- Industrial Demand: Automotive manufacturing accounts for approximately 85% of palladium demand through catalytic converters, making vehicle production rates critical price drivers.

- Supply Constraints: Mining disruptions, labor strikes, or export restrictions from major producing countries can significantly impact available supply.

- Economic Indicators: Manufacturing data, GDP growth reports, and inflation figures influence palladium’s industrial demand outlook.

- Currency Strength: As palladium is priced in USD, fluctuations in dollar strength affect its relative price for international buyers.

Palladium Spot Trading: Essential Knowledge for Profitable Investments

Trading Palladium Spot offers a valuable opportunity to diversify your investment portfolio, but success requires understanding this precious metal's market dynamics. This article explores Palladium Spot fundamentals, price quotation mechanics, and provides a practical walkthrough on how to trade this asset effectively. With these insights, you'll be equipped to make informed trading decisions in the palladium market.

What is Palladium Spot?

Palladium Spot represents the current market price at which palladium can be bought or sold for immediate delivery. As a rare precious metal primarily used in automotive catalytic converters, electronics, and jewelry, palladium holds significant industrial value. The spot price fluctuates continuously based on global supply and demand factors, making it an attractive asset for both long-term investors and active traders.

Unlike futures contracts that specify delivery at a later date, Palladium Spot trading focuses on the metal’s present value. Understanding how to invest in Palladium Spot requires knowledge of its price determinants and market behavior patterns.

How Palladium Spot Pricing Works

Palladium Spot prices are quoted in USD per troy ounce (approximately 31.1 grams) on global markets. For instance, when Palladium Spot = 1,800 USD, one troy ounce of palladium trades at $1,800. The price updates in real-time during market hours, reflecting immediate supply-demand dynamics.

Unlike some commodities, palladium’s limited supply contributes to its price volatility. South Africa and Russia produce over 75% of the world’s palladium, making the market sensitive to geopolitical developments in these regions.

Factors Affecting Palladium Spot Prices

How to Read Palladium Spot Price Charts

Interpreting Palladium Spot pricing requires understanding these basic principles:

- Upward price movement indicates strengthening demand or supply concerns, potentially offering buying opportunities.

- Downward price movement suggests weakening demand or increasing supply, which might present selling positions.

- Price consolidation periods often precede significant breakout movements in either direction.

For example, if Palladium Spot rises from $1,800 to $1,850, this 2.8% increase might signal growing industrial demand or supply disruptions that savvy traders can capitalize on.

Step-by-Step Tutorial on Trading Palladium Spot

Here’s how to buy Palladium Spot on Pocket Option’s platform:

