- Microsoft (MSFT): As the largest strategic investor, Microsoft integrates OpenAI’s technologies across its Azure, Office, and Bing products. This makes MSFT a primary vehicle for those interested in OpenAI’s success.

- Nvidia (NVDA): A leading manufacturer of GPUs, which are essential for the intensive computations required by AI and machine learning workloads.

- Alphabet (GOOGL): The parent company of DeepMind and a key competitor and investor in AI research and development.

Is OpenAI Publicly Traded? Complete Guide to AI Investment Opportunities

Many investors are wondering: Is OpenAI publicly traded and what AI investment opportunities does one of the most influential companies in the field of artificial intelligence offer today?

Is OpenAI publicly traded? Current status in 2025

OpenAI, the creator of ChatGPT and DALL-E, has revolutionized AI development, but the main question about the OpenAI stock status remains open. In this article, we clarify the current status of OpenAI’s public listing, discuss alternatives like Microsoft stock, and explain what OpenAI stock is for investors interested in the growing AI sector.

The direct answer to the question “Is OpenAI publicly traded?” is no. In 2025, OpenAI remains a private company. Despite substantial funding rounds, including a more than $13 billion Microsoft OpenAI investment, the company has not yet conducted an initial public offering (IPO). Therefore, there is no official stock symbol for OpenAI listed on any exchange.

The company’s latest valuation has seen a significant increase. As of mid-2025, reports suggest a tender offer is being negotiated that could value OpenAI at as much as $150 billion. Industry insiders report that discussions regarding a potential future IPO are ongoing, but there is no concrete timeline. This decision depends on capital needs for research, market conditions, and regulatory considerations.

🔍 Key AI Companies and Investment Landscape

As OpenAI remains a private company in 2025, investors often turn to strategic partners, competitors, and ecosystem enablers to gain exposure to the booming artificial intelligence sector. The table below provides a consolidated view of OpenAI, its key investors, and other major players in the AI landscape–highlighting their market status, roles, and relevance for investment.

| Company | Publicly Traded | Stock Symbol | AI Role / Investment Relationship |

|---|---|---|---|

| OpenAI | ❌ No | None | Developer of ChatGPT, DALL·E, Codex; Private AI R&D |

| Microsoft | ✅ Yes | MSFT | Largest OpenAI investor; AI integration via Azure, Copilot |

| Alphabet | ✅ Yes | GOOGL | AI competitor; Owner of DeepMind and Gemini models |

| Nvidia | ✅ Yes | NVDA | Provides GPU infrastructure powering AI and machine learning |

| Anthropic | ❌ No | None | AI startup focused on safety; Creator of Claude AI |

What is OpenAI stock and how to invest indirectly?

Since there is no available OpenAI stock, investors seeking indirect exposure to OpenAI’s technology should consider artificial intelligence stocks from companies closely related to its innovation:

For those looking for a ChatGPT stock investment, Microsoft stock is the closest available public market equivalent.

Private Market Investment Options

While OpenAI is not publicly traded, there are avenues for accredited investors to gain exposure through the private market. These options include:

- Secondary Markets: Platforms like Forge Global and EquityZen allow accredited investors to purchase shares from existing stakeholders, such as employees and early investors.

- Venture Capital Funds: Some VC funds that hold a stake in OpenAI may be accessible, offering another path to indirect investment, though typically requiring significant capital.

These methods generally involve higher risk, lower liquidity, and are restricted to investors who meet specific financial criteria.

AI Sector Analysis and Market Trends

The AI sector is experiencing exponential growth, projected to contribute nearly $20 trillion to the global economy by 2030. AI-related companies in the S&P 500 have already outpaced broader market performance by 28% between 2022 and 2025, driven by investments in generative models and cloud infrastructure. This expansion is driven by several key factors:

- Infrastructure Demand: The need for powerful data centers and specialized hardware, like Nvidia’s GPUs, to train AI models is immense.

- Corporate Adoption: Companies across all industries are increasingly integrating AI to enhance efficiency, from data analytics to customer service automation.

- Competition and Innovation: The race between giants like OpenAI, Google (Alphabet), and Anthropic, along with a thriving ecosystem of startups, is fueling rapid technological advancements.

