- ✅ Minimum trade size: only $1

- ✅ Instant access to real profits and no withdrawal fees

- ✅ Start with promo code “50START” and get $25 as a gift

- ✅ Enjoy tools like AI bots, copy trading, tournaments & more

Day Trading Simulator No Login: Instant Access Trading Practice Platforms

Mastering Day Trading Without Risk Day trading is fast-paced and high-risk, requiring skill and discipline. Simulators let traders practice in realistic market conditions without financial loss.

In this article, we will take a detailed look at what day trading simulators are, why they are so important, how to choose the best day trading simulator, and how to use it effectively to succeed in financial markets. We will also pay special attention to the opportunities offered by day trading simulator free and day trading simulator no login, including unique features from Pocket Option.

What is a day trading simulator and why is it necessary?

A day trading simulator is a specialized software or online platform that meticulously replicates real market conditions, allowing users to execute trades using virtual money. It serves as a “sandbox” for traders, where they can sharpen their skills, test strategies, and familiarize themselves with market dynamics—all without risking actual capital. The primary goal of a simulator is to provide a safe and controlled environment for learning and development before transitioning to live trading.

Many simulators offer features such as demo trading no sign up or day trading simulator free, making them accessible to a wide audience, including beginners who want to explore trading without any commitments. It’s also an ideal tool for those looking for a trading simulator no sign up or demo trading without account.

⚡ Why Opening a Real Account Is the Smartest Move – Even for Beginners!

By opening a Pocket Option real account you can switch to a demo account and back at any time, and on a real account you can get real profit! Thus, for $5 both a demo and a real account! Start trading with just $5 and unlock your earning potential — from as fast as 30 seconds with returns up to 92% per successful prediction. 💸

Key Features of High-Quality Simulators:

- Virtual Capital: Users receive a set amount of virtual funds to trade with, enabling them to make trades without any real financial loss.

- Real Market Data: The best simulators use historical or live market data to ensure maximum realism. This includes accurate price action, volume, and market movements.

- Variety of Assets: The ability to trade a range of instruments—stocks, forex, futures, options, crypto, and more—gives traders broad exposure and helps them identify their preferences.

- Trading Platform Emulation: The simulator’s interface and functionality often mirror real trading platforms, making the transition to live trading smoother and shortening the learning curve.

- Psychological Training: A simulator helps develop emotional resilience and the discipline needed to make rational decisions during volatile market conditions.

Why is a day trading simulator your best ally on the road to success?

Using a day trading simulator offers numerous benefits, especially for those just beginning their trading journey or for experienced traders looking to refine their strategies. Here are the key reasons why a simulator is an essential tool for anyone striving for success in day trading:

Risk-Free Practice: Learn from Mistakes Without Losing Money

The most obvious and crucial advantage is the ability to practice without the risk of losing real money. Beginner traders often make mistakes, and a day trading simulator allows them to learn from those mistakes in a safe environment. You can experiment with various assets such as stocks, forex, futures, or cryptocurrencies and observe their behavior without worrying about financial loss.

This is especially true for platforms offering day trading simulator no login or demo trading without account, allowing users to start practicing immediately. It gives you the freedom to experiment—something that’s not possible when real capital is at stake. It’s also a great solution for those searching for paper trading no sign up or stock market simulator free no sign up.

Strategy Testing: Perfect Your Trading Approach

Day trading simulators provide an ideal environment for testing trading strategies. You can develop your own methods for entries and exits, risk management, and capital allocation, and then test their effectiveness across various market conditions. This allows you to identify weaknesses in your approach and fine-tune it before applying it in live markets.

A feature like real time day trading simulator enables you to test strategies using up-to-date data, increasing their relevance. You can conduct backtesting to see how your strategy would have performed historically, and forward-testing to validate it in current conditions. This is critically important for any practice day trading simulator.

Skill and Emotional Discipline Development: Become a Cool-Headed Trader

Day trading requires more than analytical skill—it demands strong emotional discipline. A day trading simulator helps develop vital capabilities such as recognizing chart patterns, accurately identifying entry and exit points, and managing emotions during market volatility.