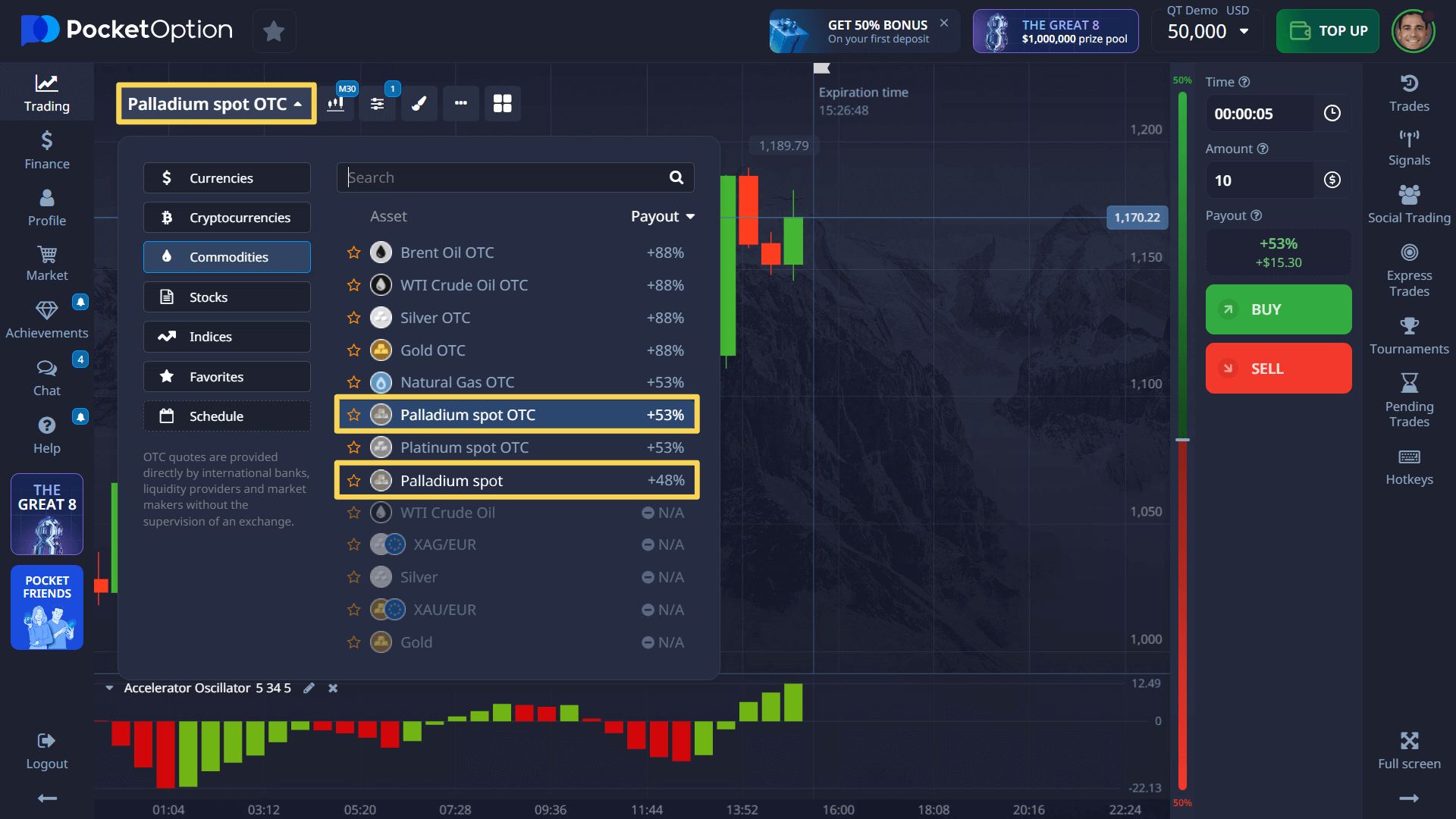

- Locate Palladium Spot: Navigate to the metals section in the asset list and select “Palladium Spot” or “Palladium Spot OTC” for extended trading hours.

