- D30EUR rises from 1.35 to 1.40: The Euro is strengthening against the index

- D30EUR falls from 1.35 to 1.30: The index is strengthening against the Euro

D30EUR: What It Is and How to Buy, Invest In, and Trade It

Trading financial instruments like D30EUR can be profitable but requires understanding the basics. In this article, we'll explore D30EUR in detail - from what it represents to practical trading strategies. Whether you're a complete beginner or have some market experience, you'll discover how to trade D30EUR effectively and how to invest in this European market index instrument.

What is D30EUR?

D30EUR is a specialized financial instrument representing the exchange rate between the Euro (EUR) and the D30 index. This index tracks 30 major blue-chip companies from across the European market, including prominent corporations in manufacturing, technology, and financial services sectors. When you trade D30EUR, you’re essentially speculating on the collective performance of these European industrial giants relative to the Euro currency.

Unlike direct stock purchases, trading D30EUR doesn’t give you ownership of company shares. Instead, it allows you to profit from price movements in either direction – whether the index strengthens or weakens against the Euro. This makes it a versatile instrument for both bullish and bearish market conditions.

How Does Currency Quotation Work with D30EUR?

For traders wondering how to buy D30EUR, understanding quotations is the first step. The quotation format follows standard currency pair principles but with the index as the base. If D30EUR = 1.35, it means one unit of the D30 index equals 1.35 Euros.

Price movement interpretation works as follows:

To buy D30EUR positions, you’ll select the asset from your trading platform and determine whether to go long (buy) if you expect the rate to increase, or short (sell) if you anticipate a decrease. The minimum investment starts at just $1 on platforms like Pocket Option.

Factors Affecting D30EUR Movement

Understanding what drives D30EUR price action is essential for anyone looking to invest in D30EUR. Several key factors influence its movement:

- Economic Reports: Eurozone GDP figures, inflation data, and employment statistics directly impact Euro strength

- Corporate Earnings: Quarterly reports from companies within the D30 index can cause significant price shifts

- ECB Decisions: European Central Bank interest rate changes and monetary policy announcements

- Political Developments: Elections, trade agreements, and regulatory changes affecting European markets

- Market Sentiment: Overall investor confidence in European economic outlook

For example, when major European manufacturers report stronger-than-expected earnings, the D30 component typically strengthens, potentially causing D30EUR values to decrease as the index gains against the Euro.