By practicing in a simulator, you learn to make decisions quickly and without panic—an essential skill for real-world success. Continuous practice conditions your reaction and builds resistance to stress. You’ll learn to control fear and greed, which are a trader’s worst enemies. This is especially valuable when using a day trading simulator for beginners.

Platform and Tools Familiarization: Confidence in Every Click

Every trading platform has its own features and set of tools. A day trading simulator lets you become familiar with the platform’s interface, learn how to use various indicators, charts, and order types. This significantly shortens the learning curve when transitioning to live trading and helps avoid mistakes caused by a lack of platform knowledge.

Many platforms offer trading demo no account or trading simulator no sign up, allowing users to immediately start exploring the tools. The better you know your platform, the faster and more efficiently you can trade. This applies to both a stock market simulator no login and a forex day trading simulator.

Accessibility and Convenience: Practice Anytime, Anywhere

Many day trading simulators are available online and don’t require downloading or installing complex software. This makes them convenient to use on any device—be it a desktop, tablet, or smartphone. With options like day trading simulator free and day trading simulator no login, they are extremely accessible to anyone interested.

You can practice anytime and anywhere, allowing you to integrate learning into your daily routine. This is especially helpful for those with tight schedules or frequent travel. Some are even available as a day trading simulator app or a day trading simulator game.

How to Choose the Best Day Trading Simulator in 2025?

Choosing the Best Day Trading Simulator: What to Look for in 2025

Choosing the best day trading simulator is a crucial step toward trading success. In 2025, the market offers a wide range of options, so it’s important to know what to look for. Here are the key criteria to help you find the ideal day trading simulator software:

Realism and Data Accuracy: The Foundation of Effective Practice

A good day trading simulator should provide real time or near real-time market conditions. This includes not only asset prices but also accurate simulation of order types, spreads, commissions, and slippage. The more realistically the simulator reflects actual market behavior, the better prepared you’ll be for live trading. Look for simulators that use high-resolution historical data and offer the option of a virtual day trading simulator.

Asset Variety: Broaden Your Market Experience

Make sure the simulator supports a wide range of assets you plan to trade: stocks, forex, futures, crypto, etc. This allows you to gain experience across various markets and instruments. The more assets available, the broader your trading exposure. Seek out stock day trading simulator, forex day trading simulator, futures day trading simulator, and crypto day trading simulator platforms.

User Interface and Ease of Use: Comfort and Efficiency

The simulator’s interface should be intuitive and user-friendly. Ideally, it should closely resemble real trading platforms to ensure a smooth transition to live trading. For beginners, ease of use is especially important. Choose simulators with a clean layout and easy navigation. Also, make sure the simulator is compatible with your operating system—such as a mac day trading simulator.

Additional Features and Tools: Maximize Your Potential

Many day trading simulators come with extra tools such as:

- Charting tools: Advanced charts with multiple timeframes and indicators

- Scanners and filters: To identify trading opportunities

- Backtesting: To test strategies using historical data

- Community access: Engage with other traders, share ideas and insights

- Educational content: Tutorials, webinars, and analytics

Accessibility and Cost: Find the Right Balance

Consider starting with a day trading simulator free or day trading simulator no login version. Some platforms offer free demo accounts with limited features, while full access is available via subscription. Assess whether the price matches the feature set and your trading needs. Read day trading simulator reviews from 2025 to get the most current user feedback.