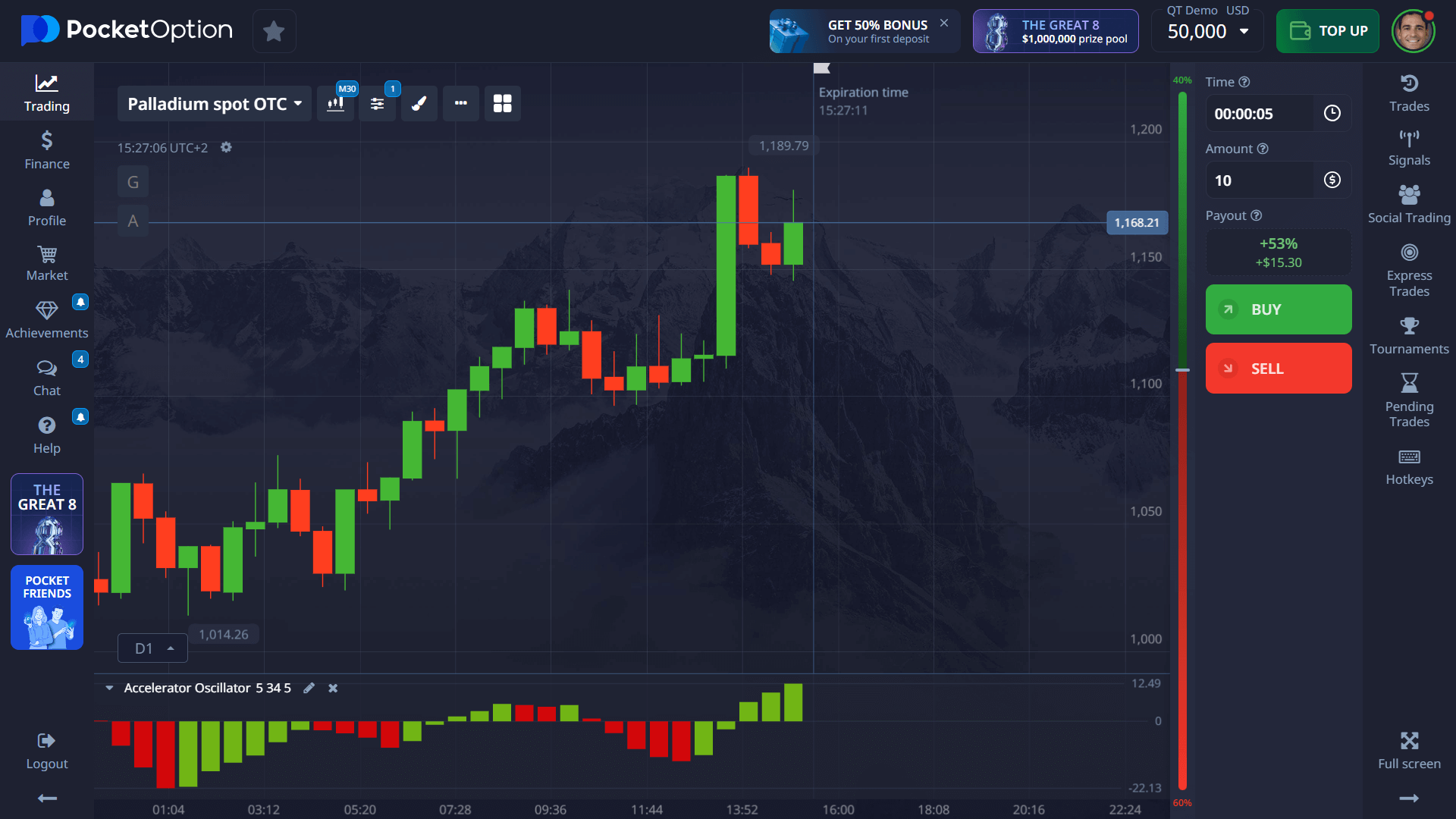

- Analyze the Price Chart: Apply technical indicators like RSI, Moving Averages, or Fibonacci retracements to identify potential entry points.

- Set Your Position Size: Determine your investment amount based on your risk management strategy, starting from as little as $1 per trade.

- Select Your Timeframe: Choose trade durations ranging from 60 seconds to end-of-day positions based on your trading strategy.

- Execute Your Trade: Based on your analysis, enter a BUY position if you anticipate price increases or a SELL position if you expect declines.

Potential returns on successful trades can reach up to 92%, depending on market conditions and selected timeframes.

Try Trading Without Risk on Demo Account

New to Palladium Spot trading? Test your strategy risk-free with Pocket Option’s comprehensive demo account. Upon registration, you’ll receive $50,000 in virtual funds to practice how to trade Palladium Spot in real market conditions.

The demo environment perfectly replicates live trading conditions, allowing you to:

- Test different technical analysis methods specific to palladium markets

- Practice timing entries and exits during various market conditions

- Develop a personal trading strategy without financial risk

- Understand price movement patterns unique to precious metals

When ready to transition to live trading, you can start with a minimal deposit of $5 (amount may vary by payment method) and access additional features including tournaments, social trading, and rewards programs.

FAQ

What is Palladium Spot?

Palladium Spot refers to the current market price of palladium for immediate delivery, quoted in USD per troy ounce.

How to buy Palladium Spot?

To buy Palladium Spot, create an account with Pocket Option, select Palladium Spot from the asset list, analyze the price chart, set your investment amount, choose your timeframe, and execute a BUY position.

How to invest in Palladium Spot?

You can invest in Palladium Spot by opening a trading account with a broker like Pocket Option, analyzing market conditions, and placing trades based on your market forecast and risk management strategy.

What factors influence Palladium Spot prices?

Palladium Spot prices are influenced by automotive industry demand, mining supply constraints, global economic indicators, and currency strength fluctuations.

How to trade Palladium Spot with no risk?

Practice trading Palladium Spot risk-free using Pocket Option's demo account with $50,000 in virtual funds before committing real capital.