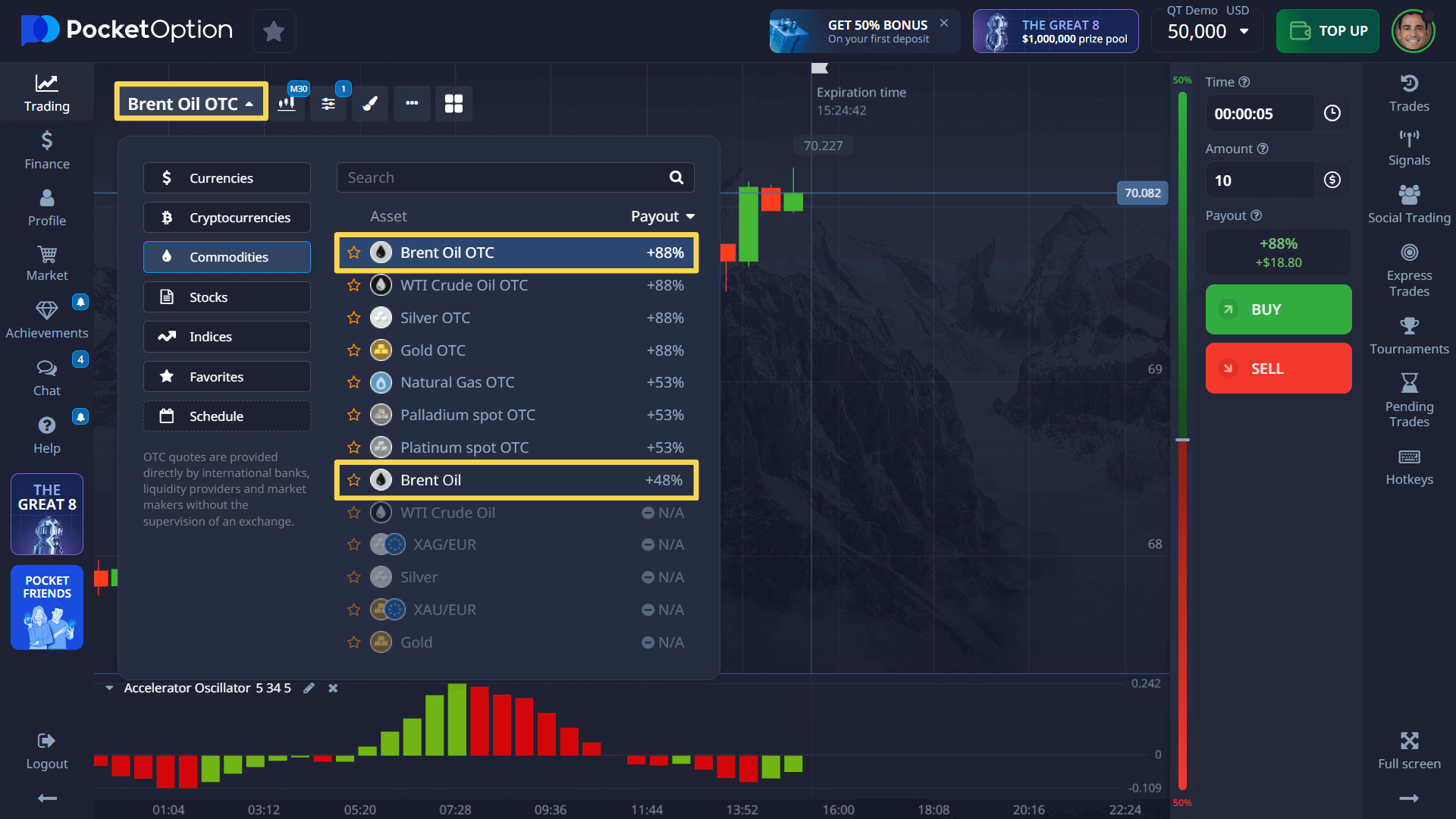

- Select the asset: Navigate to the asset menu and choose either standard Brent Oil or Brent Oil OTC (available during extended hours).

- Analyze price movements: Examine the chart using technical indicators like MACD, RSI, or moving averages to identify potential entry points.

- Set your investment amount: Begin with conservative positions starting from just $1 while you develop your strategy.

- Choose your timeframe: Select trade durations ranging from 5 seconds (for OTC assets) to several hours based on your analysis approach.

- Execute your position: Click BUY if you forecast price appreciation or SELL if you anticipate a decline.

- Manage risk: Remember that accurate forecasts can generate returns up to 92%, but always implement risk management strategies.

Start with a practice account to refine your approach before transitioning to real-money trading with a minimum $5 deposit.

Try Trading Without Risk on Demo Account

Not ready to trade with real capital? Perfect your Brent Oil trading strategy using a comprehensive demo account. Upon registration, you’ll receive $50,000 in virtual funds to practice how to trade Brent Oil without financial exposure. This simulator replicates real market conditions, allowing you to test strategies, experiment with technical indicators, and gain platform familiarity.

When you’re confident in your approach, transition to a live account with just $5 (minimum deposits vary by payment method). Live accounts unlock additional features including Copy Trading functionality, Cashback rewards, and competitive Trading Tournaments.

FAQ

How do I trade Brent Oil?

To trade Brent Oil, select it from the asset list, determine your investment amount and timeframe, then predict price direction based on your market analysis. The Pocket Option platform makes the process straightforward for beginners learning how to trade Brent Oil.

What factors affect the movement of Brent Oil?

Brent Oil prices respond to multiple factors including OPEC+ production decisions, geopolitical developments, global economic indicators, seasonal demand patterns, and currency fluctuations. Understanding these influences is crucial when learning how to invest in Brent Oil.

How much can I earn by trading Brent Oil?

With correct price forecasts when trading Brent Oil on Pocket Option, you can earn returns up to 92% on individual positions. However, actual profitability depends on your strategy effectiveness and risk management approach.

What is the minimum deposit to start trading Brent Oil?

You can begin trading Brent Oil with a minimum deposit of just $5 on Pocket Option, though the exact minimum may vary depending on your selected payment method and region.

Can I try trading Brent Oil without risk?

Yes! Pocket Option provides a comprehensive demo account with $50,000 in virtual funds, allowing you to practice how to buy Brent Oil and test strategies without financial risk before committing real capital.