These trends support strong performance in AI sector stocks and bolster expectations for a highly anticipated future OpenAI IPO.

According to a 2025 Gartner report, “Generative AI is expected to drive over $4.4 trillion in business value within the next five years.” This projection underscores the immense interest surrounding a potential OpenAI IPO.

Potential Future OpenAI IPO: Expert Opinions

Financial experts highlight several factors influencing a potential OpenAI IPO:

- Capital Needs: Large-scale AI research requires significant and continuous funding.

- Market Interest: There is a growing appetite from investors for AI-related stocks.

- Regulatory Environment: Increased oversight of AI technologies may impact the timing and structure of an IPO.

- Business Model Maturity: Revenue growth from licensing and commercial partnerships is a key indicator of readiness for public markets.

“An OpenAI IPO would be one of the most anticipated tech listings, reflecting the transformative potential of artificial intelligence,” says Dr. Elena Martinez, a senior AI investment analyst. “Investors should closely watch market conditions and regulatory developments to see if OpenAI will become publicly traded.”

Other Ways to Invest in AI: ETFs and Listed Companies

For investors hesitant to pick individual stocks or waiting for OpenAI’s IPO, AI- and robotics-focused ETFs offer a diversified option:

| ETF Name | Symbol | Focus Area |

|---|---|---|

| Global X Robotics & AI ETF | BOTZ | Robotics and AI companies |

| ARK Autonomous Tech & Robotics ETF | ARKQ | Autonomous technologies and robotics |