Pocket Option: Your Path to Successful Trading Without the Complexity

Pocket Option: Your Path to Successful Trading Without the Complexity

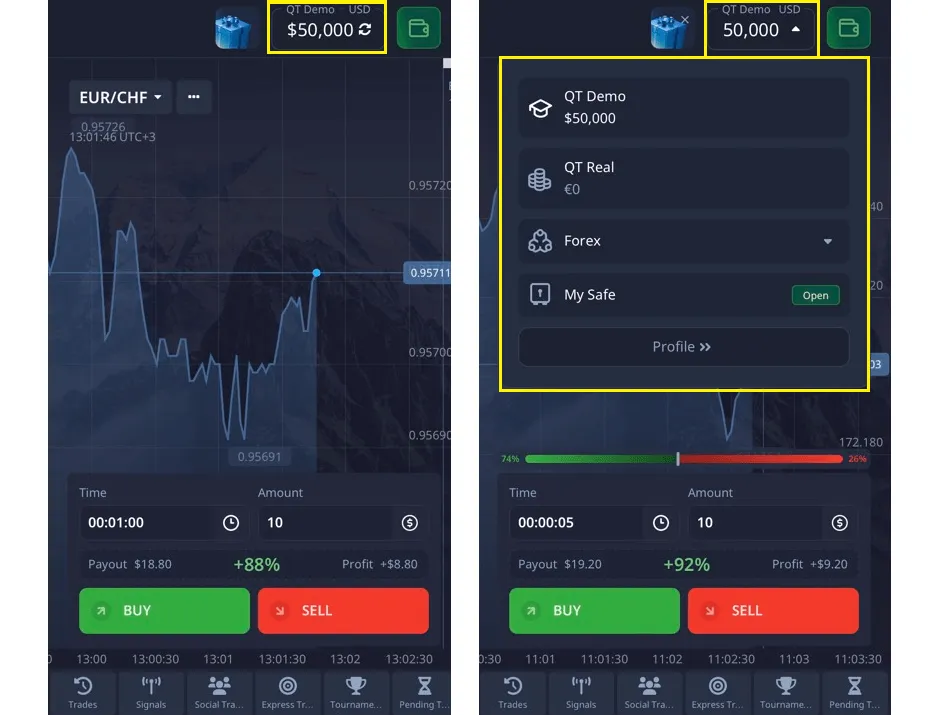

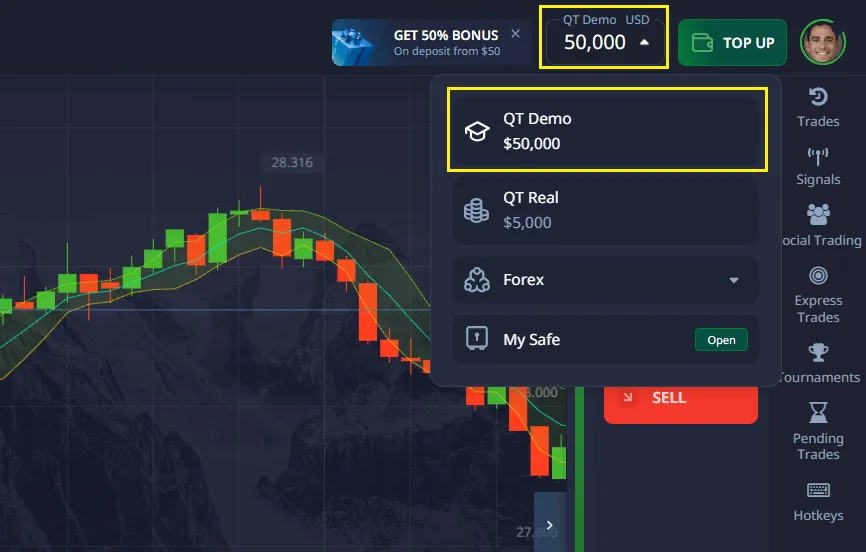

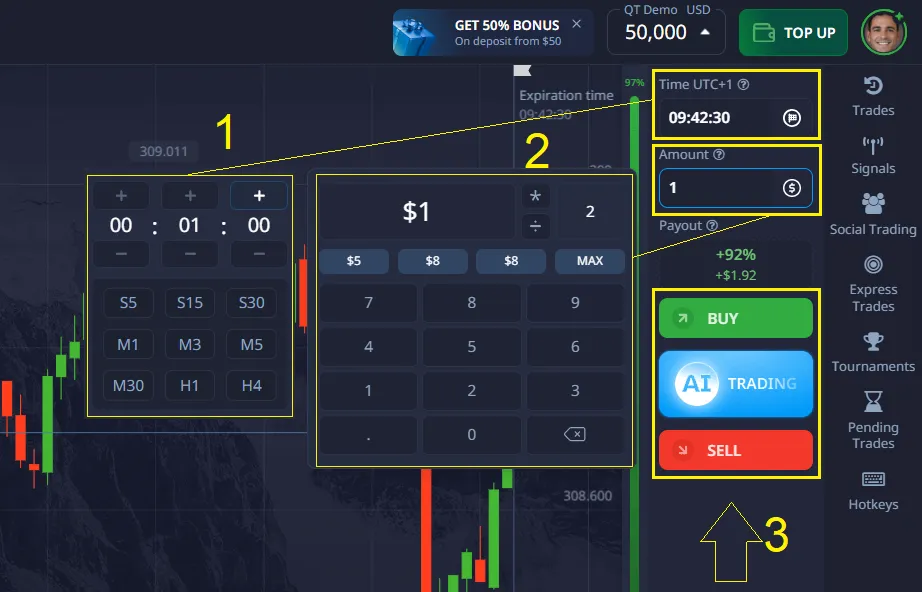

Pocket Option offers traders a convenient way to start practicing trading without the need to create a full account. This is made possible through Pocket Option practice trading — a dedicated free demo account that becomes available immediately upon visiting the platform. Simply open the platform, and you’ll gain access to a virtual balance of $50,000 that can be used to place trades under real market conditions. Trade on Windows, Linux and Mac (Macbook).

What the Pocket Option practice account offers:

- Instant Access: Start trading immediately, with no registration delays. This is a perfect solution for those looking for a demo trading website without login or trading demo no account.

- Virtual Funds: Use the virtual balance for practice without risking real money, creating a safe environment for learning.

- Real Market Conditions: Practice using real-time quotes and charts that simulate actual market behavior, enhancing the realism of your training.

- Wide Range of Assets: Trade various instruments including currency pairs, stocks, cryptocurrencies, and commodities to gain diversified experience. This makes it a versatile trading simulator no login.

This approach makes Pocket Option an excellent choice for anyone searching for a day trading simulator no login or demo trading without account. It enables beginners to get comfortable quickly, and experienced traders to test new strategies in a dynamic environment without any commitments. It’s also a great solution for those seeking a paper trading simulator no sign up.

Trading Skills You Can Develop in a Simulator: From Beginner to Pro

A day trading simulator is an invaluable tool for developing the essential trading skills required to succeed in real markets. Here are some key abilities you can sharpen by using a day trading simulator no login or Pocket Option practice trading:

- Chart Pattern Recognition: Learn to identify various price chart patterns such as head and shoulders, double tops/bottoms, triangles, and flags. Understanding these formations helps you anticipate future price movements.