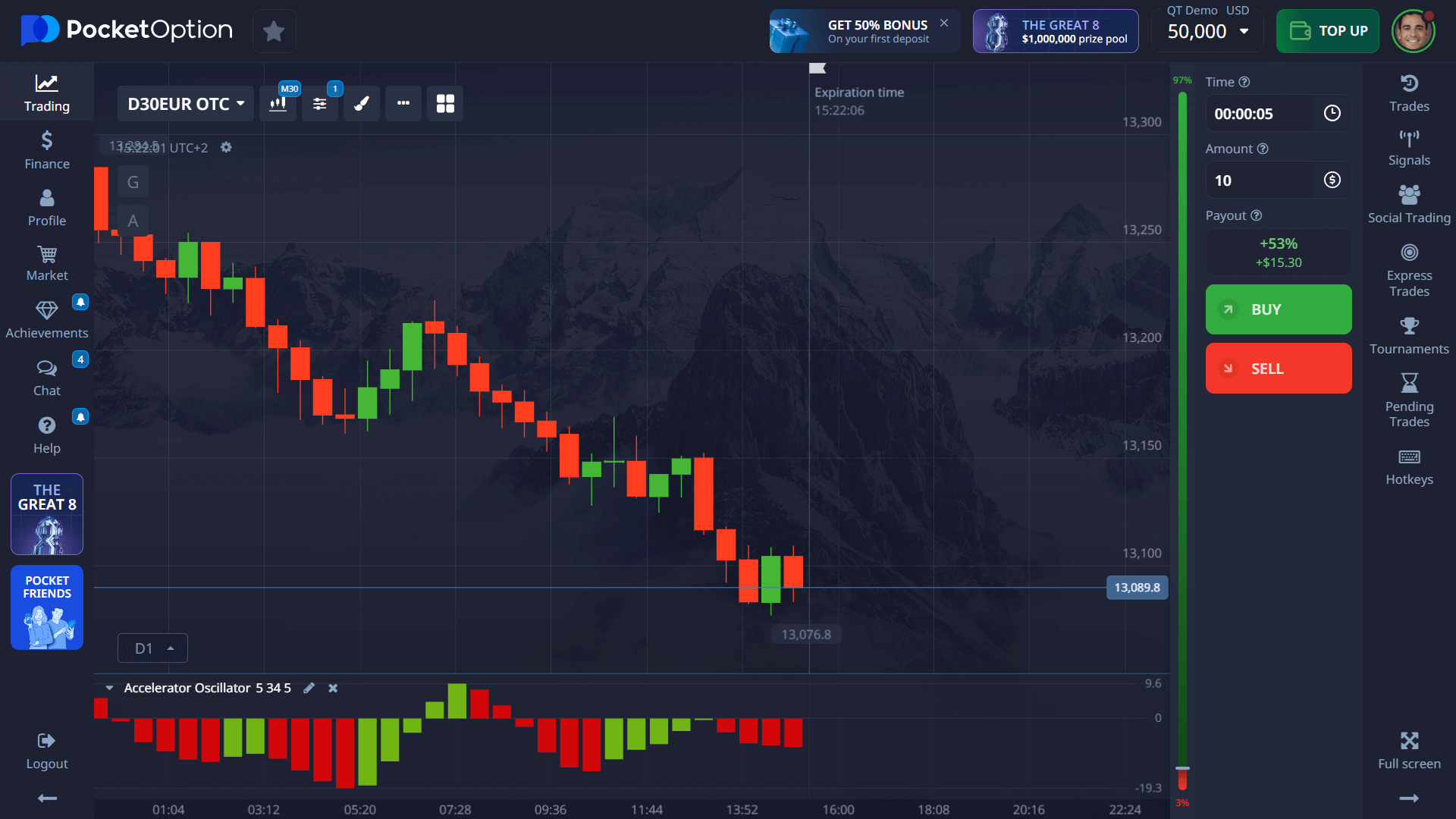

Step-by-Step Tutorial for Trading D30EUR

If you’re ready to learn how to trade D30EUR practically, follow these straightforward steps:

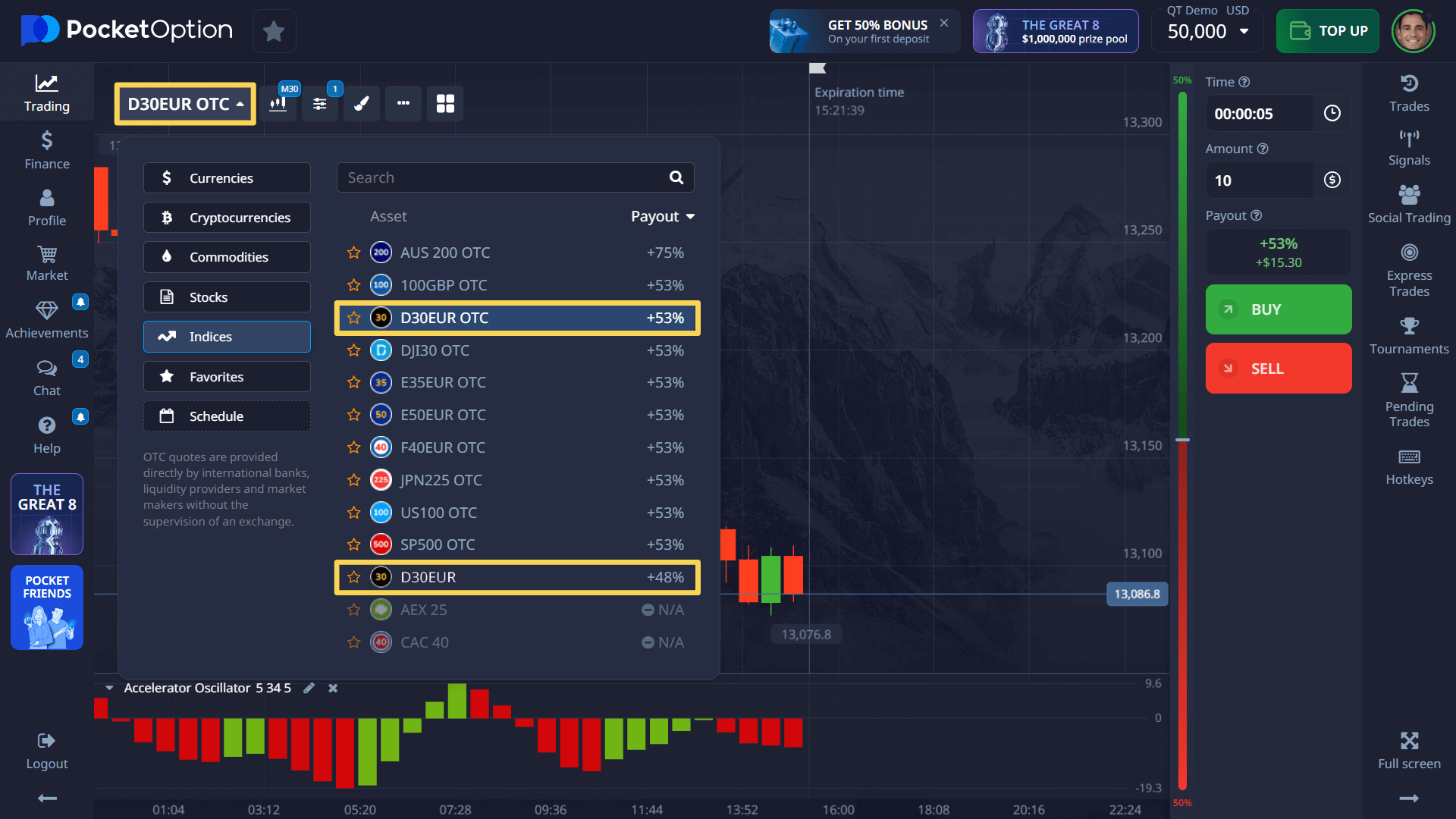

- Select the Asset: Navigate to the asset selection menu and choose D30EUR or D30EUR OTC (available for extended hours trading)

- Analyze the Chart: Review price patterns using technical indicators like MACD, RSI, or moving averages to identify potential entry points

- Set Your Position Size: Determine your investment amount (minimum $1) based on your risk management strategy

- Choose Trade Duration: Select how long you want your position to remain open, from 5 seconds (for OTC) to longer timeframes

- Execute Your Trade: Click BUY if you predict upward movement or SELL if you anticipate downward movement

- Monitor and Close: Track your position’s performance and close manually if needed, or let it expire at the predetermined time

With correct market analysis and prediction, returns can reach up to 92% of your investment amount. For beginners learning how to invest in D30EUR, starting with smaller positions is recommended until you develop confidence in your strategy.

Try Trading Without Risk on Demo Account

Before committing real capital, practice how to trade D30EUR on a risk-free demo environment. New traders receive access to a fully functional practice account with $50,000 in virtual funds. This allows you to:

- Experiment with different entry and exit strategies

- Test various technical indicators and timeframes

- Practice managing positions during volatile market conditions

- Develop a consistent trading approach without financial risk

The demo environment includes all features of the live platform, giving you authentic trading experience. Once comfortable with your trading approach, transition to a live account with a minimum deposit of just $5 (actual minimum may vary by payment method).

Live accounts unlock additional benefits including Copy Trading functionality (follow successful traders automatically), Cashback programs on trading volume, and participation in Trading Tournaments with prize pools.

Understanding D30EUR Market Timing

Knowing when to trade D30EUR can significantly impact your results. The standard D30EUR follows European market hours, typically 8:00 AM to 4:30 PM Central European Time. However, the D30EUR OTC (Over-The-Counter) version allows trading outside regular market hours.

Market volatility tends to peak during:

- European market opening (8:00-9:30 AM CET)

- Major economic announcements from Eurozone countries

- Overlap with US market opening (around 2:30-4:30 PM CET)

These periods often present the most trading opportunities but also carry higher risk due to rapid price movements. For beginners learning how to trade D30EUR, the mid-session periods typically offer more stability for developing trading strategies.

Risk Management for D30EUR Trading

Successful traders prioritize capital preservation alongside profit generation. When trading D30EUR, implement these risk management principles:

- Limit position sizes to 1-3% of your total trading capital per trade

- Use the platform’s stop-loss features where available

- Avoid emotional trading decisions, particularly after losses

- Track your performance with a trading journal to identify patterns

Remember that market forecasts are never guaranteed. Even with thorough analysis, price movements can be unpredictable due to unforeseen global events or sudden economic shifts. Developing a methodical approach to how you invest in D30EUR will improve your long-term results.

FAQ

How do I trade D30EUR?

To trade D30EUR, select it from the asset list on your trading platform, analyze the chart using technical indicators, set your position size (minimum $1), choose your trade duration, then click BUY if you expect the price to rise or SELL if you anticipate a decline.

What factors affect the movement of D30EUR?

D30EUR is influenced by Eurozone economic reports, corporate earnings from companies in the D30 index, European Central Bank policy decisions, political developments across Europe, and overall market sentiment toward European economic prospects.

How much can I earn by trading D30EUR?

With correct market analysis and predictions on Pocket Option, D30EUR trades can yield returns up to 92% of your investment amount. However, actual returns vary based on market conditions and your trading strategy.

What is the minimum deposit to start trading D30EUR?

You can begin trading D30EUR with a minimum deposit of $5 on Pocket Option, though this minimum threshold may vary depending on your selected payment method.

Can I try trading D30EUR without risk?

Yes, you can practice trading D30EUR completely risk-free using a demo account loaded with $50,000 in virtual funds. This allows you to develop your strategy and gain confidence before trading with real money.