| iShares Robotics and AI ETF | IRBO | Global AI and robotics companies |

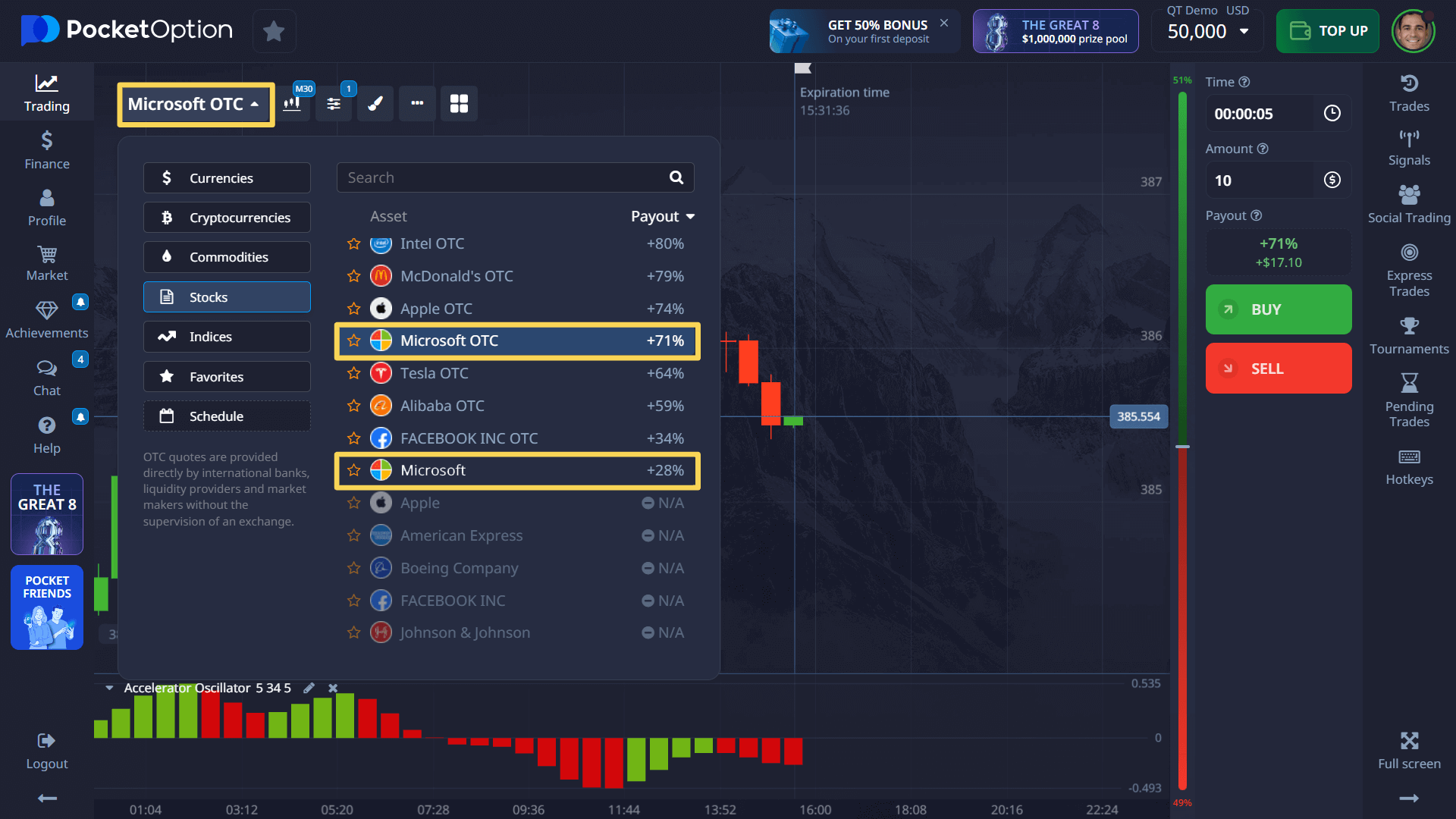

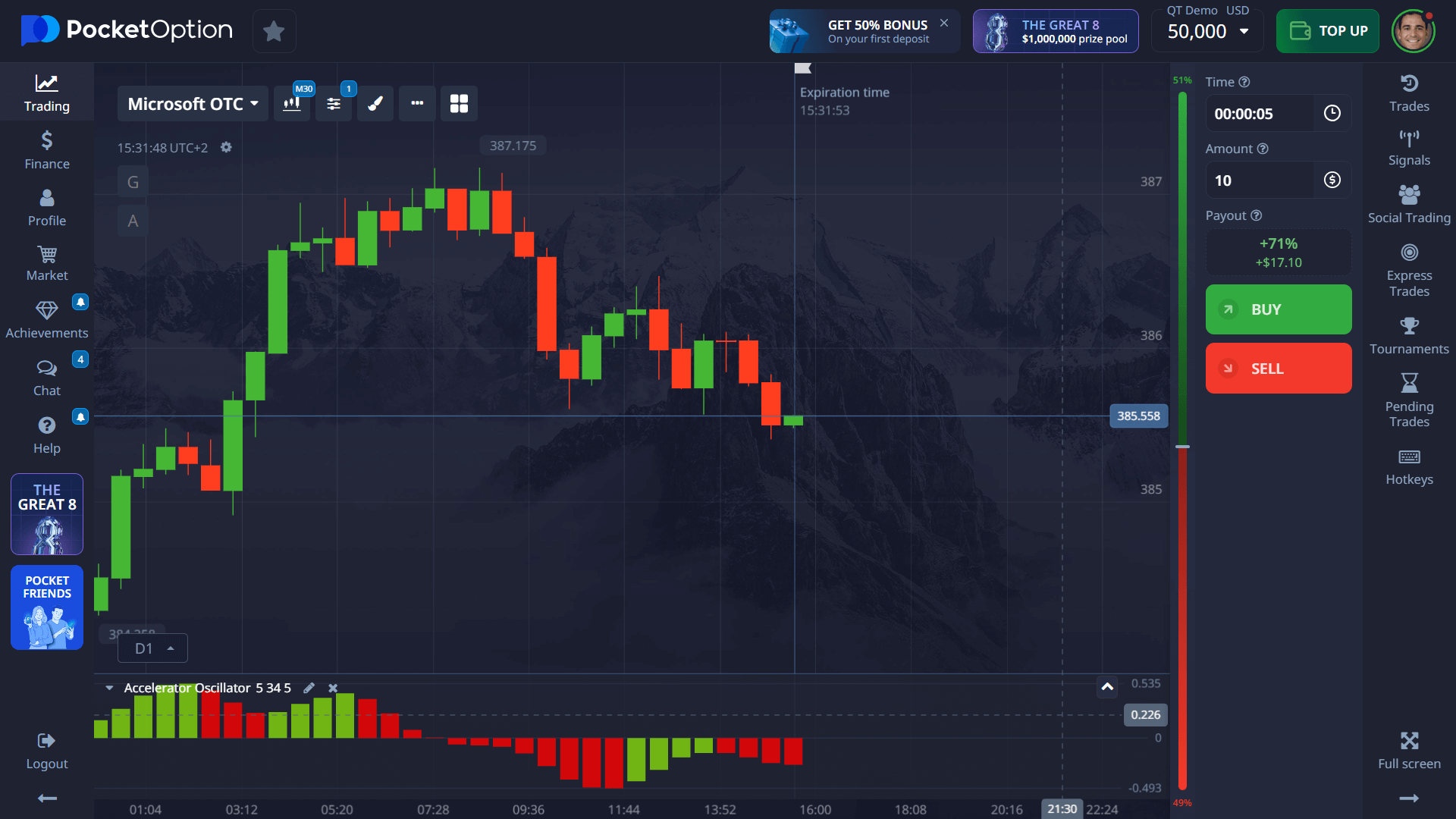

How Pocket Option Facilitates Trading AI-Related Stocks

Pocket Option is a versatile trading platform offering access to stocks like Microsoft (MSFT) and other AI sector companies.

It provides:

- Interactive real-time charts with customizable technical indicators

- Fast order execution with low minimum deposits starting at $5

- A $50,000 virtual demo account to practice strategies without financial risk

- Social trading options to follow expert traders

- Trading tournaments and cashback rewards

“The intuitive Pocket Option platform helped me navigate complex AI stock trades with confidence,” shares James Collins, an experienced trader. “The demo account allowed me to test my strategies before investing real money.”

FAQ

Is OpenAI a public company?

No, OpenAI is not a public company. As of 2025, it remains privately held and has not gone through an initial public offering (IPO).

Can I buy OpenAI stock?

No, you cannot buy OpenAI stock directly. It is not listed on any stock exchange, and no official stock symbol exists for OpenAI.

How can I invest in OpenAI indirectly?

You can invest indirectly through companies closely partnered with or benefiting from OpenAI’s technology, such as Microsoft (MSFT), which is OpenAI’s largest investor and integration partner, or Nvidia (NVDA) and Alphabet (GOOGL), which are major players in the AI space.

When will OpenAI go public?

There is no confirmed date for an OpenAI IPO. Discussions are reportedly ongoing, and a future public listing will depend on market conditions, capital needs, and regulatory considerations.

How can I invest in AI technology stocks?