- Entry and Exit Timing: Practice identifying optimal points for opening and closing trades. This includes analyzing technical indicators, support and resistance levels, and the news backdrop.

- Risk Management Techniques: Build your ability to manage risk through setting stop-loss and take-profit levels, determining position size, and calculating risk-to-reward ratios — all critical for preserving capital.

- Strategy Testing and Refinement: Use the simulator to test your trading strategies across different market conditions. Identify strengths and weaknesses and make adjustments to improve performance. This includes tools like stock market simulator free no sign up and paper trading no sign up.

- Emotional Discipline: Trading in live markets often triggers strong emotions like fear and greed. A simulator helps you develop emotional control and make rational decisions without panic or euphoria. This is especially vital in day trading, where decisions must be made in seconds.

Ongoing practice of these skills in a virtual environment like Pocket Option practice trading helps you gain confidence and readiness before transitioning to live markets.

Common Trading Scenarios to Practice: Be Ready for Anything

Effective use of a trading simulator involves practicing specific scenarios that frequently occur in live markets. This builds adaptability and preparedness for various conditions—especially helpful for those using a day trading simulator for beginners:

| Scenario | Skills Developed |

| Market Opening Volatility | Fast decision-making, trading gap openings |

| Trend Following | Trend identification, entry timing |

| Reversal Trading | Reversal pattern recognition, risk management |

| News Reaction | Volatility handling, fast information analysis |

| Range Trading | Range identification, trading from channel boundaries |

| Managing Losing Trades | Loss minimization, exiting via stop-loss |

| Managing Winning Trades | Profit maximization, break-even stop or trailing stop adjustments |

By practicing these scenarios in a simulator, you’ll gain a deeper understanding of market dynamics and develop effective strategies for every situation. This is particularly beneficial for users of a day trading simulator game or practice day trading simulator.

Transitioning from Simulation to Real Trading: Steps Toward Success and Risk Mitigation

Once you’ve become comfortable with a day trading simulator and feel confident in the virtual environment, it’s time to transition to real trading. This step requires caution and discipline. Here are several important recommendations to help you move successfully from paper trading to live trades:

- Start with Small Positions: Don’t rush into trading large sums. Begin with minimal position sizes to get used to the psychological pressure of live trading. This will help you gradually adapt to the new environment.

- Apply the Same Strategies Used in the Simulator: Stick to the trading strategies and risk management rules you practiced successfully in the simulator. Consistency is key to long-term success.

- Maintain Stop-Loss Discipline: Always use stop-losses to limit potential losses. This is one of the most crucial risk management principles and must be followed rigorously.

- Track Your Performance Metrics: Keep a trading journal where you record all your trades, outcomes, and reasons for entry and exit. Analyzing this data will help you identify your strengths and weaknesses and continuously improve.

- Don’t Be Afraid of Mistakes: Mistakes are part of the learning process. The key is to learn from each one and avoid repeating them. Even experienced traders make errors.

Transitioning from simulation to live trading is a gradual process that requires patience and ongoing learning. Use your Pocket Option practice account as a launchpad for a confident and successful start in real trading.

Pocket Option Platform Features: Tools to Support Your Growth

The Pocket Option platform offers a variety of features that make its simulator a powerful tool for preparing traders for real market conditions. These tools are available in both Pocket Option practice trading and live accounts, making it one of the best choices for trading demo no account:

| Feature | Advantage |

| Multi-timeframe Analysis | Allows you to get a comprehensive view of the market by analyzing price movements across multiple timeframes (e.g., 1-minute, 5-minute, 1-hour). |

| Economic Calendar and News | Provides updates on important economic events and news that can impact the markets. Helps traders stay informed and make well-reasoned decisions. |

| Technical Indicators | A wide selection of indicators (moving averages, RSI, MACD, etc.) for in-depth market analysis and precise entry/exit point identification. |

| Social Trading Elements | Enables users to observe and copy trades from others. This is a great way to learn from more experienced market participants. |

Conclusion: Your Path to Mastery in Day Trading

Day trading simulators are not just for fun—they are powerful educational platforms that can become your gateway to success in the financial markets. They offer a unique opportunity to immerse yourself in the world of day trading, master its nuances, test your strategies, and build emotional resilience without risking actual capital. Whether it’s a day trading simulator no login for instant access, a day trading simulator free for unlimited practice, or the specialized Pocket Option practice trading, there’s an option for everyone.

Remember, the path to mastery in day trading is a continuous journey of learning and adaptation. Treat your simulator as a personal “laboratory,” where you can experiment, make mistakes, and learn valuable lessons. Consistent practice, performance analysis, and discipline are the three pillars of success in this dynamic and exciting world. Start your journey today with the best day trading simulator and turn your ambition into real market achievement.

From Simulator to Live Trading: When Is the Right Time to Make the Switch?

Transitioning from a simulator to live trading is a crucial milestone that requires thorough preparation. Don’t rush it—but don’t delay unnecessarily either. Here are a few signs that indicate you may be ready for real trading:

- Consistent Profitability in the Simulator: You’ve demonstrated steady profitability for several months using the same strategy. This shows that your approach works and that you know how to execute it.

- Emotional Stability: You can remain calm and make rational decisions even in volatile market conditions. You don’t panic during losses or become euphoric during wins.

- Understanding of Risks: You are fully aware of the risks involved in day trading and are mentally and financially prepared for possible losses. You know how to manage your capital and mitigate risks.

- A Solid Trading Plan: You have a clear and detailed trading plan that outlines your entry and exit strategies, risk management rules, and profit goals. You stick to this plan without deviation.

Start with small amounts of real capital to gradually acclimate to the psychological pressure of live trading. Remember, even experienced traders continue to use simulators to test new strategies and sharpen their skills.