You can invest in AI technology through publicly traded companies like Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOGL), or by purchasing shares of AI-focused ETFs such as BOTZ, ARKQ, or IRBO, which offer diversified exposure to the AI sector.

What is the stock symbol for Open AI?

OpenAI does not have a stock symbol as it is not publicly traded on any stock exchange. The company remains privately held, so there is no stock symbol for Open AI available to investors.

Can I invest in OpenAI through Microsoft stock?

Yes, investing in Microsoft (MSFT) is currently the closest way to gain exposure to OpenAI. Microsoft has invested billions in OpenAI and integrates its technology across its products, making it an indirect investment option.

Is there any news about an upcoming OpenAI IPO?

As of early 2025, OpenAI has not officially announced plans for an initial public offering. While speculation exists about a potential future IPO, the company continues to operate with private funding and has not filed the necessary paperwork for going public.

How can I invest in AI if Open AI stock isn't available?

You can invest in publicly traded companies developing AI technology (like NVIDIA, Google, Microsoft), AI-focused ETFs (such as BOTZ or ARKQ), or other AI startups that may go public. These alternatives provide exposure to the AI market while OpenAI remains private.

What is Open AI's current market valuation?

While OpenAI's exact valuation as a private company isn't constantly updated in public markets, recent private funding rounds have valued the company at over $80 billion. This valuation can fluctuate based on private investments and is not determined by public stock trading.

Comment puis-je investir dans la technologie OpenAI aujourd’hui ?

Vous pouvez investir indirectement via les actions de Microsoft (MSFT), Nvidia (NVDA) et Alphabet (GOOGL).