Glossary of Key Terms

Day Trading

A dynamic trading activity where a trader opens and closes positions within the same trading day without carrying them over to the next day, aiming to profit from short-term price fluctuations.

Day Trading Simulator

Specialized software or an online platform that replicates real market conditions, allowing users to execute trades with virtual money and no financial risk.

Virtual Capital

A fictitious amount of money provided to users in a simulator, enabling them to practice trading without incurring actual financial losses.

Real Market Data

Historical or live data reflecting actual prices, volumes, and real market movements, used by simulators to ensure maximum realism.

Assets

Financial instruments available for trading, such as stocks, forex, futures, and crypto.

Backtesting

A method for testing a trading strategy using historical market data to see how it would have performed in the past.

Forward Testing

Testing a trading strategy under current market conditions or in a real-time simulator to assess its potential future effectiveness.

Risk Management

A set of methods and strategies used to minimize potential losses in trading, including setting stop-loss levels and determining position size.

Stop-Loss

An order that automatically closes a trade when a predefined price level is reached, limiting potential losses.

Take-Profit

An order that automatically closes a trade once a specified profit target has been reached.

Graphical Patterns

Recognizable configurations on price charts that may indicate potential future price movements (e.g., “head and shoulders,” “double bottom”).

Volatility

The degree of price fluctuation of an asset over a specific period; high volatility means sharp and frequent price changes.

Emotional Discipline

A trader’s ability to make rational trading decisions without being influenced by emotions such as fear, greed, or euphoria.

Trading Journal

A detailed log of all executed trades, their outcomes, and the rationale behind entry and exit decisions—used for reviewing and improving trading strategies.

Pocket Option Practice Account

A demo account offered by the Pocket Option platform that allows users to start practicing immediately with virtual funds, without needing to register.

Paper Trading

A synonym for trading on a simulator or demo account, referring to trading with virtual money and no financial risk.

Day Trading Simulator No Login

A day trading simulator that does not require registration or account login to start using.

Day Trading Simulator Free

A free version of a day trading simulator.

Multi-timeframe Analysis

A method of analyzing the market by viewing price charts across multiple timeframes (e.g., 1-minute, 5-minute, 1-hour) for a more comprehensive perspective.

Economic Calendar and News

Tools that provide information on upcoming economic events and news that may impact the markets.

Technical Indicators

Mathematical calculations based on price, volume, or open interest, used for market analysis and forecasting future price movements (e.g., RSI, MACD, moving averages).

Social Trading Elements

Platform features that allow users to observe the trades of others, share ideas, or copy the strategies of more successful traders.

FAQ

What is a day trading simulator no login platform?

A day trading simulator no login platform is a trading practice environment that allows users to test trading strategies and develop skills without creating an account or providing personal information. These platforms offer immediate access to simulated markets where users can practice trading without financial risk.

How accurate are no-login trading simulators compared to real markets?

No-login simulators vary in accuracy. Most provide reasonably realistic market conditions with some limitations, such as delayed data feeds or simplified execution. While they capture essential market mechanics, they may not perfectly replicate slippage, liquidity issues, or emotional factors present in real trading.

Can I use Pocket Option without creating an account?

Pocket Option offers demo functionality that can be accessed with minimal information. While some basic information might be required, their demo environment provides a low-barrier entry point for practicing trading strategies across multiple asset classes with virtual funds.

What skills can I develop using a trading simulator?

Trading simulators help develop pattern recognition, entry and exit timing, risk management, strategy testing, and emotional discipline. Regular practice in a simulator environment allows traders to build these skills without financial consequences.

Are free trading simulators effective for learning day trading?

Free trading simulators can be effective learning tools, especially for beginners. They provide practical experience with market mechanics and basic strategy testing. However, serious traders may eventually need more advanced features found in comprehensive platforms that require registration.

What is the best day trading simulator?

The best day trading simulator depends on your specific needs, but Pocket Option stands out as a great choice. It offers a no-login demo account with $50,000 in virtual funds, access to multiple assets, and compatibility across web, mobile, and tablet platforms. This makes it ideal for both beginners and experienced traders.